Group Sonangol is a parastatal that formerly oversaw petroleum and natural gas production in Angola. The group consisted of Sonangol E.P. and its many subsidiaries. The subsidiaries generally had Sonangol E.P. as a primary client, along with other corporate, commercial, and individual clients. Angola is estimated to have over 5 billion barrels (790,000,000 m3) of offshore and coastal petroleum reserves, and new discoveries are outpacing consumption by a 5-to-1 ratio.

Galp Energia, SGPS, S.A. is a Portuguese multinational energy corporation, headquartered in Lisbon, Portugal. Galp consists of more than 100 companies engaged in every aspect of the oil and natural gas supply, hydrocarbon exploration and production; refining, trading, logistics and retailing; co-generation and renewable energy. Galp was founded in 1999 through the merger of Petrogal, Gás de Portugal and Transgás. As of 2020, it is the largest oil and gas group in Portugal, where it distributes gas and sells petrol.

Brazil is the 7th largest energy consumer in the world and the largest in South America. At the same time, it is an important oil and gas producer in the region and the world's second largest ethanol fuel producer. The government agencies responsible for energy policy are the Ministry of Mines and Energy (MME), the National Council for Energy Policy (CNPE), the National Agency of Petroleum, Natural Gas and Biofuels (ANP) and the National Agency of Electricity (ANEEL). State-owned companies Petrobras and Eletrobras are the major players in Brazil's energy sector, as well as Latin America's.

Angola LNG is a liquid natural gas (LNG) facility in Soyo, Angola.

Energy in Kazakhstan describes energy and electricity production, consumption and import in Kazakhstan and the politics of Kazakhstan related to energy.

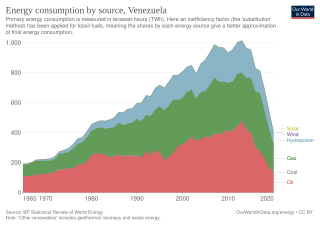

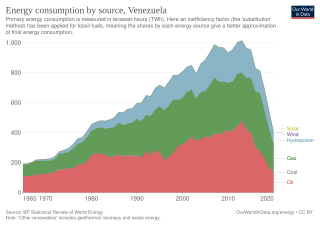

Venezuela was one of the world's largest producers of oil, and the country with the largest proven oil reserves in the world. Venezuela is a member of OPEC.

Energy in Mexico describes energy, fuel, and electricity production, consumption and import in Mexico.

Energy in Paraguay is primarily sourced from hydropower, with pivotal projects like the Itaipu Dam, one of the world's largest hydroelectric facilities. This reliance underscores the need for a robust infrastructure, including efficient transmission networks and distribution systems, to leverage the country's renewable resources fully.

The Democratic Republic of the Congo was a net energy exporter in 2008. Most energy was consumed domestically in 2008. According to the IEA statistics the energy export was in 2008 small and less than from the Republic of Congo. 2010 population figures were 3.8 million for the RC compared to CDR 67.8 Million.

This article describes the energy and electricity production, consumption and import in Egypt.

Energy in Kuwait describes energy and electricity production, consumption, import and export in Kuwait.

Energy in Libya primarily revolves around the production, consumption, import, and export of energy, with a significant focus on the petroleum industry, which serves as the backbone of the Libyan economy. As of 2021, Libya is recognized as the seventh-largest crude oil producer in OPEC and ranks third in total petroleum liquids production in Africa. The country holds 3% of the world's proven oil reserves and 39% of Africa's, marking it as a key player in the global energy sector. Despite its abundant resources, the energy industry in Libya has faced significant challenges due to political instability following the civil war that began in 2011. These challenges have led to frequent disruptions in oil production and exports, directly impacting the national economy and its contributions to the global oil market. The sector's future is closely tied to the resolution of political conflicts and the effective management of its vast hydrocarbon resources.

Energy in Algeria encompasses the production, consumption, and import of energy. As of 2009, the primary energy use in Algeria was 462 TWh, with a per capita consumption of 13 TWh. Algeria is a significant producer and exporter of oil and gas and has been a member of the Organization of the Petroleum Exporting Countries (OPEC) since 1969. It also participates in the OPEC+ agreement, collaborating with non-OPEC oil-producing nations. Historically, the country has relied heavily on fossil fuels, which are heavily subsidized and constitute the majority of its energy consumption. In response to global energy trends, Algeria updated its Renewable Energy and Energy Efficiency Development Plan in 2015, aiming for significant advancements by 2030. This plan promotes the deployment of large-scale renewable technologies, such as solar photovoltaic systems and onshore wind installations, supported by various incentive measures.

Energy in the United Arab Emirates describes energy and electricity production, consumption and import in the United Arab Emirates (UAE). The UAE has 7% of global proved oil reserves, about 100 billion barrels. Primary energy usage in 2009 in the UAE was 693 TWh and 151 TWh per million persons.

Energy in the Czech Republic describes energy and electricity production, consumption and import in the Czech Republic.

Energy in Belarus describes energy and electricity production, consumption and import in Belarus. Belarus is a net energy importer. According to IEA, the energy import vastly exceeded the energy production in 2015, describing Belarus as one of the world's least energy sufficient countries in the world. Belarus is very dependent on Russia.

Uzbekistan had a total primary energy supply (TPES) of 48.28 Mtoe in 2012. Electricity consumption was 47.80 TWh. The majority of primary energy came from fossil fuels, with natural gas, coal and oil the main sources. Hydroelectricity, the only significant renewable source in the country, accounted for about 2% of the primary energy supply. Natural gas is the source for 73.8% of electricity production, followed by hydroelectricity with 21.4%.

The energy sector in Tunisia includes all production, processing and, transit of energy consumption in this country. The production involves the upstream sector that includes general oil and gas, the downstream sector that includes the only refinery in Tunisia and most of the production of natural gas, and varied electrical/renewable energies. Renewable energy has been a strong point of focus for Tunisia as they look to optimize their green energy sources and advance their developing country. The Tunisian government has partnered with Russia and France in hopes of establishing nuclear energy as a viable alternative to fossil fuels and taking up a nontrivial chunk of the energy production in Tunisia. This is expected to be accomplished in the 2020s.

World energy supply and consumption refers to the global supply of energy resources and its consumption. The system of global energy supply consists of the energy development, refinement, and trade of energy. Energy supplies may exist in various forms such as raw resources or more processed and refined forms of energy. The raw energy resources include for example coal, unprocessed oil & gas, uranium. In comparison, the refined forms of energy include for example refined oil that becomes fuel and electricity. Energy resources may be used in various different ways, depending on the specific resource, and intended end use. Energy production and consumption play a significant role in the global economy. It is needed in industry and global transportation. The total energy supply chain, from production to final consumption, involves many activities that cause a loss of useful energy.

The Lobito Oil Refinery, is a crude oil refinery planned in Angola. When fully operationalized, the refinery is expected to process 200,000 billion barrels, equivalent to 32,000 cubic meters (32,000,000 L) of crude oil on a daily basis. The oil infrastructure facility is under development by Sonangol, the national oil company of Angola.