| |

| Department overview | |

|---|---|

| Type | Taxation & Revenue Services |

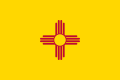

| Jurisdiction | State of New Mexico |

| Headquarters | 1100 South St. Francis Drive Santa Fe, New Mexico 87504-1028 |

| Employees | 803 |

| Annual budget | US$90,078,526.00 [1] |

| Department executive |

|

| Child agencies |

|

| Website | http://tax.newmexico.gov/ |

The New Mexico Taxation and Revenue Department is the state agency responsible for collecting and distributing governmental revenue in New Mexico [2] and administering the state's motor vehicle code.