Related Research Articles

Financial economics is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on both sides of a trade". Its concern is thus the interrelation of financial variables, such as share prices, interest rates and exchange rates, as opposed to those concerning the real economy. It has two main areas of focus: asset pricing and corporate finance; the first being the perspective of providers of capital, i.e. investors, and the second of users of capital. It thus provides the theoretical underpinning for much of finance.

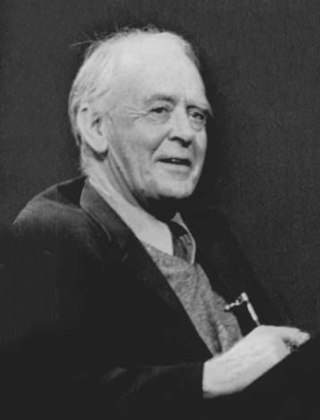

Sir John Richard Hicks was a British economist. He is considered one of the most important and influential economists of the twentieth century. The most familiar of his many contributions in the field of economics were his statement of consumer demand theory in microeconomics, and the IS–LM model (1937), which summarised a Keynesian view of macroeconomics. His book Value and Capital (1939) significantly extended general-equilibrium and value theory. The compensated demand function is named the Hicksian demand function in memory of him.

Frank Plumpton Ramsey was a British philosopher, mathematician, and economist who made major contributions to all three fields before his death at the age of 26. He was a close friend of Ludwig Wittgenstein and, as an undergraduate, translated Wittgenstein's Tractatus Logico-Philosophicus into English. He was also influential in persuading Wittgenstein to return to philosophy and Cambridge. Like Wittgenstein, he was a member of the Cambridge Apostles, the secret intellectual society, from 1921.

Sir David Roxbee Cox was a British statistician and educator. His wide-ranging contributions to the field of statistics included introducing logistic regression, the proportional hazards model and the Cox process, a point process named after him.

Sir Partha Sarathi Dasgupta is an Indian-British economist who is Frank Ramsey Professor Emeritus of Economics at the University of Cambridge, United Kingdom, and a fellow of St John's College, Cambridge.

Financial modeling is the task of building an abstract representation of a real world financial situation. This is a mathematical model designed to represent the performance of a financial asset or portfolio of a business, project, or any other investment.

Kenneth George "Ken" Binmore, is an English mathematician, economist, and game theorist, a Professor Emeritus of Economics at University College London (UCL) and a Visiting Emeritus Professor of Economics at the University of Bristol. As a founder of modern economic theory of bargaining, he made important contributions to the foundations of game theory, experimental economics, evolutionary game theory and analytical philosophy. He took up economics after holding the Chair of Mathematics at the London School of Economics. The switch has put him at the forefront of developments in game theory. His other interests include political and moral philosophy, decision theory, and statistics. He has written over 100 scholarly papers and 14 books.

Frank J. Fabozzi is an American economist, educator, writer, and investor, currently Professor of Practice at The Johns Hopkins University Carey Business School and a Member of Edhec Risk Institute. He was previously a Professor of Finance at EDHEC Business School, Professor in the Practice of Finance and Becton Fellow in the Yale School of Management, and a visiting professor of Finance at the Sloan School of Management at the Massachusetts Institute of Technology. He has authored and edited many books, three of which were coauthored with Nobel laureates, Franco Modigliani and Harry Markowitz. He has been the editor of the Journal of Portfolio Management since 1986 and is on the board of directors of the BlackRock complex of closed-end funds.

Guy Philip Nason is a British statistician, and professor of Statistics at Imperial College London.

Damiano Brigo is a mathematician known for research in mathematical finance, filtering theory, stochastic analysis with differential geometry, probability theory and statistics, authoring more than 130 research publications and three monographs. From 2012 he serves as full professor with a chair in mathematical finance at the Department of Mathematics of Imperial College London, where he headed the Mathematical Finance group in 2012–2019. He is also a well known quantitative finance researcher, manager and advisor in the industry. His research has been cited and published also in mainstream industry publications, including Risk Magazine, where he has been the most cited author in the twenty years 1998–2017. He is often requested as a plenary or invited speaker both at academic and industry international events. Brigo's research has also been used in court as support for legal proceedings.

Peter George Harrison is an Emeritus Professor of Computing Science at Imperial College London known for the reversed compound agent theorem, which gives conditions for a stochastic network to have a product-form solution.

William R. M. Perraudin is a British economist. He is an adjunct professor and former Chair of Finance at Imperial College London, specialising in the fields of risk and pricing of debt instruments. He is a director of the risk management software and consultancy firm Risk Control Limited.

Henry Philip Wynn was a British statistician who served as President of the Royal Statistical Society.

Terence John LyonsFLSW is a British mathematician, specialising in stochastic analysis. Lyons, previously the Wallis Professor of Mathematics, is a fellow of St Anne's College, Oxford and a Faculty Fellow at The Alan Turing Institute. He was the director of the Oxford-Man Institute from 2011 to 2015 and the president of the London Mathematical Society from 2013 to 2015. His mathematical contributions have been to probability, harmonic analysis, the numerical analysis of stochastic differential equations, and quantitative finance. In particular he developed what is now known as the theory of rough paths. Together with Patrick Kidger he proved a universal approximation theorem for neural networks of arbitrary depth.

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling in the financial field.

Mark Herbert Ainsworth Davis was Professor of Mathematics at Imperial College London. He made fundamental contributions to the theory of stochastic processes, stochastic control and mathematical finance.

Riccardo Rebonato is Professor of Finance at EDHEC Business School and EDHEC-Risk Institute, Scientific Director of the EDHEC Risk Climate Impact Institute (ERCII), and author of journal articles and books on Mathematical Finance, covering derivatives pricing, risk management, asset allocation and climate change. In 2022 he was granted the PRM Quant of the Year award for 'outstanding contributions to the field of quantitative portfolio theory'. Prior to this, he was Global Head of Rates and FX Analytics at PIMCO.

Robert Sinclair MacKay is a British mathematician and professor at the University of Warwick. He researches dynamical systems, the calculus of variations, Hamiltonian dynamics and applications to complex systems in physics, engineering, chemistry, biology and economics.

Rama Cont is the Statutory Professor of Mathematical Finance at the University of Oxford. He is known for contributions to probability theory, stochastic analysis and mathematical modelling in finance, in particular mathematical models of systemic risk. He was awarded the Louis Bachelier Prize by the French Academy of Sciences in 2010.

Alan Frank Beardon is a British mathematician.

References

- ↑ "Imperial College". Imperial College London . Retrieved 12 November 2011.

- ↑ "London School of Economics". London School of Economics . Retrieved 12 November 2011.

- ↑ "University of Liverpool". University of Liverpool . Retrieved 19 September 2016.

- ↑ "math genealogy". Mathematics Genealogy Project . Retrieved 12 November 2011.

- ↑ Regular Variation. ASIN 0521379431.

- ↑ Risk Neutral Valuation. ASIN 184996873X.

- ↑ "Regular Variation". Imperial College London . Retrieved 14 November 2011.

- 1 2 "Homepage of Nick".