U.S. Bancorp is an American bank holding company based in Minneapolis, Minnesota, and incorporated in Delaware. It is the parent company of U.S. Bank National Association, and is the fifth largest banking institution in the United States. The company provides banking, investment, mortgage, trust, and payment services products to individuals, businesses, governmental entities, and other financial institutions. As of 2019, it had 3,106 branches and 4,842 automated teller machines, primarily in the Western and Midwestern United States. In 2023 it ranked 149th on the Fortune 500, and it is considered a systemically important bank by the Financial Stability Board. The company also owns Elavon, a processor of credit card transactions for merchants, and Elan Financial Services, a credit card issuer that issues credit card products on behalf of small credit unions and banks across the U.S.

Comerica Incorporated is an American financial services company, headquartered in Dallas, Texas. It is the parent of Comerica Bank, a regional commercial bank with 413 branches in the U.S. states of Texas, Michigan, California, Florida and Arizona. Comerica is among the largest U.S. financial holding companies, with offices in a number of U.S. cities.

National City Corporation was a regional bank holding company based in Cleveland, Ohio, founded in 1845; it was once one of the ten largest banks in America in terms of deposits, mortgages and home equity lines of credit. Subsidiary National City Mortgage is credited for doing the first mortgage in America. The company operated through an extensive banking network primarily in Ohio, Illinois, Indiana, Kentucky, Michigan, Missouri, Pennsylvania, Florida, and Wisconsin, and also served customers in selected markets nationally. Its core businesses included commercial and retail banking, mortgage financing and servicing, consumer finance, and asset management. The bank reached out to customers primarily through mass advertising and offered comprehensive banking services online. In its last years, the company was commonly known in the media by the abbreviated NatCity, with its investment banking arm even bearing the official name NatCity Investments.

Yadkin Financial Corporation was a bank holding company and the parent of Yadkin Bank, a defunct regional bank with $7.3 billion in assets and 110 branches in North and South Carolina before the 2017 purchase by FNB Corporation of Pittsburgh. The bank was headquartered in Elkin, North Carolina.

Union Bank was an American national bank with 398 branches in California, Washington, and Oregon. It was owned by MUFG Americas Holdings Corporation and was acquired by U.S. Bancorp in December 2022. It was headquartered in New York City and had commercial branches in Dallas, Houston, New York City, and Chicago, and two international offices.

Huntington Bancshares Incorporated is an American bank holding company headquartered in Columbus, Ohio. Its banking subsidiary, The Huntington National Bank, operates 1047 banking offices, primarily in the Midwest: 459 in Ohio, 290 in Michigan, 80 in Minnesota, 51 in Pennsylvania, 45 in Indiana, 35 in Illinois, 32 in Colorado, 29 in West Virginia, 16 in Wisconsin, and 10 in Kentucky.

The Lorain National Bank was a bank headquartered in Lorain, Ohio. The bank was a subsidiary of LNB Bancorp, a bank holding company. It operated 20 branches, all of which were in Lorain County, Cuyahoga County, or Summit County. In 2015, the bank was acquired by Northwest Bank.

Firstar Corporation was a Milwaukee, Wisconsin-based regional bank holding company that existed from 1853 to 2001. In 2001, Firstar acquired U.S. Bancorp and assumed its name, moving its headquarters to Minneapolis.

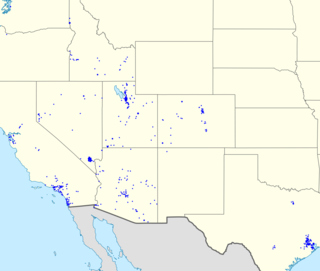

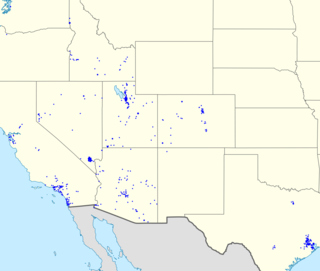

Zions Bancorporation is a national bank headquartered in Salt Lake City, Utah. It operates as a national bank rather than as a bank holding company and does business under the following seven brands: Zions Bank, Amegy Bank of Texas, California Bank and Trust, National Bank of Arizona, Nevada State Bank, Vectra Bank Colorado, and the Commerce Bank of Washington. It has 416 branches and over 1 million customers. It was founded by the Church of Jesus Christ of Latter-day Saints in 1873, although the church divested its interest in the bank in 1960.

First Citizens Bancshares, Inc. is a bank holding company based in Raleigh, North Carolina and one of the largest banks in the United States. Its primary subsidiary is First Citizens Bank, which operates over 500 branches in 23 states. A second subsidiary is Silicon Valley Bank, which operates 39 offices in 15 states.

WesBanco, Inc., is a bank holding company headquartered in Wheeling, West Virginia, United States. It has over 200 branches in West Virginia, Ohio, Western Pennsylvania, Kentucky, Maryland, and Southern Indiana.

Mercantile Bancorporation was the largest bank holding company in Missouri when it was acquired by Firstar Corporation in 1999.

Premier Financial Corp., headquartered in Defiance, Ohio, is the holding company for Premier Bank. Premier Bank, headquartered in Youngstown, Ohio, operates 73 branches and 9 loan offices in Ohio, Michigan, Indiana and Pennsylvania and serves clients through a team of wealth professionals dedicated to each community banking branch. For more information, visit the company’s website at PremierFinCorp.com.

Cadence Bank is a commercial bank with dual headquarters in Tupelo, Mississippi, and Houston, Texas, with operations in Alabama, Arkansas, Florida, Georgia, Louisiana, Mississippi, Missouri, Oklahoma, Tennessee, Texas, and Illinois. In 1876, Raymond Trice and Company received a charter to create a bank in its hardware store in Verona, Mississippi. In 1886, the banking operation was moved to Tupelo, Mississippi and the company was renamed to Bank of Lee County, Mississippi. Soon after, it was renamed to the Bank of Tupelo. The bank was renamed to Bank of Mississippi in 1966. In 1997, the bank changed its name to BancorpSouth. In October 2021, the bank changed its name to Cadence Bank. It has the naming rights to Cadence Bank Amphitheatre in Atlanta and Cadence Bank Arena in Tupelo.

United Community Banks, Inc. is an American bank. United is one of the largest full-service financial institutions in the Southeast, with $25.9 billion in assets, and 161 offices in Alabama, Florida, Georgia, North Carolina, South Carolina and Tennessee.

Byline Bank is a bank headquartered in Chicago, Illinois, United States. It is the primary subsidiary of Byline Bancorp, Inc., a bank holding company. As of 31 December 2019, it operated 57 branches, 56 of which were in the Chicago metropolitan area. It is the 4th largest Small Business Administration lender.

First Community Bancshares, Inc. is a $2.43 billion bank holding company and the parent company of First Community Bank of Bluefield, Virginia in the United States. As of 2012 First Community Bank had 45 locations in Virginia, West Virginia, and North Carolina, and two locations operating as Peoples Community Bank in Tennessee. As of April 21, 2023 First Community had $3.6 billion in assets.

Sterling Financial Corporation was a bank holding company headquartered in Spokane, Washington. In 2014, the company was acquired by Umpqua Holdings Corporation.

Reliant Bancorp, Inc, formerly Commerce Union Bancshares, is an American financial corporation based in Brentwood, Tennessee, USA. It was listed on the NASDAQ until its merger with United Community Bank in January 2022. It controls a subsidiary, Reliant Bank, a commercial bank.

TCF Financial Corporation, an acronym for Twin City Federal, was a bank holding company based in Detroit, Michigan. Its operating subsidiary, TCF Bank, operated 478 branches in Minnesota, Illinois, Michigan, Colorado, Wisconsin, Ohio, and South Dakota. It also operated specialty lending and leasing businesses in all 50 states, Canada, New Zealand, and Australia. TCF was acquired by Huntington Bancshares in June 2021.