Proposition 13 is an amendment of the Constitution of California enacted during 1978, by means of the initiative process. The initiative was approved by California voters on June 6, 1978. It was upheld as constitutional by the United States Supreme Court in the case of Nordlinger v. Hahn, 505 U.S. 1 (1992). Proposition 13 is embodied in Article XIII A of the Constitution of the State of California.

The state controller of California is a constitutional office in the executive branch of the government of the U.S. state of California. Thirty-three individuals have held the office of state controller since statehood. The incumbent is Malia Cohen, a Democrat. The state controller's main office is located at 300 Capitol Mall in Sacramento.

The Constitution of the State of Michigan is the governing document of the U.S. state of Michigan. It describes the structure and function of the state's government.

The State Treasurer of Oklahoma is the chief custodian of Oklahoma’s cash deposits, monies from bond sales, and other securities and collateral and directs the investments of those assets. The treasurer provides for the safe and efficient operation of state government through effective banking, investment, and cash management. The state treasurer has the powers of a typical chief financial officer for a corporation.

The government of the U.S. State of Oklahoma, established by the Oklahoma Constitution, is a republican democracy modeled after the federal government of the United States. The state government has three branches: the executive, legislative, and judicial. Through a system of separation of powers or "checks and balances," each of these branches has some authority to act on its own, some authority to regulate the other two branches, and has some of its own authority, in turn, regulated by the other branches.

The Oklahoma State Auditor and Inspector is an elected Constitutional officer for the U.S. State of Oklahoma. The State Auditor and Inspector is responsible for auditing and prescribing bookkeeping standards of all government agencies and county treasurers within Oklahoma. The office in its current form is a consolidation of the office of State Auditor with that of the office of State Examiner and Inspector, both of which dated back to statehood in 1907. The two positions were combined in 1979 after passage of State Question 510 in 1975. Tom Daxon was the first person to hold the combined office and the first Republican as all previous occupants of either position were Democrats.

The Wisconsin Department of Revenue (DOR) is an agency of the Wisconsin state government responsible for the administration of all tax laws, as well as valuing property and overseeing the wholesale distribution of alcoholic beverages and enforcement of liquor laws. The Department also administers the state's unclaimed property program and the state lottery.

The Oklahoma Tax Commission (OTC) is the Oklahoma state government agency that collects taxes and enforces the taxation and revenue laws of the state. The Commission is composed of three members appointed by the Governor of Oklahoma and confirmed by the Oklahoma Senate. The Commissioners are charged with oversight of the agency but appoint an Executive Director to serve as the chief administrative officer of the Commission and to oversee the general practices of the Commission.

The Texas Comptroller of Public Accounts is an executive branch position created by the Texas Constitution. The comptroller is popularly elected every four years, and is primarily tasked with collecting all state tax revenue and estimating the amount of revenue that the Texas Legislature can spend each biennium. The current comptroller is Glenn Hegar, who took office on January 2, 2015.

Thomas E. Daxon was an American businessman and politician from Oklahoma. Daxon had held numerous positions with the Oklahoma state government, including being elected Oklahoma State Auditor and Inspector in 1978 and serving as the Oklahoma Secretary of Finance and Revenue under Governor of Oklahoma Frank Keating. He was the Republican nominee for governor in the 1982 election, ultimately losing to Democratic incumbent George Nigh.

The Budget of the State of Oklahoma is the governor's proposal to the Oklahoma Legislature which recommends funding levels to operate the state government for the next fiscal year, beginning July 1. Legislative decisions are governed by rules and legislation regarding the state budget process.

Most local governments in the United States impose a property tax, also known as a millage rate, as a principal source of revenue. This tax may be imposed on real estate or personal property. The tax is nearly always computed as the fair market value of the property, multiplied by an assessment ratio, multiplied by a tax rate, and is generally an obligation of the owner of the property. Values are determined by local officials, and may be disputed by property owners. For the taxing authority, one advantage of the property tax over the sales tax or income tax is that the revenue always equals the tax levy, unlike the other types of taxes. The property tax typically produces the required revenue for municipalities' tax levies. One disadvantage to the taxpayer is that the tax liability is fixed, while the taxpayer's income is not.

The Oklahoma State Budget for Fiscal Year 2011, is a spending request by Governor Brad Henry to fund government operations for July 1, 2010–June 30, 2011. Governor Henry and legislative leader approved the budget in May 2010. This was Governor Henry's eight and final budget submitted as governor.

The Oklahoma State Budget for Fiscal Year 2004 was the spending request by Governor Brad Henry to fund government operations for July 1, 2003–June 30, 2004. Governor Henry and legislative leaders approved the budget in May 2003. This was Henry's first budget submitted as governor.

The Oklahoma State Budget for Fiscal Year 2007, was a spending request by Governor Brad Henry to fund government operations for July 1, 2006–June 30, 2007. Governor Henry and legislative leader approved the budget in May 2006.

The Oklahoma State Budget for Fiscal Year 2012, is a spending request by Governor Mary Fallin to fund government operations for July 1, 2011–June 30, 2012. Governor Fallin proposed the budget on February 7, 2011. This was Governor Fallin's first budget submitted as governor.

The Oklahoma State Budget for Fiscal Year 2010, is a spending request by Governor Brad Henry to fund government operations for July 1, 2009–June 30, 2010. Governor Henry and legislative leader approved the budget in May 2009.

The Oklahoma State Budget for Fiscal Year 2013, is a spending request by Governor Mary Fallin to fund government operations for July 1, 2012–June 30, 2013. Governor Fallin proposed the budget on February 6, 2012. This was Governor Fallin's second budget submitted as governor.

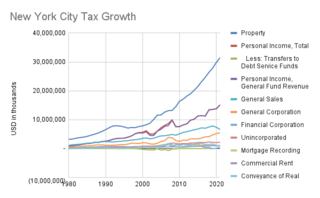

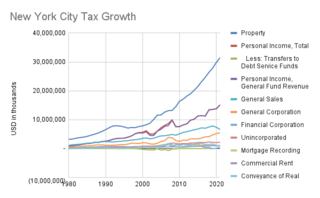

S.7000-A is the name given to the current dominant property tax law in effect in New York State affecting New York City. Surrounding areas such as Nassau County have similar laws. The bill was enacted in 1981 in response to the Hellerstein decision. The law is embodied in Article 18 of the New York State Real Property Law.

The state auditor of West Virginia is an elected constitutional officer in the executive branch of the U.S. state of West Virginia. The incumbent is JB McCuskey, a Republican.