The economy of Denmark is a modern mixed economy with comfortable living standards, a high level of government services and transfers, and a high dependence on foreign trade. The economy is dominated by the service sector with 80% of all jobs, whereas about 11% of all employees work in manufacturing and 2% in agriculture. The nominal gross national income per capita was the seventh-highest in the world at $58,439 in 2020. Correcting for purchasing power, per capita income was Int$57,781 or 10th-highest globally. The income distribution is relatively equal but inequality has somewhat increased during the last decades. This increase was attributed to both a larger spread in gross incomes and various economic policy measures. In 2017, Denmark had the seventh-lowest Gini coefficient of the then 28 European Union countries. With 5,932,654 inhabitants, Denmark has the 36th largest national economy in the world measured by nominal gross domestic product (GDP), and the 51st largest in the world measured by purchasing power parity (PPP).

The economy of Estonia is an advanced economy and the country is a member of the European Union and of the eurozone. Estonia's economy is heavily influenced by developments in the Finnish and Swedish economies.

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. For example, using interest rates, taxes, and government spending to regulate an economy's growth and stability. This includes regional, national, and global economies.

The economy of North Macedonia has become more liberalized, with an improved business environment, since its independence from Yugoslavia in 1991, which deprived the country of its key protected markets and the large transfer payments from Belgrade. Prior to independence, North Macedonia was Yugoslavia's poorest republic. An absence of infrastructure, United Nations sanctions on its largest market, and a Greek economic embargo hindered economic growth until 1996.

Reaganomics, or Reaganism, were the neoliberal economic policies promoted by U.S. President Ronald Reagan during the 1980s. These policies are characterized as supply-side economics, trickle-down economics, or "voodoo economics" by opponents, while Reagan and his advocates preferred to call it free-market economics.

The economy of Slovakia is based upon Slovakia becoming an EU member state in 2004, and adopting the euro at the beginning of 2009. Its capital, Bratislava, is the largest financial centre in Slovakia. As of Q1 2018, the unemployment rate was 5.72%.

Full employment is a situation in which there is no cyclical or deficient-demand unemployment. Full employment does not entail the disappearance of all unemployment, as other kinds of unemployment, namely structural and frictional, may remain. For instance, workers who are "between jobs" for short periods of time as they search for better employment are not counted against full employment, as such unemployment is frictional rather than cyclical. An economy with full employment might also have unemployment or underemployment where part-time workers cannot find jobs appropriate to their skill level, as such unemployment is considered structural rather than cyclical. Full employment marks the point past which expansionary fiscal and/or monetary policy cannot reduce unemployment any further without causing inflation.

The economy of Belgium is a modern, capitalist economy that has capitalised on the country's central geographic location, highly developed transport network, and diversified industrial and commercial base. Belgium was the first country to undergo an Industrial Revolution on the continent of Europe in the early 19th century. It has since developed an excellent transportation infrastructure of ports, canals, railways, and highways, in order to integrate its industry with that of its neighbours.

The economy of Andorra is a developed and free market economy driven by finance, retail, and tourism. The country's gross domestic product (GDP) was US$5.30 billion in 2022. Attractive for shoppers from France and Spain as a free port, Andorra also has developed active summer and winter tourist resorts. With some 270 hotels and 400 restaurants, as well as many shops, the tourist trade employs a growing portion of the domestic labour force. An estimated 13 million tourists visit annually.

In economics, the fiscal multiplier is the ratio of change in national income arising from a change in government spending. More generally, the exogenous spending multiplier is the ratio of change in national income arising from any autonomous change in spending. When this multiplier exceeds one, the enhanced effect on national income may be called the multiplier effect. The mechanism that can give rise to a multiplier effect is that an initial incremental amount of spending can lead to increased income and hence increased consumption spending, increasing income further and hence further increasing consumption, etc., resulting in an overall increase in national income greater than the initial incremental amount of spending. In other words, an initial change in aggregate demand may cause a change in aggregate output that is a multiple of the initial change.

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit; the opposite of budget surplus. The term may be applied to the budget of a government, private company, or individual. Government deficit spending was first identified as a necessary economic tool by John Maynard Keynes in the wake of the Great Depression. It is a central point of controversy in economics, as discussed below.

The government budget balance, also alternatively referred to as general government balance, public budget balance, or public fiscal balance, is the overall difference between government revenues and spending. A positive balance is called a government budget surplus, and a negative balance is a government budget deficit. A government budget is a financial statement presenting the government's proposed revenues and spending for a financial year. A budget is prepared for each level of government and takes into account public social security obligations.

The economies of Canada and the United States are similar because both are developed countries. While both countries feature in the top ten economies in the world in 2022, the U.S. is the largest economy in the world, with US$24.8 trillion, with Canada ranking ninth at US$2.2 trillion.

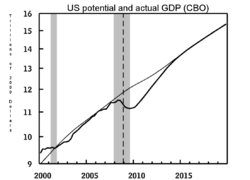

In economics, potential output refers to the highest level of real gross domestic product that can be sustained over the long term. Actual output happens in real life while potential output shows the level that could be achieved.

The Taylor rule is a monetary policy targeting rule. The rule was proposed in 1992 by American economist John B. Taylor for central banks to use to stabilize economic activity by appropriately setting short-term interest rates.

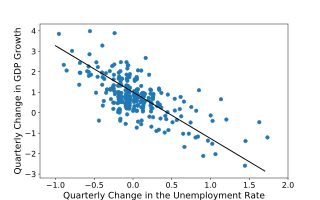

In economics, Okun's law is an empirically observed relationship between unemployment and losses in a country's production. It is named after Arthur Melvin Okun, who first proposed the relationship in 1962. The "gap version" states that for every 1% increase in the unemployment rate, a country's GDP will be roughly an additional 2% lower than its potential GDP. The "difference version" describes the relationship between quarterly changes in unemployment and quarterly changes in real GDP. The stability and usefulness of the law has been disputed.

National accounts or national account systems (NAS) are the implementation of complete and consistent accounting techniques for measuring the economic activity of a nation. These include detailed underlying measures that rely on double-entry accounting. By design, such accounting makes the totals on both sides of an account equal even though they each measure different characteristics, for example production and the income from it. As a method, the subject is termed national accounting or, more generally, social accounting. Stated otherwise, national accounts as systems may be distinguished from the economic data associated with those systems. While sharing many common principles with business accounting, national accounts are based on economic concepts. One conceptual construct for representing flows of all economic transactions that take place in an economy is a social accounting matrix with accounts in each respective row-column entry.

The Solow residual is a number describing empirical productivity growth in an economy from year to year and decade to decade. Robert Solow, the Nobel Memorial Prize in Economic Sciences-winning economist, defined rising productivity as rising output with constant capital and labor input. It is a "residual" because it is the part of growth that is not accounted for by measures of capital accumulation or increased labor input. Increased physical throughput – i.e. environmental resources – is specifically excluded from the calculation; thus some portion of the residual can be ascribed to increased physical throughput. The example used is for the intracapital substitution of aluminium fixtures for steel during which the inputs do not alter. This differs in almost every other economic circumstance in which there are many other variables. The Solow residual is procyclical and measures of it are now called the rate of growth of multifactor productivity or total factor productivity, though Solow (1957) did not use these terms.

Gross regional domestic product (GRDP), gross domestic product of region (GDPR), or gross state product (GSP) is a statistic that measures the size of a region's economy. It is the aggregate of gross value added (GVA) of all resident producer units in the region, and analogous to national gross domestic product. The GRDP includes regional estimates on the three major sectors including their sub-sectors, namely:

This glossary of economics is a list of definitions of terms and concepts used in economics, its sub-disciplines, and related fields.