Related Research Articles

A stock exchange, securities exchange, or bourse is an exchange where stockbrokers and traders can buy and sell securities, such as shares of stock, bonds and other financial instruments. Stock exchanges may also provide facilities for the issue and redemption of such securities and instruments and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as "continuous auction" markets with buyers and sellers consummating transactions via open outcry at a central location such as the floor of the exchange or by using an electronic system to process financial transactions.

Euronext Dublin is Ireland's main stock exchange, and has been in existence since 1793.

The Panic of 1907, also known as the 1907 Bankers' Panic or Knickerbocker Crisis, was a financial crisis that took place in the United States over a three-week period starting in mid-October, when the New York Stock Exchange suddenly fell almost 50% from its peak the previous year. The panic occurred during a time of economic recession, and there were numerous runs affecting banks and trust companies. The 1907 panic eventually spread throughout the nation when many state and local banks and businesses entered bankruptcy. The primary causes of the run included a retraction of market liquidity by a number of New York City banks and a loss of confidence among depositors, exacerbated by unregulated side bets at bucket shops.

Singapore Exchange Limited is a Singapore-based exchange conglomerate, operating equity, fixed income, currency and commodity markets. It provides a range of listing, trading, clearing, settlement, depository and data services. SGX Group is also a member of the World Federation of Exchanges and the Asian and Oceanian Stock Exchanges Federation. It is ASEAN's second largest market capitalization after Indonesia Stock Exchange at US$609.653 billion as of September 2023.

Rene Walter Rivkin was a Chinese-born Australian entrepreneur, investor, investment adviser and stockbroker. He was convicted of insider trading in 2003 and sentenced to nine months of periodic detention.

Olivia Lum Ooi Lin is a Singaporean businesswoman. She is the founder, group chief executive officer, and president of the Singapore-based Hyflux Group.

The Nicoll Highway collapse occurred in Singapore on 20 April 2004 at 3:30 pm local time when a Mass Rapid Transit (MRT) tunnel construction site caved in, leading to the collapse of the Nicoll Highway near the Merdeka Bridge. Four workers were killed and three were injured, delaying the construction of the Circle Line (CCL).

The Japanese asset price bubble was an economic bubble in Japan from 1986 to 1991 in which real estate and stock market prices were greatly inflated. In early 1992, this price bubble burst and Japan's economy stagnated. The bubble was characterized by rapid acceleration of asset prices and overheated economic activity, as well as an uncontrolled money supply and credit expansion. More specifically, over-confidence and speculation regarding asset and stock prices were closely associated with excessive monetary easing policy at the time. Through the creation of economic policies that cultivated the marketability of assets, eased the access to credit, and encouraged speculation, the Japanese government started a prolonged and exacerbated Japanese asset price bubble.

Jefferies Group LLC is an American multinational independent investment bank and financial services company that is headquartered in New York City. The firm provides clients with capital markets and financial advisory services, institutional brokerage, securities research, and asset management. This includes mergers and acquisitions, restructuring, and other financial advisory services. The Capital Markets segment also includes its securities trading and investment banking activities.

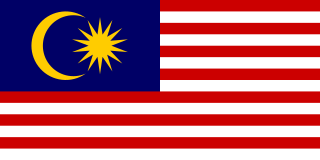

A remisier is an agent of a stockbroking company and receives a commission for each transaction handled. Although the origin of the word is French, and although remisiers are still a feature of the Paris Bourse, the term is now most commonly used in the context of the Kuala Lumpur Stock Exchange and the Singapore Stock Exchange.

Glenn Jeyasingam Knight is a Singaporean lawyer. He was the first Director of the Commercial Affairs Department (CAD) when it was founded in 1984. He lost his post in 1991 after being convicted of corruption in a much-publicised trial. In 1998, he was again tried and convicted for misappropriating money while in office.

Peter Tham Wing Fai is a Singaporean stockbroker and the director of Pan-Electric Industries. A failure by him to observe a forward contract agreement that he negotiated with Tan Koon Swan was responsible for the company's collapse in 1985.

Tan Koon Swan is a Malaysian political and corporate figure. He was the fifth president of the Malaysian Chinese Association (MCA), a component party of Barisan Nasional (BN) coalition; from November 1985 to September 1986.

Private equity in the 1990s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital, experienced growth along parallel although interrelated tracks.

Goodbody & Co. was a United States stock brokerage firm headquartered in New York City. It was founded in 1886 by Irishman Robert Goodbody after the demise of Goodbody, Glynn, and Dow.

UOB Kay Hian Holdings Limited is a Singapore-based brokerage firm that engages in brokerage services, private wealth management, investment management and financial research. UOB Kay Hian was founded in the early 1900s by Khoo Kay Hian as Kay Hian & Co (Pte).

Tan Boon Teik was a Singaporean judge who served as the second attorney-general of Singapore between 1969 and 1992. At the age of 39, Tan was the youngest person to be appointed as attorney-general, and was the longest-serving attorney-general after the Independence of Singapore, after 25 years in office.

According to a 2013 public survey in Malaysia by Transparency International, a majority of the surveyed households perceived Malaysian political parties to be highly corrupt. A quarter of the surveyed households consider the government's efforts in the fight against corruption to be ineffective. Corruption in Malaysia generally involves political connections still playing an important role in the outcome of public tenders.

Vickers, da Costa was a prominent stockbroking firm of the London Stock Exchange in the City of London, and later also of the New York Stock Exchange and the Tokyo Stock Exchange. It was in business from its creation in 1917 until 1986, when after a takeover by Citicorp it was merged into a new firm called Scrimgeour Vickers. In 1987, this was closed.

References

- 1 2 3 National Heritage Board (Singapore) (2006). "Pan-El crisis". In Tommy T.B. Koh; et al. (eds.). Singapore: The Encyclopedia . Singapore: Editions Didier Millet. p. 402. ISBN 981-4155-63-2.

- ↑ Pan-Electric Liquidation, The New York Times , February 7, 1986.

- ↑ "The Pan-Electric crisis hits the stock market - Singapore History". eresources.nlb.gov.sg. Retrieved 2022-05-25.

- ↑ "Trading halt causes crisis in Singapore". The Globe and Mail. 3 December 1985. p. B15.

- ↑ Ahmad, Zakaria Haji (1986). "Malaysia in 1985: The Beginnings of Sagas". Asian Survey . 26 (2). University of California Press: 150–7. doi:10.2307/2644450. ISSN 1533-838X. JSTOR 2644450.

- ↑ "Remembering the Pan-Electric crisis, nearly 40 years on". sal.org.sg. Singapore Academy of Law. 11 October 2022. Retrieved 28 December 2022.

- ↑ "Case Study on Pan-Electric Crisis, MAS Staff Paper No.32, June 2004" (PDF). Monetary Authority of Singapore. July 2004. Retrieved 28 December 2022.