Related Research Articles

A hedge fund is a pooled investment fund that holds liquid assets and that makes use of complex trading and risk management techniques to improve investment performance and insulate returns from market risk. Among these portfolio techniques are short selling and the use of leverage and derivative instruments. In the United States, financial regulations require that hedge funds be marketed only to institutional investors and other accredited investors such as high-net-worth individuals and ultra-high-net-worth individuals.

The Goldman Sachs Group, Inc. is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered in Lower Manhattan in New York City, with regional headquarters in many international financial centers. Goldman Sachs is the second largest investment bank in the world by revenue and is ranked 55th on the Fortune 500 list of the largest United States corporations by total revenue. It is considered a systemically important financial institution by the Financial Stability Board.

ABN AMRO Bank N.V. is the third-largest Dutch bank, with headquarters in Amsterdam. It was initially formed in 1991 by merger of the two prior Dutch banks that form its name, Algemene Bank Nederland (ABN) and Amsterdamsche en Rotterdamsche Bank.

TPG Inc., previously known as Texas Pacific Group and TPG Capital, is an American private equity firm based in Fort Worth, Texas. The firm is focused on leveraged buyouts and growth capital. TPG manages investment funds in growth capital, venture capital, public equity, and debt investments. The firm invests in a range of industries including consumer/retail, media and telecommunications, industrials, technology, travel, leisure, and health care.

Permal Group is a global investment management firm focused on hedge funds and private equity funds products for international investors. Permal, founded in 1973, operates one of the oldest fund of hedge funds and manages approximately $22 billion in assets. Clients include sovereign wealth funds, pension funds, endowments, foundations, insurance companies, family offices, private banks and high-net-worth individuals. Its CEO is Omar Kodmani and its Chairman is Isaac R. Souede. Permal is headquartered in London, with offices in New York, Boston, Singapore, Paris, Nassau, Dubai, Hong Kong, and Beijing.

Gary P. Naftalis is an American trial lawyer, and head of the litigation department and co-chair of Kramer Levin Naftalis & Frankel LLP, a New York City law firm.

Marshall Wace LLP is a British hedge fund headquartered in London, England, founded by Paul Marshall and Ian Wace in 1997. Marshall serves as chairman and chief investment officer, and Wace as a chief executive officer & chief risk officer. The company is recognized as one of the world's largest hedge fund managers.

LGT Group is the largest royal family-owned private banking and asset management group in the world. LGT, originally known as The Liechtenstein Global Trust, is owned by the princely House of Liechtenstein through the Prince of Liechtenstein Foundation and led by its royal family members H.S.H. Prince Maximilian von und zu Liechtenstein (CEO) and H.S.H. Prince Philipp von und zu Liechtenstein (chairman).

The Children’s Investment Fund Management (UK) LLP (TCI) is a London‐based hedge fund management firm founded by Chris Hohn in 2003 which manages The Children’s Investment Master Fund. TCI makes long‐term investments in companies globally. The management company is authorized and regulated in the United Kingdom by the Financial Conduct Authority. Its holding company is TCI Fund Management Limited, based in the Cayman Islands. TCI derives its name from a charitable foundation called The Children's Investment Fund Foundation (CIFF), set up by Chris Hohn and his ex-wife, Jamie Cooper-Hohn, and initially contributed a proportion of profits to the foundation. In January 2022, TCI was named by the Guardian as the world's top-performing hedge fund. It is known as one of the most aggressive activist investors.

Private equity funds and hedge funds are private investment vehicles used to pool investment capital, usually for a small group of large institutional or wealthy individual investors. They are subject to favorable regulatory treatment in most jurisdictions from which they are managed, which allows them to engage in financial activities that are off-limits for more regulated companies. Both types of fund also take advantage of generally applicable rules in their jurisdictions to minimize the tax burden on their investors, as well as on the fund managers. As media coverage increases regarding the growing influence of hedge funds and private equity, these tax rules are increasingly under scrutiny by legislative bodies. Private equity and hedge funds choose their structure depending on the individual circumstances of the investors the fund is designed to attract.

Man GLG is a discretionary investment manager and a wholly owned subsidiary of British alternative investment manager Man Group plc. It is a diversified and multi-strategy fund manager that operates strategies including equity long-short funds, convertible arbitrage funds, emerging market funds and long-only mutual funds. The firm is also a founding member of the Hedge Fund Standards Board and a signatory of the Principles for Responsible investment. As of 2022, Man GLG had $35.4 billion assets under management.

Union Bancaire Privée is a private bank and wealth management firm headquartered in Geneva. UBP is one of the largest private banks in Switzerland, and serves private and institutional clients. The bank was founded in 1969 by Edgar de Picciotto.

Brevan Howard is a European hedge fund management company based in Jersey with its funds domiciled in the Cayman Islands. Brevan Howard was founded in 2002 by Alan Howard, alongside four other co-founders including Chris Rokos, and is widely considered to be one of the top global macro hedge funds.

The LSE SU Alternative Investments Conference is an international conference on hedge funds, private equity and venture capital held annually in London, United Kingdom by the LSE Alternative Investments Society (AIC), a Student’s Union society at the London School of Economics and Political Science (LSE).

Pine River Capital Management L.P. is an asset management firm. The firm trades stocks, fixed income, derivatives and warrants. As of 2018 the company manages approximately US$7 billion across three actively managed platforms: hedge funds, managed accounts and listed investment vehicles to support a number of strategies including interest rates, mortgages, equity long/short, event-driven equity, and global convertible bond arbitrage. The company is currently managed by founder and CEO Brian Taylor and 6 partners.

Michael Edward Platt is a British billionaire hedge fund manager. He is the co-founder and managing director of BlueCrest Capital Management, Europe's third-largest hedge-fund firm which he co-founded in 2000. He is Britain's wealthiest hedge fund manager according to the Forbes Real Time Billionaires List, with an estimated wealth of US$15.2 billion.

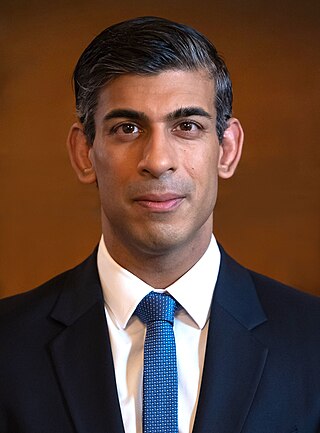

Rishi Sunak is a British politician who has served as Prime Minister of the United Kingdom and Leader of the Conservative Party since 2022. The first British Asian prime minister, he previously held two cabinet positions under Boris Johnson, lastly as Chancellor of the Exchequer from 2020 to 2022. Sunak has been Member of Parliament (MP) for Richmond (Yorks) since 2015.

The March 2021 United Kingdom budget, officially known as Protecting the Jobs and Livelihoods of the British People was a budget delivered by Rishi Sunak, the Chancellor of the Exchequer in March 2021. It was expected to be delivered in autumn 2020, but was postponed because of the COVID-19 pandemic. It succeeds the budget held in March 2020, and the summer statement and Winter Economy Plan held in summer and autumn 2020, respectively. The budget is the second under Boris Johnson's government, also the second to be delivered by Sunak and the second since Britain's withdrawal from the European Union. The budget was the first for government expenditure in the United Kingdom to exceed £1 trillion.

Dominic Robert Andrew Johnson, Baron Johnson of Lainston,, is a British financier, hedge fund manager and politician, the co-founder and chief executive officer (CEO) of Somerset Capital Management. He currently serves as a Minister of State in the Department for Business and Trade, having served in the department during the tenure of Liz Truss. Johnson has given more than £250,000 to the Conservative Party, and was its vice-chairman from 2016 to 2019.

References

- ↑ "Patrick DEGORCE". Companies House. Retrieved 6 August 2022.

- ↑ "Patrick Degorce". Institutional Investor. 14 June 2010. Retrieved 6 August 2022.

- 1 2 3 4 5 "Hedgie Degorce calls up old friends to set up a fund at Lansdowne's offices". City AM. 12 July 2009. Retrieved 6 August 2022.

- ↑ Fletcher, Laurence (9 January 2009). "TCI founder, partner Degorce leaves hedge firm". Reuters. Retrieved 6 August 2022.

- 1 2 Partington, Richard (14 February 2020). "New chancellor Rishi Sunak challenged over hedge fund past". The Guardian. Retrieved 6 August 2022.

- ↑ Sebastiano, Craig (30 July 2007). "ABN Boards Drop Support for Barclays Bid". Benefits Canada. Retrieved 28 August 2022.

- ↑ "Patrick Degorce Chief Executive Officer, Theleme Partners LLP". Bloomberg LP. Retrieved 6 August 2022.

- ↑ Peston, Robert (17 February 2020). "Robert Peston on 'Boris Johnson's hedge-fund government'". ITV. Retrieved 6 August 2022.

- ↑ Chung, Juliet (2 October 2020). "The Millionaire Who Gave Moderna a Shot". The Wall Street Journal. Retrieved 6 August 2022.

- ↑ Kinder, Tabby (12 October 2017). "Hedge fund manager loses multi-million pound tax battle". Financial News. Retrieved 6 August 2022.

- ↑ Lovell, Hamlin (November 2017). "Tomorrow's Titans 2010–2016: Revisited". The Hedge Fund Journal. Retrieved 6 August 2022.