Oil sands, tar sands, crude bitumen, or bituminous sands, are a type of unconventional petroleum deposit. Oil sands are either loose sands or partially consolidated sandstone containing a naturally occurring mixture of sand, clay, and water, soaked with bitumen, a dense and extremely viscous form of petroleum.

The Athabasca oil sands, also known as the Athabasca tar sands, are large deposits of bitumen or extremely heavy crude oil that constitute unconventional resources, located in northeastern Alberta, Canada – roughly centred on the boomtown of Fort McMurray. These oil sands, hosted primarily in the McMurray Formation, consist of a mixture of crude bitumen, silica sand, clay minerals, and water. The Athabasca deposit is the largest known reservoir of crude bitumen in the world and the largest of three major oil sands deposits in Alberta, along with the nearby Peace River and Cold Lake deposits.

Suncor Energy is a Canadian integrated energy company based in Calgary, Alberta. It specializes in production of synthetic crude from oil sands. In the 2020 Forbes Global 2000, Suncor Energy was ranked as the 48th-largest public company in the world.

Heavy crude oil is highly viscous oil that cannot easily flow from production wells under normal reservoir conditions.

Petroleum production in Canada is a major industry which is important to the overall economy of North America. Canada has the third largest oil reserves in the world and is the world's fourth largest oil producer and fourth largest oil exporter. In 2019 it produced an average of 750,000 cubic metres per day (4.7 Mbbl/d) of crude oil and equivalent. Of that amount, 64% was upgraded from unconventional oil sands, and the remainder light crude oil, heavy crude oil and natural-gas condensate. Most of the Canadian petroleum production is exported, approximately 600,000 cubic metres per day (3.8 Mbbl/d) in 2019, with 98% of the exports going to the United States. Canada is by far the largest single source of oil imports to the United States, providing 43% of US crude oil imports in 2015.

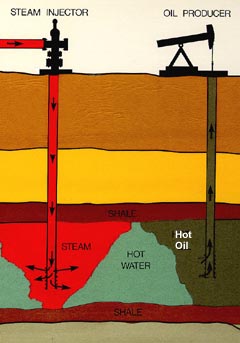

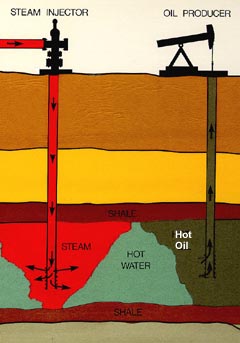

Steam-assisted gravity drainage is an enhanced oil recovery technology for producing heavy crude oil and bitumen. It is an advanced form of steam stimulation in which a pair of horizontal wells are drilled into the oil reservoir, one a few metres above the other. High pressure steam is continuously injected into the upper wellbore to heat the oil and reduce its viscosity, causing the heated oil to drain into the lower wellbore, where it is pumped out. Dr. Roger Butler, engineer at Imperial Oil from 1955 to 1982, invented the steam assisted gravity drainage (SAGD) process in the 1970s. Butler "developed the concept of using horizontal pairs of wells and injected steam to develop certain deposits of bitumen considered too deep for mining". In 1983 Butler became director of technical programs for the Alberta Oil Sands Technology and Research Authority (AOSTRA), a crown corporation created by Alberta Premier Lougheed to promote new technologies for oil sands and heavy crude oil production. AOSTRA quickly supported SAGD as a promising innovation in oil sands extraction technology.

Connacher Oil and Gas Limited is a Calgary-based exploration, development and production company active in the production and sale of bitumen in the Athabasca oil sands region. Connacher's shares used to trade on the Toronto Stock Exchange, but it was de-listed in 2016, after filing for insolvency.

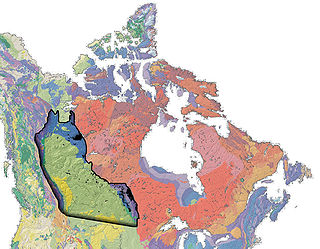

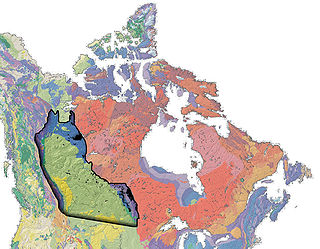

The Western Canadian Sedimentary Basin (WCSB) underlies 1.4 million square kilometres (540,000 sq mi) of Western Canada including southwestern Manitoba, southern Saskatchewan, Alberta, northeastern British Columbia and the southwest corner of the Northwest Territories. This vast sedimentary basin consists of a massive wedge of sedimentary rock extending from the Rocky Mountains in the west to the Canadian Shield in the east. This wedge is about 6 kilometres (3.7 mi) thick under the Rocky Mountains, but thins to zero at its eastern margins. The WCSB contains one of the world's largest reserves of petroleum and natural gas and supplies much of the North American market, producing more than 450 million cubic metres per day of gas in 2000. It also has huge reserves of coal. Of the provinces and territories within the WCSB, Alberta has most of the oil and gas reserves and almost all of the oil sands.

OPTI Canada is a Calgary, Alberta based oil sands development company. Established in 1999, its sole project is the Long Lake oil sands project, of which it owns 35%. The remaining 65% is owned by project operator Nexen Inc.

Steam injection is an increasingly common method of extracting heavy crude oil. Used commercially since the 1960s, it is considered an enhanced oil recovery (EOR) method and is the main type of thermal stimulation of oil reservoirs. There are several different forms of the technology, with the two main ones being Cyclic Steam Stimulation and Steam Flooding. Both are most commonly applied to oil reservoirs, which are relatively shallow and which contain crude oils which are very viscous at the temperature of the native underground formation. Steam injection is widely used in the San Joaquin Valley of California (US), the Lake Maracaibo area of Venezuela, and the oil sands of northern Alberta, Canada.

The Bakken Formation is a rock unit from the Late Devonian to Early Mississippian age occupying about 200,000 square miles (520,000 km2) of the subsurface of the Williston Basin, underlying parts of Montana, North Dakota, Saskatchewan and Manitoba. The formation was initially described by geologist J. W. Nordquist in 1953. The formation is entirely in the subsurface, and has no surface outcrop. It is named after Henry O. Bakken (1901–1982), a farmer in Tioga, North Dakota, who owned the land where the formation was initially discovered while drilling for oil.

Japan Canada Oil Sands Limited (JACOS) was an oil sands extraction company. It was the operator of the Hangingstone oil sands project. JACOS was acquired by Greenfire Resources Operating Corporation in 2021.

The Clearwater Formation is a stratigraphic unit of Early Cretaceous (Albian) age in the Western Canada Sedimentary Basin in northeastern Alberta, Canada. It was first defined by R.G. McConnell in 1893 and takes its name from the Clearwater River near Fort McMurray.

Although there are numerous oil companies operating in Canada, as of 2009, the majority of production, refining and marketing was done by fewer than 20 of them. According to the 2013 edition of Forbes Global 2000, canoils.com and any other list that emphasizes market capitalization and revenue when sizing up companies, as of March 31, 2014 these are the largest Canada-based oil and gas companies.

The Long Lake oil sands upgrader project is an in situ oil extraction project near Anzac, Alberta, 40 km (25 mi) southeast of Fort McMurray in the Athabasca oil sands region of Alberta.

Frontera Energy is a Canadian petroleum exploration and production company in the business of heavy crude oil and natural gas. Its focus is on Colombia and Peru where it holds numerous properties including 38 blocks in the Llanos, Sucre-Co Lower Magdalena and Cesar Valley, Rancheria, Upper and Middle Magdalena Valley, Putumayo Valley, Ucayali and Maranon basins. In early 2010 it was the largest independent oil company operating in South America and in terms of private companies the fastest growing one in Colombia. In 2011 it was responsible for 41% of the growth in oil production in Colombia. In mid-2015 it changed its name from Pacific Rubiales to Pacific Exploration and Production, signalling the diminished importance of the Rubiales oil field in Colombia in the company's total assets and a broader focus in Latin America. When Pacific Exploration and Production filed for bankruptcy protection on April 27, 2016, it listed Pacific E&P Holdings Corp., Meta Petroleum Corp., Pacific Stratus International Energy Ltd., Pacific Stratus Energy Colombia Corp., Pacific Stratus Energy S.A., Pacific Off Shore Peru S.R.L., Pacific Rubiales Guatemala S.A., Pacific Guatemala Energy Corp., PRE-PSIE Coöperatief U.A., Petrominerales Colombia Corp. and Grupo C&C Energia (Barbados) Ltd. as subsidiaries. In June 2017, it renamed itself Frontera Energy, and was relisted on the Toronto Stock Exchange.

Baytex Energy Corp. is an energy company based in Calgary, Alberta. The company is engaged in the acquisition, development and production of crude oil and natural gas in the Western Canadian Sedimentary Basin and in the Eagle Ford in the United States. Baytex's common shares trade on the Toronto Stock Exchange and on the New York Stock Exchange under the symbol BTE.

MEG Energy is a pure play Canadian oil sands producer engaged in exploration in Northern Alberta. All of its oil reserves are more than 1,000 feet (300 m) below the surface and so they depend on steam-assisted gravity drainage and associated technology to produce. The company's main thermal project is Christina Lake. 85-megawatt cogeneration plants are used to produce the steam used in SAGD which is required to bring bitumen to the surface. The excess heat and electricity produced at its plants is then sold to Alberta's power grid. Its proven reserves have been independently pegged at 1.7 billion barrels and probable reserves 3.7 billion barrels ; That's significant considering only 300 billion barrels of the 1.6 trillion barrels of bitumen in Alberta is considered recoverable under current technology. The value of those reserves is over $19.8 billion. CNOOC has a minority 16.69% interest in MEG Energy.

Laricina Energy Ltd. was a private Canadian oil producing company engaged in exploration in North-Eastern Alberta. The company targeted oil sands opportunities outside of the Athabasca mining area and was focusing on in situ plays in the Grosmont and Grand Rapids formations. Its headquarters were located in Calgary, Alberta, Canada.

Western Canadian Select (WCS) is a heavy sour blend of crude oil that is one of North America's largest heavy crude oil streams and, historically, its cheapest. It was established in December 2004 as a new heavy oil stream by EnCana (now Cenovus), Canadian Natural Resources, Petro-Canada (now Suncor) and Talisman Energy (now Repsol Oil & Gas Canada). It is composed mostly of bitumen blended with sweet synthetic and condensate diluents and 21 existing streams of both conventional and unconventional Alberta heavy crude oils at the large Husky Midstream General Partnership terminal in Hardisty, Alberta. Western Canadian Select—the benchmark for heavy, acidic (TAN <1.1) crudes—is one of many petroleum products from the Western Canadian Sedimentary Basin oil sands. Calgary-based Husky Energy, now a subsidiary of Cenovus, had joined the initial four founders in 2015.