The Federal Deposit Insurance Corporation (FDIC) is a United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. The FDIC was created by the Banking Act of 1933, enacted during the Great Depression to restore trust in the American banking system. More than one-third of banks failed in the years before the FDIC's creation, and bank runs were common. The insurance limit was initially US$2,500 per ownership category, and this has been increased several times over the years. Since the enactment of the Dodd–Frank Wall Street Reform and Consumer Protection Act in 2010, the FDIC insures deposits in member banks up to $250,000 per ownership category. FDIC insurance is backed by the full faith and credit of the government of the United States, and according to the FDIC, "since its start in 1933 no depositor has ever lost a penny of FDIC-insured funds".

The Reserve Bank of New Zealand (RBNZ) is the central bank of New Zealand. It was established in 1934 and is currently constituted under the Reserve Bank of New Zealand Act 2021. The governor of the Reserve Bank, currently Adrian Orr, is responsible for New Zealand's currency and operating monetary policy.

The Commonwealth Bank of Australia (CBA), or CommBank, is an Australian multinational bank with businesses across New Zealand, Asia, the United States, and the United Kingdom. It provides a variety of financial services, including retail, business and institutional banking, funds management, superannuation, insurance, investment, and broking services. The Commonwealth Bank is the largest Australian listed company on the Australian Securities Exchange as of August 2015, with brands including Bankwest, Colonial First State Investments, ASB Bank, Commonwealth Securities (CommSec) and Commonwealth Insurance (CommInsure). Its former constituent parts were the Commonwealth Trading Bank of Australia, the Commonwealth Savings Bank of Australia, and the Commonwealth Development Bank.

The Philadelphia Savings Fund Society (PSFS), originally called the Philadelphia Saving Fund Society, was a savings bank headquartered in Philadelphia, Pennsylvania, United States. PSFS was founded in December 1816, the first savings bank to organize and do business in the United States. The bank would develop as one of the largest savings banks in the United States and became a Philadelphia institution. Generations of Philadelphians first opened accounts as children and became lifelong depositors.

Postal savings systems provide depositors who do not have access to banks a safe and convenient method to save money. Many nations have operated banking systems involving post offices to promote saving money among the poor.

India Post is an Indian government-operated postal system in India, and is the trade name of the Department of Post under the Ministry of Communications. Generally known as the Post Office, it is the most widely distributed postal system in the world. Warren Hastings had taken initiative under East India Company to start the Postal Service in the country in 1766. It was initially established under the name "Company Mail". It was later modified into a service under the Crown in 1854 by Lord Dalhousie. Dalhousie introduced uniform postage rates and helped to pass the India Post Office Act 1854 which significantly improved upon 1837 Post Office act which had introduced regular post offices in India. It created the position Director General of Post for the whole country.

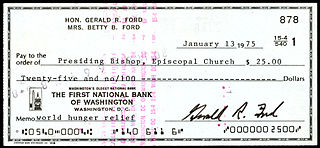

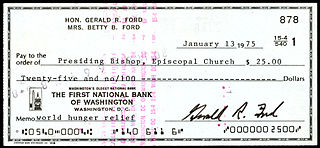

A cheque or check is a document that orders a bank, building society to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the drawer, has a transaction banking account where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the drawee, to pay the amount of money stated to the payee.

Banking in Australia is dominated by four major banks: Commonwealth Bank, Westpac, Australia & New Zealand Banking Group and National Australia Bank. There are several smaller banks with a presence throughout the country which includes Bendigo and Adelaide Bank, Suncorp Bank, and a large number of other financial institutions, such as credit unions, building societies and mutual banks, which provide limited banking-type services and are described as authorised deposit-taking institutions (ADIs). Many large foreign banks have a presence, but few have a retail banking presence. The central bank is the Reserve Bank of Australia (RBA). The Australian government’s Financial Claims Scheme (FCS) guarantees deposits up to $250,000 per account-holder per ADI in the event of the ADI failing.

Deposit insurance or deposit protection is a measure implemented in many countries to protect bank depositors, in full or in part, from losses caused by a bank's inability to pay its debts when due. Deposit insurance systems are one component of a financial system safety net that promotes financial stability.

Westland Savings Bank was one of 14 regional trustee savings banks operating in New Zealand. WSB was based on the West Coast of the South Island of New Zealand.

Post Office Savings Bank, or very briefly PostBank, was a bank owned by the New Zealand Government as the government's postal savings system. The bank was established in 1867. It became PostBank in 1987 and was disestablished and the branches were rebranded when it was acquired by Australia and New Zealand Banking Group (ANZ) in 1989.

A Christmas club is a special-purpose savings account, first offered by various banks and credit unions in the United States beginning in the early 20th century, including the Great Depression. Bank customers would deposit a set amount of money each week into a savings account, and receive the money back at the end of the year for Christmas shopping.

The Savings Bank of South Australia was a bank founded in the colony of South Australia in 1848, based in Adelaide. In the early 20th century it established a presence in schools by setting up a special category of savings accounts for schoolchildren, and grew through the following decades.

The Public Provident Fund (PPF) is a savings-cum-tax-saving instrument in India, introduced by the National Savings Institute of the Ministry of Finance in 1968. The main objective of the scheme is to mobilize small savings by offering an investment with reasonable returns combined with income tax benefits. The scheme is offered by the Central Government. Balance in the PPF account is not subject to attachment under any order or decree of court under the Government Savings Banks Act, 1873. However, Income Tax & other Government authorities can attach the account for recovering tax dues.

Japan Post Bank Co., Ltd. is a Japanese bank headquartered in Tokyo. It is a corporation held by Japan Post Holdings, in which the government of Japan has a majority stake.

The United States Postal Savings System was a postal savings system signed into law by President William Howard Taft and operated by the United States Post Office Department, predecessor of the United States Postal Service, from January 1, 1911, until July 1, 1967.

Pride Microfinance Limited (PMFL), is a microfinance deposit-taking institution (MDI) in Uganda. It is licensed by the Bank of Uganda, the central bank and national banking regulator.

A savings stamp is a stamp issued by a government or other body to enable small amounts of money to be saved over time to accumulate a larger capital sum. The funds accumulated may then be used to make a larger purchase such as taking out a savings bond or to pay a large upcoming bill. Often issued in conjunction with post office run savings banks, savings stamps have also been issued by private companies. Supermarkets have issued the stamps to enable the spreading of large bills, package holiday companies have used them to enable customers to save for an annual holiday, and utilities companies have used the stamps to enable customers to spread the cost of their bills.

A fixed deposit (FD) is a tenured deposit account provided by banks or non-bank financial institutions which provides investors a higher rate of interest than a regular savings account, until the given maturity date. It may or may not require the creation of a separate account. The term fixed deposit is most commonly used in India and the United States. It is known as a term deposit or time deposit in Canada, Australia, New Zealand, and as a bond in the United Kingdom.

Equitable Bank is a Canadian bank that specializes in residential and commercial real estate lending, as well as personal banking through its digital arm, EQ Bank. Founded in 1970 as The Equitable Trust Company, it became a Schedule I Bank in 2013 and has since grown to become Canada's seventh largest bank by assets.