Gary Wayne Coleman was an American actor, known as a high-profile child star of the late 1970s and 1980s. Born in Zion, Illinois, Coleman grew up with his adopted parents, and a kidney disease; due to the corticosteroids and other medications used to treat it, his growth was limited to 4 ft 8 in (142 cm). In the mid-1970s, he appeared in commercials and acted in an episode of Medical Center. He caught the attention of a producer after acting in a pilot for a revival of The Little Rascals (1977), who decided to cast him as Arnold Jackson in the sitcom Diff'rent Strokes (1978–1986), a role which launched Coleman into stardom. For playing the role of Arnold, he received several accolades, which include two Young Artist Awards; in 1980 for Outstanding Contribution to Youth Through Entertainment and in 1982 for Best Young Actor in a Comedy Series; and three People's Choice Awards; a consecutive three wins for Favorite Young TV Performer from 1980 to 1983; as well as nominations for two TV Land Awards.

Stuart Maxwell Whitman was an American actor, known for his lengthy career in film and television. Whitman was born in San Francisco and raised in New York until the age of 12, when his family relocated to Los Angeles. In 1948, Whitman was discharged from the Corps of Engineers in the U.S. Army and started to study acting and appear in plays. From 1951 to 1957, Whitman had a streak working in mostly bit parts in films, including When Worlds Collide (1951), The Day the Earth Stood Still (1951), Barbed Wire (1952) and The Man from the Alamo (1952). On television, Whitman guest-starred in series such as Dr. Christian, The Roy Rogers Show, and Death Valley Days, and also had a recurring role on Highway Patrol. Whitman's first lead role was in John H. Auer's Johnny Trouble (1957).

The Glass–Steagall legislation describes four provisions of the United States Banking Act of 1933 separating commercial and investment banking. The article 1933 Banking Act describes the entire law, including the legislative history of the provisions covered.

Gary Leonard Oldman is an English actor and filmmaker. Known for his versatility and intense acting style, he has received various accolades, including an Academy Award, a Golden Globe Award, three British Academy Film Awards, and nominations for two Primetime Emmy Awards. His films have grossed over $11 billion worldwide, making him one of the highest-grossing actors of all time.

Judith Eva Barsi was an American child actress. She began her career in television, making appearances in commercials and television series, as well as the 1987 film Jaws: The Revenge. She also provided the voices of Ducky in The Land Before Time and Anne-Marie in All Dogs Go to Heaven, both released after her death. She and her mother, Maria, were killed in July 1988 in a double murder–suicide committed in their home by her father, József Barsi.

Edward James Begley Jr. is an American actor and environmental activist. He has appeared in hundreds of films, television shows, and stage performances. He played Dr. Victor Ehrlich on the television series St. Elsewhere (1982–1988). The role earned him six consecutive Primetime Emmy Award nominations and a Golden Globe Award nomination. He also co-hosted, along with wife Rachelle Carson, the green living reality show titled Living with Ed (2007–2010).

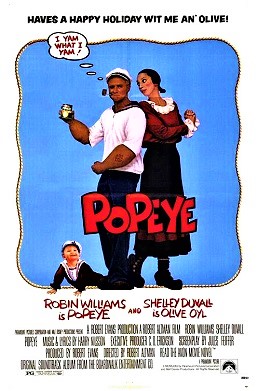

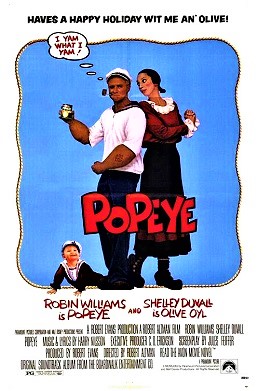

Popeye is a 1980 American musical comedy film directed by Robert Altman and produced by Paramount Pictures and Walt Disney Productions. It is based on E. C. Segar's Popeye comics character. The script was written by Jules Feiffer, and stars Robin Williams as Popeye the Sailor Man and Shelley Duvall as Olive Oyl. Its story follows Popeye's adventures as he arrives in the town of Sweethaven.

Adolph Caesar was an American film and theater actor. Known for his signature deep voice, Caesar was a staple of off-Broadway as a member of the Negro Ensemble Company, and as a voiceover artist for numerous film trailers. He earned widespread acclaim for his performance as Sgt. Vernon Waters in Charles Fuller's Pulitzer Prize-winning A Soldier's Play, a role he reprised in the 1984 film adaptation A Soldier's Story, for which he received Academy Award and Golden Globe Award nominations, and won an NAACP Image Award for Outstanding Actor in a Motion Picture.

Pamelyn Wanda Ferdin is an American animal rights activist and former actress. Ferdin's acting career was primarily during the 1960s and 1970s, though she appeared in projects sporadically in the 1980s and later years. She began her acting career in television commercials, made 250 television shows and films and gained renown for her work as a voice actress supplying the voice of Lucy Van Pelt in A Boy Named Charlie Brown (1969), as well as in two other Peanuts television specials.

The Banking Act of 1933 was a statute enacted by the United States Congress that established the Federal Deposit Insurance Corporation (FDIC) and imposed various other banking reforms. The entire law is often referred to as the Glass–Steagall Act, after its Congressional sponsors, Senator Carter Glass (D) of Virginia, and Representative Henry B. Steagall (D) of Alabama. The term "Glass–Steagall Act", however, is most often used to refer to four provisions of the Banking Act of 1933 that limited commercial bank securities activities and affiliations between commercial banks and securities firms. That limited meaning of the term is described in the article on Glass–Steagall Legislation.

Cathay Bank is a Chinese American bank founded in 1962.

Gary Michael Null is an American talk radio host and author who advocates pseudoscientific alternative medicine and produces a line of questionable dietary supplements.

Great Western Bank was a large retail bank that operated primarily in the Western United States. Great Western's headquarters were in Chatsworth, California. At one time, Great Western was one of the largest savings and loan in the United States, second only to Home Savings of America. The bank was acquired by Washington Mutual in 1997 for $6.8 billion.

OneWest Bank, a division of First Citizens BancShares, was a regional bank with over 60 retail branches in Southern California. OneWest Bank specialized in consumer deposit and lending including personal checking and savings accounts, money market accounts, CDs, and home loan products. OneWest offered small business checking, savings, CD, and money market accounts as well as small business loans and treasury management products.

First Interstate Bancorp was a bank holding company based in the United States that was taken over in 1996 by Wells Fargo. Headquartered in Los Angeles, it was the nation's eighth largest banking company.

"Too big to fail" (TBTF) is a theory in banking and finance that asserts that certain corporations, particularly financial institutions, are so large and so interconnected that their failure would be disastrous to the greater economic system, and therefore should be supported by government when they face potential failure. The colloquial term "too big to fail" was popularized by U.S. Congressman Stewart McKinney in a 1984 Congressional hearing, discussing the Federal Deposit Insurance Corporation's intervention with Continental Illinois. The term had previously been used occasionally in the press, and similar thinking had motivated earlier bank bailouts.

George Edward Griffin is an American author, filmmaker, lecturer, and a conspiracy theorist. Griffin's writings promote a number of right-wing views and conspiracy theories regarding politics, defense and health care. In his book World Without Cancer, he argued in favor of a pseudo-scientific theory that asserted cancer to be a nutritional deficiency curable by consuming amygdalin. He is the author of The Creature from Jekyll Island (1994), which advances debunked conspiracy theories about the Federal Reserve System. He is an HIV/AIDS denialist, supports the 9/11 Truth movement, and supports the specific John F. Kennedy assassination conspiracy theory that Oswald was not the assassin. He also believes that the Biblical Noah's Ark is located at the Durupınar site in Turkey.

The Emergency Economic Stabilization Act of 2008, also known as the "bank bailout of 2008" or the "Wall Street bailout", was a United States federal law enacted during the Great Recession, which created federal programs to "bail out" failing financial institutions and banks. The bill was proposed by Treasury Secretary Henry Paulson, passed by the 110th United States Congress, and was signed into law by President George W. Bush. It became law as part of Public Law 110-343 on October 3, 2008. It created the $700 billion Troubled Asset Relief Program (TARP), which utilized congressionally appropriated taxpayer funds to purchase toxic assets from failing banks. The funds were mostly redirected to inject capital into banks and other financial institutions while the Treasury continued to examine the usefulness of targeted asset purchases.

The 2007–2008 financial crisis, or the global financial crisis (GFC), was the most severe worldwide economic crisis since the Great Depression. Predatory lending in the form of subprime mortgages targeting low-income homebuyers, excessive risk-taking by global financial institutions, a continuous buildup of toxic assets within banks, and the bursting of the United States housing bubble culminated in a "perfect storm", which led to the Great Recession.

Joseph M. Otting is an American businessman and government official. He served as the 31st Comptroller of the Currency from November 27, 2017 to May 29, 2020.