Mechanism design is a field in economics and game theory that takes an objectives-first approach to designing economic mechanisms or incentives, toward desired objectives, in strategic settings, where players act rationally. Because it starts at the end of the game, then goes backwards, it is also called reverse game theory. It has broad applications, from economics and politics in such fields as market design, auction theory and social choice theory to networked-systems.

In game theory, an asymmetric game where players have private information is said to be strategy-proof or strategyproof (SP) if it is a weakly-dominant strategy for every player to reveal his/her private information, i.e. given no information about what the others do, you fare best or at least not worse by being truthful.

A Vickrey auction or sealed-bid second-price auction (SBSPA) is a type of sealed-bid auction. Bidders submit written bids without knowing the bid of the other people in the auction. The highest bidder wins but the price paid is the second-highest bid. This type of auction is strategically similar to an English auction and gives bidders an incentive to bid their true value. The auction was first described academically by Columbia University professor William Vickrey in 1961 though it had been used by stamp collectors since 1893. In 1797 Johann Wolfgang von Goethe sold a manuscript using a sealed-bid, second-price auction.

A double auction is a process of buying and selling goods with multiple sellers and multiple buyers. Potential buyers submit their bids and potential sellers submit their ask prices to the market institution, and then the market institution chooses some price p that clears the market: all the sellers who asked less than p sell and all buyers who bid more than p buy at this price p. Buyers and sellers that bid or ask for exactly p are also included. A common example of a double auction is stock exchange.

The Myerson–Satterthwaite theorem is an important result in mechanism design and the economics of asymmetric information, and named for Roger Myerson and Mark Satterthwaite. Informally, the result says that there is no efficient way for two parties to trade a good when they each have secret and probabilistically varying valuations for it, without the risk of forcing one party to trade at a loss.

Auction theory is an applied branch of economics which deals with how bidders act in auction markets and researches how the features of auction markets incentivise predictable outcomes. Auction theory is a tool used to inform the design of real-world auctions. Sellers use auction theory to raise higher revenues while allowing buyers to procure at a lower cost. The conference of the price between the buyer and seller is an economic equilibrium. Auction theorists design rules for auctions to address issues which can lead to market failure. The design of these rulesets encourages optimal bidding strategies among a variety of informational settings. The 2020 Nobel Prize for Economics was awarded to Paul R. Milgrom and Robert B. Wilson “for improvements to auction theory and inventions of new auction formats.”

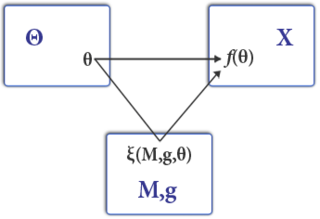

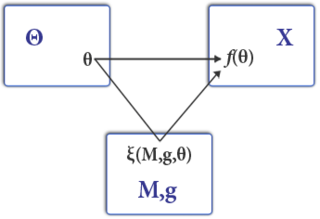

The revelation principle is a fundamental principle in mechanism design. It states that if a social choice function can be implemented by an arbitrary mechanism, then the same function can be implemented by an incentive-compatible-direct-mechanism with the same equilibrium outcome (payoffs).

A first-price sealed-bid auction (FPSBA) is a common type of auction. It is also known as blind auction. In this type of auction, all bidders simultaneously submit sealed bids so that no bidder knows the bid of any other participant. The highest bidder pays the price that was submitted.

Revenue equivalence is a concept in auction theory that states that given certain conditions, any mechanism that results in the same outcomes also has the same expected revenue.

In mechanism design, a Vickrey–Clarke–Groves (VCG) mechanism is a generic truthful mechanism for achieving a socially-optimal solution. It is a generalization of a Vickrey–Clarke–Groves auction. A VCG auction performs a specific task: dividing items among people. A VCG mechanism is more general: it can be used to select any outcome out of a set of possible outcomes.

A random-sampling mechanism (RSM) is a truthful mechanism that uses sampling in order to achieve approximately-optimal gain in prior-free mechanisms and prior-independent mechanisms.

A Bayesian-optimal mechanism (BOM) is a mechanism in which the designer does not know the valuations of the agents for whom the mechanism is designed, but the designer knows that they are random variables and knows the probability distribution of these variables.

Consensus estimate is a technique for designing truthful mechanisms in a prior-free mechanism design setting. The technique was introduced for digital goods auctions and later extended to more general settings.

In mechanism design and auction theory, a profit extraction mechanism is a truthful mechanism whose goal is to win a pre-specified amount of profit, if it is possible.

A Prior-independent mechanism (PIM) is a mechanism in which the designer knows that the agents' valuations are drawn from some probability distribution, but does not know the distribution.

In auction theory, particularly Bayesian-optimal mechanism design, a virtual valuation of an agent is a function that measures the surplus that can be extracted from that agent.

Bayesian-optimal pricing is a kind of algorithmic pricing in which a seller determines the sell-prices based on probabilistic assumptions on the valuations of the buyers. It is a simple kind of a Bayesian-optimal mechanism, in which the price is determined in advance without collecting actual buyers' bids.

A sequential auction is an auction in which several items are sold, one after the other, to the same group of potential buyers. In a sequential first-price auction (SAFP), each individual item is sold using a first price auction, while in a sequential second-price auction (SASP), each individual item is sold using a second price auction.

The Price of Anarchy (PoA) is a concept in game theory and mechanism design that measures how the social welfare of a system degrades due to selfish behavior of its agents. It has been studied extensively in various contexts, particularly in auctions.

Regularity, sometimes called Myerson's regularity, is a property of probability distributions used in auction theory and revenue management. Examples of distributions that satisfy this condition include Gaussian, uniform, and exponential; some power law distributions also satisfy regularity. Distributions that satisfy the regularity condition are often referred to as "regular distributions".