Related Research Articles

A debit card, also known as a check card or bank card, is a payment card that can be used in place of cash to make purchases. The card usually consists of the bank's name, a card number, the cardholder's name, and an expiration date, on either the front or the back. Many new cards now have a chip on them, which allows people to use their card by touch (contactless), or by inserting the card and keying in a PIN as with swiping the magnetic stripe. Debit cards are similar to a credit card, but the money for the purchase must be in the cardholder's bank account at the time of the purchase and is immediately transferred directly from that account to the merchant's account to pay for the purchase.

Electronic Funds Transfer at Point Of Sale, abbreviated as EFTPOS; is the technical term referring to a type of payment transaction where electronic funds transfers (EFT) are processed at a point of sale (POS) system or payment terminal usually via payment methods such as payment cards. EFTPOS technology was developed during the 1980s.

Visa Inc. is an American multinational payment card services corporation headquartered in San Francisco, California. It facilitates electronic funds transfers throughout the world, most commonly through Visa-branded credit cards, debit cards and prepaid cards. Visa is one of the world's most valuable companies.

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in payment of a debt extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt.

Mastercard Inc. is an American multinational payment card services corporation headquartered in Purchase, New York. It offers a range of payment transaction processing and other related-payment services. Throughout the world, its principal business is to process payments between the banks of merchants and the card-issuing banks or credit unions of the purchasers who use the Mastercard-brand debit, credit and prepaid cards to make purchases. Mastercard has been publicly traded since 2006.

The Reserve Bank of New Zealand (RBNZ) is the central bank of New Zealand. It was established in 1934 and is currently constituted under the Reserve Bank of New Zealand Act 2021. The governor of the Reserve Bank, currently Adrian Orr, is responsible for New Zealand's currency and operating monetary policy.

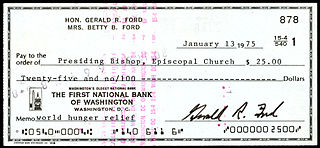

A cheque or check ; is a document that orders a bank, building society to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the drawer, has a transaction banking account where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the drawee, to pay the amount of money stated to the payee.

ISO 20022 is an ISO standard for electronic data interchange between financial institutions. It describes a metadata repository containing descriptions of messages and business processes, and a maintenance process for the repository content. The standard covers financial information transferred between financial institutions that includes payment transactions, securities trading and settlement information, credit and debit card transactions and other financial information.

Settlement is the "final step in the transfer of ownership involving the physical exchange of securities or payment". After settlement, the obligations of all the parties have been discharged and the transaction is considered complete.

The BACHO record format is the standard format used for the interchange of financial transactions in the New Zealand banking system. Until 2012 it stared this status with another standard format, QC. BACHO-format transactions are primarily used in batch processing systems running on MVS mainframe computers.

Interchange fee is a term used in the payment card industry to describe a fee paid between banks for the acceptance of card-based transactions. Usually for sales/services transactions it is a fee that a merchant's bank pays a customer's bank.

A credit card is a payment card, usually issued by a bank, allowing its users to purchase goods or services or withdraw cash on credit. Using the card thus accrues debt that has to be repaid later. Credit cards are one of the most widely used forms of payment across the world.

RuPay is an Indian multinational financial services and payment service system, conceived and launched by the National Payments Corporation of India (NPCI) in 2012. It was created to fulfil the Reserve Bank of India's (RBI) vision of establishing a domestic, open and multilateral system of payments. RuPay facilitates electronic payment at all Indian banks and financial institutions. NPCI maintains ties with Discover Financial and JCB to enable the RuPay Card scheme to gain international acceptance.

The AT HOP card is an electronic fare payment card that was released in two versions on Auckland public transport services, beginning in May 2011. The smart card roll out was the first phase in the introduction of an integrated ticketing and fares system that was rolled out across the region.

Vocalink is a payment systems company headquartered in the United Kingdom, created in 2007 from the merger between Voca and LINK. It designs, builds and operates the UK payments infrastructure, which underpins the provision of the Bacs payment system and the UK ATM LINK switching platform covering 65,000 ATMs and the UK Faster Payments systems.

Utimaco Atalla, founded as Atalla Technovation and formerly known as Atalla Corporation or HP Atalla, is a security vendor, active in the market segments of data security and cryptography. Atalla provides government-grade end-to-end products in network security, and hardware security modules (HSMs) used in automated teller machines (ATMs) and Internet security. The company was founded by Egyptian engineer Mohamed M. Atalla in 1972. Atalla HSMs are the payment card industry's de facto standard, protecting 250 million card transactions daily as of 2013, and securing the majority of the world's ATM transactions as of 2014.

The Cross-border Interbank Payment System (CIPS) is a Chinese payment system that offers clearing and settlement services for its participants in cross-border renminbi (RMB) payments and trade. CIPS is backed by the People's Bank of China and was launched in 2015 as part of a policy effort to internationalize the use of China’s currency.

Unified Payments Interface, commonly referred to as UPI, is an Indian instant payment system as well as protocol developed by the National Payments Corporation of India (NPCI) in 2016. The interface facilitates inter-bank peer-to-peer (P2P) and person-to-merchant (P2M) transactions. It is used on mobile devices to instantly transfer funds between two bank accounts. The mobile number of the device is required to be registered with the bank. The UPI ID of the recipient can be used to transfer money. It runs as an open source application programming interface (API) on top of the Immediate Payment Service (IMPS), and is regulated by the Reserve Bank of India (RBI). Indian Banks started making their UPI-enabled apps available on Google Play on 25 August 2016.

Oxigen Services is an Indian fintech company. It is involved in the micropayment of services and remittances in real time.

The Digital Rupee (e₹) or eINR or E-Rupee is a tokenised digital version of the Indian Rupee, issued by the Reserve Bank of India (RBI) as a central bank digital currency (CBDC). The Digital Rupee was proposed in January 2017 and launched on 1 December 2022. Digital Rupee is using blockchain distributed-ledger technology.

References

- 1 2 Dunstan, Tim (March 2015). "Re-mastering payments messaging (Second edition)" (PDF). paymentsnz.co.nz. Payments NZ. Retrieved 24 July 2024.

- ↑ "Case Study: New Zealand's move to intraday payments and settlement via SWIFTNet". swift.com. Payments NZ. 2013. Retrieved 24 July 2024.