Daniel Ellsberg was an American political activist, economist, and United States military analyst. While employed by the RAND Corporation, he precipitated a national political controversy in 1971 when he released the Pentagon Papers, a top-secret Pentagon study of U.S. government decision-making in relation to the Vietnam War, to The New York Times, The Washington Post, and other newspapers.

The War Resisters League (WRL) is the oldest secular pacifist organization in the United States. The organization is celebrating its centennial from the founding date of October 19 into 2024.

Tax resistance is the refusal to pay tax because of opposition to the government that is imposing the tax, or to government policy, or as opposition to taxation in itself. Tax resistance is a form of direct action and, if in violation of the tax regulations, also a form of civil disobedience.

Wallace Floyd Nelson was an American civil rights activist and war tax resister. He spent three and a half years in prison as a conscientious objector during World War II, was on the first of the "Freedom Rides" enforcing desegregation in 1947, and was the first national field organizer for the Congress of Racial Equality.

Juanita Morrow Nelson was an American activist and war tax resister.

Irwin Allen Schiff was an American libertarian and tax resistance advocate known for writing and promoting literature in which he argued that the way in which the income tax in the United States is enforced upon individuals as a tax on one's time or wages, is illegal and unconstitutional. Judges in several civil and criminal cases ruled in favor of the federal government and against Schiff. As a result of these judicial rulings Schiff was in a hospital prison serving a sentence of 162 months at the time of his death.

Robert Barnwell Clarkson was an American tax protester in South Carolina.

A tax protester, in the United States, is a person who denies that he or she owes a tax based on the belief that the Constitution of the United States, statutes, or regulations do not empower the government to impose, assess or collect the tax. The tax protester may have no dispute with how the government spends its revenue. This differentiates a tax protester from a tax resister, who seeks to avoid paying a tax because the tax is being used for purposes with which the resister takes issue.

Tax protesters in the United States have advanced a number of arguments asserting that the assessment and collection of the federal income tax violates statutes enacted by the United States Congress and signed into law by the President. Such arguments generally claim that certain statutes fail to create a duty to pay taxes, that such statutes do not impose the income tax on wages or other types of income claimed by the tax protesters, or that provisions within a given statute exempt the tax protesters from a duty to pay.

Wayne C. Bentson is a businessman and tax protester from Payson, Arizona.

War Resisters' International (WRI), headquartered in London, is an international anti-war organisation with members and affiliates in over 30 countries.

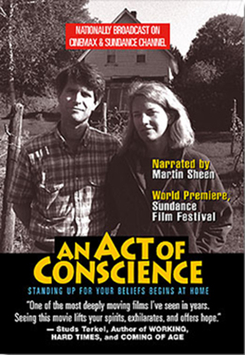

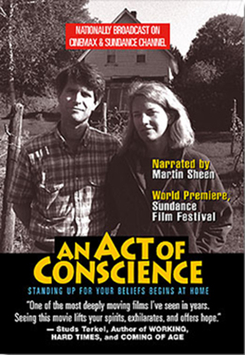

An Act of Conscience is a 1997 American documentary film directed, shot and edited by Robbie Leppzer. It centers around war tax resisters Randy Kehler and Betsy Corner, and the years-long struggle that ensued after the Internal Revenue Service (IRS) seized their home in Colrain, Massachusetts, in 1989, to collect $27,000 in unpaid taxes and interest. When the house is sold to another couple, Kehler, Corner, and hundreds of supporters occupy the property in protest.

The 861 argument is a statutory argument used by tax protesters in the United States, which interprets a portion of the Internal Revenue Code as invalidating certain applications of income tax. The argument has uniformly been held by courts to be incorrect, and persons who have cited the argument as a basis for refusing to pay income taxes have been penalized, and in some cases jailed.

A tax protester is someone who refuses to pay a tax claiming that the tax laws are unconstitutional or otherwise invalid. Tax protesters are different from tax resisters, who refuse to pay taxes as a protest against a government or its policies, or a moral opposition to taxation in general, not out of a belief that the tax law itself is invalid. The United States has a large and organized culture of people who espouse such theories. Tax protesters also exist in other countries.

Tax protester arguments are arguments made by people, primarily in the United States, who contend that tax laws are unconstitutional or otherwise invalid.

Thomas C. Cornell was an American journalist and a peace activist against the Vietnam War and the Iraq War. He was an associate editor of the Catholic Worker and a deacon in the Catholic Church.

Under the federal law of the United States of America, tax evasion or tax fraud is the purposeful illegal attempt of a taxpayer to evade assessment or payment of a tax imposed by Federal law. Conviction of tax evasion may result in fines and imprisonment. Compared to other countries, Americans are more likely to pay their taxes on time and law-abidingly.

United States v. Snider, 502 F.2d 645 (1972) was a case before the United States Court of Appeals for the Fourth Circuit. It was a consolidation of two separate cases: the first was a conviction for violation of 26 U.S.C. §7205, which prohibits submitting fraudulent tax information to an employer. The second was a conviction for violation of 18 U.S.C. §401, which prohibits "misbehavior ... as to obstruct the administration of justice."

Tax resistance in the United States has been practiced at least since colonial times, and has played important parts in American history.