Related Research Articles

Economic history is the study of history using methodological tools from economics or with a special attention to economic phenomena. Research is conducted using a combination of historical methods, statistical methods and the application of economic theory to historical situations and institutions. The field can encompass a wide variety of topics, including equality, finance, technology, labour, and business. It emphasizes historicizing the economy itself, analyzing it as a dynamic entity and attempting to provide insights into the way it is structured and conceived.

The legal institution of human chattel slavery, comprising the enslavement primarily of Africans and African Americans, was prevalent in the United States of America from its founding in 1776 until 1865, predominantly in the South. Slavery was established throughout European colonization in the Americas. From 1526, during the early colonial period, it was practiced in what became Britain's colonies, including the Thirteen Colonies that formed the United States. Under the law, an enslaved person was treated as property that could be bought, sold, or given away. Slavery lasted in about half of U.S. states until abolition in 1865, and issues concerning slavery seeped into every aspect of national politics, economics, and social custom. In the decades after the end of Reconstruction in 1877, many of slavery's economic and social functions were continued through segregation, sharecropping, and convict leasing. Involuntary servitude as a punishment for crime is still legal in the United States.

Monetary reform is any movement or theory that proposes a system of supplying money and financing the economy that is different from the current system.

Monetary economics is the branch of economics that studies the different theories of money: it provides a framework for analyzing money and considers its functions, and it considers how money can gain acceptance purely because of its convenience as a public good. The discipline has historically prefigured, and remains integrally linked to, macroeconomics. This branch also examines the effects of monetary systems, including regulation of money and associated financial institutions and international aspects.

The causes of the Great Depression in the early 20th century in the United States have been extensively discussed by economists and remain a matter of active debate. They are part of the larger debate about economic crises and recessions. The specific economic events that took place during the Great Depression are well established.

A country's gross government debt is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occurs when a government's expenditures exceed revenues. Government debt may be owed to domestic residents, as well as to foreign residents. If owed to foreign residents, that quantity is included in the country's external debt.

The Mexican peso crisis was a currency crisis sparked by the Mexican government's sudden devaluation of the peso against the U.S. dollar in December 1994, which became one of the first international financial crises ignited by capital flight.

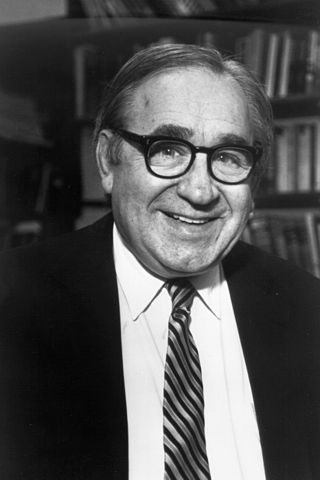

Robert William Fogel was an American economic historian and winner of the 1993 Nobel Memorial Prize in Economic Sciences. As of his death, he was the Charles R. Walgreen Distinguished Service Professor of American Institutions and director of the Center for Population Economics (CPE) at the University of Chicago's Booth School of Business. He is best known as an advocate of new economic history (cliometrics) – the use of quantitative methods in history.

Peter Temin is an economist and economic historian, serving as the Gray Professor Emeritus of Economics at MIT, where he was formerly the head of the Economics Department.

Anna Jacobson Schwartz was an American economist who worked at the National Bureau of Economic Research in New York City and a writer for The New York Times. Paul Krugman has said that Schwartz is "one of the world's greatest monetary scholars."

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial bubbles, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy.

Some economic historians use the term merchant capitalism, a term coined by the German sociologist and economist Werner Sombart in his "The Genesis of Modern Capitalism" in 1902, to refer to the earliest phase in the development of capitalism as an economic and social system. However, others argue that mercantilism, which has flourished widely in the world without the emergence of systems like modern capitalism, is not actually capitalist as such.

Early American currency went through several stages of development during the colonial and post-Revolutionary history of the United States. John Hull was authorized by the Massachusetts legislature to make the earliest coinage of the colony in 1652.

In economics, an optimum currency area (OCA) or optimal currency region (OCR) is a geographical region in which it would maximize economic efficiency to have the entire region share a single currency.

Compensated emancipation was a method of ending slavery, under which the enslaved person's owner received compensation from the government in exchange for manumitting the slave. This could be monetary, and it could allow the owner to retain the slave for a period of labor as an indentured servant. In practice, cash compensation rarely was equal to the slave's market value.

Henry Calvert Simons was an American economist at the University of Chicago. A protégé of Frank Knight, his antitrust and monetarist models influenced the Chicago school of economics. He was a founding author of the Chicago plan for monetary reform that found broad support in the years following the 1930s Depression, which would have abolished the fractional-reserve banking system, which Simons viewed to be inherently unstable. This would have prevented unsecured bank credit from circulating as a "money substitute" in the financial system, and it would be replaced with money created by the government or central bank that would not be subject to bank runs.

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009. The scale and timing of the recession varied from country to country. At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression.

The Emergency Economic Stabilization Act of 2008, also known as the "bank bailout of 2008" or the "Wall Street bailout", was a United States federal law enacted during the Great Recession, which created federal programs to "bail out" failing financial institutions and banks. The bill was proposed by Treasury Secretary Henry Paulson, passed by the 110th United States Congress, and was signed into law by President George W. Bush. It became law as part of Public Law 110-343 on October 3, 2008. It created the $700 billion Troubled Asset Relief Program (TARP), which utilized congressionally appropriated taxpayer funds to purchase toxic assets from failing banks. The funds were mostly redirected to inject capital into banks and other financial institutions while the Treasury continued to examine the usefulness of targeted asset purchases.

Carmen M. Reinhart is a Cuban-American economist and the Minos A. Zombanakis Professor of the International Financial System at Harvard Kennedy School. Previously, she was the Dennis Weatherstone Senior Fellow at the Peterson Institute for International Economics and Professor of Economics and Director of the Center for International Economics at the University of Maryland. She is a research associate at the National Bureau of Economic Research, a Research Fellow at the Centre for Economic Policy Research, Founding Contributor of VoxEU, and a member of Council on Foreign Relations. She is also a member of American Economic Association, Latin American and Caribbean Economic Association, and the Association for the Study of the Cuban Economy. She became the subject of general news coverage when mathematical errors were found in a research paper she co-authored.

Mexico joined the International Monetary Fund (IMF) in 1945. As of 2022, Mexico has had 18 numbers of arraignment with the IMF.

References

- ↑ "Wright, Robert E. (Robert Eric), 1969-". Library of Congress. Retrieved 27 August 2015.

data sheet (Robert Eric Wright; b. 01-01-69)

- ↑ "Augustana can thank cheese for creation of economic chair | argusleader.com". Argus Leader. Retrieved 2009-06-04.[ dead link ]

- ↑ "Robert E. Wright". Nber.org. Retrieved 2009-06-04.

- ↑ "All College Honors Program - Buffalo State College - About the Program - Alumni". Buffalostate.edu. 1999-02-22. Archived from the original on 2010-05-28. Retrieved 2009-06-04.

- ↑ "Department of History, University at Buffalo". Cas.buffalo.edu. Retrieved 2009-06-04.

- ↑ "Wright, Robert E. (Robert Eric) 1969-". OCLC.

- ↑ Arango, Tim (2008-11-30). "The Housing-Bubble and the American Revolution". The New York Times.

- ↑ "Board members". Historians Against Slavery. Archived from the original on January 7, 2014.

{{cite web}}: CS1 maint: unfit URL (link) - ↑ "Book series: Slaveries since Emancipation". Cambridge University.

- ↑ "Book series: Slaveries since Emancipation". Historians Against Slavery. Archived from the original on October 8, 2013.

{{cite web}}: CS1 maint: unfit URL (link) - ↑ "Book series: Speakers Bureau". Historians Against Slavery. Archived from the original on January 7, 2014.

{{cite web}}: CS1 maint: unfit URL (link) - ↑ "Editorial Board: Dr. Robert E. Wright". Museum of American Finance.

- ↑ "4/12/2002: A Market Solution to the Oversupply of Historians". The Chronicle. Retrieved 2009-06-04.

- ↑ "Michener Wright Comment" (PDF). January 2006.

- ↑ "Michener Wright Rejoinder" (PDF). May 2006.