Related Research Articles

Private equity (PE) is capital stock in a private company that does not offer stock to the general public. In the field of finance, private equity is offered instead to specialized investment funds and limited partnerships that take an active role in the management and structuring of the companies. In casual usage, "private equity" can refer to these investment firms rather than the companies that they invest in.

KKR & Co. Inc., also known as Kohlberg Kravis Roberts & Co., is an American global investment company that manages multiple alternative asset classes, including private equity, energy, infrastructure, real estate, credit, and, through its strategic partners, hedge funds. As of December 31, 2023, the firm had completed more than 730 private equity investments in portfolio companies with approximately $710 billion of total enterprise value. As of December 31, 2023, assets under management (AUM) and fee paying assets under management (FPAUM) were $553 billion and $446 billion, respectively.

Blackstone Inc. is an American alternative investment management company based in New York City. Blackstone's private equity business has been one of the largest investors in leveraged buyouts in the last three decades, while its real estate business has actively acquired commercial real estate across the globe. Blackstone is also active in credit, infrastructure, hedge funds, secondaries, growth equity, and insurance solutions. As of May 2024, Blackstone has more than US$1 trillion in total assets under management, making it the largest alternative investment firm globally.

Lehman Brothers Inc. was an American global financial services firm founded in 1850. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States, with about 25,000 employees worldwide. It was doing business in investment banking, equity, fixed-income and derivatives sales and trading, research, investment management, private equity, and private banking. Lehman was operational for 158 years from its founding in 1850 until 2008.

Bain Capital, LP is an American private investment firm based in Boston, Massachusetts, with around $185 billion of assets under management. It specializes in private equity, venture capital, credit, public equity, impact investing, life sciences, crypto, tech opportunities, partnership opportunities, special situations, and real estate. Bain Capital invests across a range of industry sectors and geographic regions. The firm was founded in 1984 by partners from the consulting firm Bain & Company. The company is headquartered at 200 Clarendon Street in Boston with 22 offices in North America, Europe, Asia, and Australia.

Clayton, Dubilier & Rice (CD&R) is an American private equity company. It is one of the oldest private equity investment firms in the world. Founded in 1978, CD&R has managed the investment of more than $30 billion in approximately 90 businesses, representing a broad range of industries with an aggregate transaction value in excess of $140 billion. Approximately half of CD&R's investments have involved corporate divestitures.

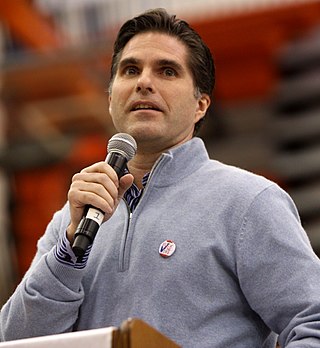

Sun Capital Partners, Inc., is an American private equity firm specializing in leveraged buyouts. Sun Capital was founded in 1995 by Marc J. Leder and Rodger Krouse, former classmates at the Wharton School of the University of Pennsylvania and investment bankers at Lehman Brothers.

William Worthington Bain Jr. was an American management consultant, known for his role as one of the founders of the management consultancy that bears his name, Bain & Company. Prior to founding Bain & Company, he was a vice-president at the Boston Consulting Group (BCG).

Fortress Investment Group is an American investment management firm based in New York City. It was founded as a private equity firm in 1998 by Wes Edens, Rob Kauffman, and Randal Nardone.

Welsh, Carson, Anderson & Stowe (WCAS), also referred to as Welsh Carson, is a private equity firm. WCAS was formed in 1979 and focuses on investing in two growth industries, technology and healthcare, primarily in the United States. WCAS has a current portfolio of approximately 30 companies and has organized 17 limited partnerships with total capital of over $27 billion, consisting of 13 equity partnerships and four subordinated debt partnerships. WCAS is currently investing equity funds, including WCAS XII, L.P. and WCAS XIII, L.P.

Private equity in the 1980s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.

Fred S. Fraenkel is an investment professional and was a vice chair of Cowen Inc. He was on the Barron's year end roundtable for four years and managed large research organizations at several Wall Street firms. He ran his own venture fund for eight years and was until September 2015 the president and chief research officer of a Miami-based advisor of mutual funds.

Guggenheim Partners, LLC is a global investment and advisory financial services firm that engages in investment banking, asset management, capital markets services, and insurance services.

Needham & Company, LLC is an independent investment bank and asset management firm specializing in advisory services and financings for growth companies. Needham & Company is a wholly owned subsidiary of The Needham Group, which also operates a private equity investment business and an investment management business.

Darrell W. Crate is an American investor, private equity manager, and philanthropist. He is the CEO of Easterly Government Properties, Inc., a New York Stock Exchange-listed company that he co-founded in 2015. He is also the founder and managing principal of Easterly Asset Management, a multi-affiliate platform of high-performing boutique investment managers.

Marc J. Leder is an American businessman who co-founded Sun Capital Partners, a private equity firm based in Boca Raton, Florida. He is also a limited partner of Harris Blitzer Sports & Entertainment, which owns the NBA's Philadelphia 76ers and the NHL's New Jersey Devils, and the Josh Harris Group, which owns Real Salt Lake of the MLS, the English Premier League's Crystal Palace F.C., and the NFL's Washington Commanders.

The business career of Mitt Romney began shortly after he finished graduate school in 1975. At that time, Romney entered the management consulting industry, and in 1977 secured a position at Bain & Company. Later serving as its chief executive officer, he helped bring the company out of financial crisis. In 1984, he co-founded and led the spin-off Bain Capital, a private equity investment firm that became highly profitable and one of the largest such firms in the nation. The fortune he earned from his business career is estimated at $190–250 million.

Taggart Mitt Romney is an American management consultant, businessman, venture capitalist and political advisor. He is the eldest son of businessman and U.S. Senator Mitt Romney.

DFO Management is an American family office that manages the capital of Michael Dell and his family. The firm, which is based in New York and has offices in Santa Monica and West Palm Beach, was formed in 1998.

Blue Owl Capital Inc. is an American alternative investment asset management company. It is currently listed on the New York Stock Exchange under the ticker symbol: "OWL".

References

- 1 2 Jewish Daily Forward: "Romney PAC Attracts New Jewish Donors - Hedge Fund Managers and Developers Top List of Supporters" By Josh Nathan-Kazis March 12, 2012

- 1 2 3 4 Bloomberg: "Blackstone, Apollo Outshone as Sun Capital Buys Boston Market" By Kambiz Foroohar October 2, 2008

- 1 2 3 BusinessWeek: "Executive Profile - Rodger R. Krouse" [ dead link ] retrieved July 7, 2013

- 1 2 3 4 5 6 7 Private Equity International: "Rising Sun" by David Snow October 2006

- ↑ Sun Capital Partners: Rodger Krouse retrieved July 7, 2013

- 1 2 New York Times: "In a Romney Believer, Private Equity’s Risks and Rewards" by JULIE CRESWELL January 21, 2012

- 1 2 Wall Street Journal: "Buyout All-Stars Stumble" By PETER LATTMAN March 10, 2008

- ↑ Private Equity Online: "Sun Capital NY dealmaker departs" by Christopher Witkowsky August 3, 2009 | "The firm...has had at least 10 portfolio companies go bankrupt and has let go of more than 30 employees from its 200-person workforce since the beginning of the year (2009)."

- ↑ Hoovers: Sun Capital Partners retrieved July 2013

- ↑ Reiman, Joey The Story of Purpose: The Path to Creating a Brighter Brand, a Greater Company, and a Lasting Legacy retrieved July 13, 2013

- ↑ 5th Annual International M&A Award Winners Announcement April 15, 2013

- 1 2 Campaign Money.com: "Rodger Krouse Political Campaign Contributions" retrieved July 7, 2013

- ↑ ABC News: "Paul Ryan Fundraises with ’47 Percent’ Host" by Shushannah Walshe October 19, 2012

- ↑ The American Presidency Project: "Press Release - Mitt Romney Announces Florida Finance Team" October 6, 2011

- ↑ New York Times: "Hillary Miller Wed" September 29, 1991

- ↑ The Deal Magazine: "Reading the face of failure" by Vyvyan Tenorio October 24, 2008