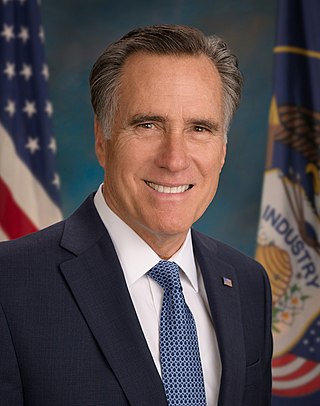

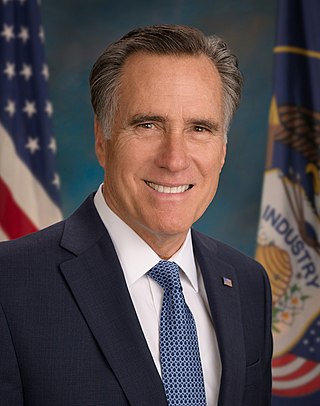

Willard Mitt Romney is an American politician, businessman, and lawyer serving as the junior United States senator from Utah since 2019. He served as the 70th governor of Massachusetts from 2003 to 2007 and was the Republican Party's nominee for president of the United States in the 2012 election.

Blackstone Inc. is an American alternative investment management company based in New York City. It was founded in 1985 as a mergers and acquisitions firm by Peter Peterson and Stephen Schwarzman, who had previously worked together at Lehman Brothers. Blackstone's private equity business has been one of the largest investors in leveraged buyouts in the last three decades, while its real estate business has actively acquired commercial real estate across the globe. Blackstone is also active in credit, infrastructure, hedge funds, secondaries, growth equity, and insurance solutions. As of May 2024, Blackstone has more than US$1 trillion in total assets under management, making it the world's largest alternative investment firm.

Bain Capital, LP is an American private investment firm based in Boston, Massachusetts, with around $185 billion of assets under management. It specializes in private equity, venture capital, credit, public equity, impact investing, life sciences, crypto, tech opportunities, partnership opportunities, special situations, and real estate. Bain Capital invests across a range of industry sectors and geographic regions. The firm was founded in 1984 by partners from the consulting firm Bain & Company. The company is headquartered at 200 Clarendon Street in Boston with 22 offices in North America, Europe, Asia, and Australia.

Accuride Corporation is a diversified manufacturer and supplier of commercial vehicle components in North America. Based in Livonia, Michigan, the company designs, manufactures and markets commercial vehicle components.

Sun Capital Partners, Inc., is an American private equity firm specializing in leveraged buyouts. Sun Capital was founded in 1995 by Marc J. Leder and Rodger Krouse, former classmates at the Wharton School of the University of Pennsylvania and investment bankers at Lehman Brothers.

TA Associates Management, L.P. is an American private equity firm and was one of the early modern-era private equity firms in the United States. The firm leads buyouts and minority recapitalizations of profitable growth companies. TA invests across five industry groups: technology, healthcare, consumer products, financial services and business services.

Erick Thohir is an Indonesian businessman and politician who served as Indonesia's Minister of State Owned Enterprises from 2019 to 2024. He is the chairman of Football Association of Indonesia since 2023 and founder of Mahaka Group, a conglomeration that focuses on media, sports and entertainment. Globally known as the former owner and chairman of Italian football giant Inter Milan and US soccer club D.C. United, Thohir is currently co-owner alongside Anindya Bakrie of English Championship team Oxford United and Liga 1 team Persis Solo along with Kaesang Pangarep, the youngest son of President Joko Widodo. He was also the president director of ANTV television station and the chief of the Indonesian Olympic Committee. In 2019, he became a member of the International Olympic Committee (IOC). Thohir is also currently a member of the FIBA Central Board.

Joshua Jordan Harris is an American investor, sports team owner, and philanthropist. He is a co-founder of the private equity firm Apollo Global Management and managing partner of the NBA's Philadelphia 76ers, the NHL's New Jersey Devils, and the NFL's Washington Commanders. Harris is also a general partner of the English football club Crystal Palace and holds a minority stake in Joe Gibbs Racing. He has an estimated net worth of around US$9 billion.

The business career of Mitt Romney began shortly after he finished graduate school in 1975. At that time, Romney entered the management consulting industry, and in 1977 secured a position at Bain & Company. Later serving as its chief executive officer, he helped bring the company out of financial crisis. In 1984, he co-founded and led the spin-off Bain Capital, a private equity investment firm that became highly profitable and one of the largest such firms in the nation. The fortune he earned from his business career is estimated at $190–250 million.

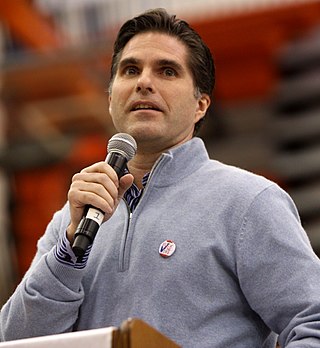

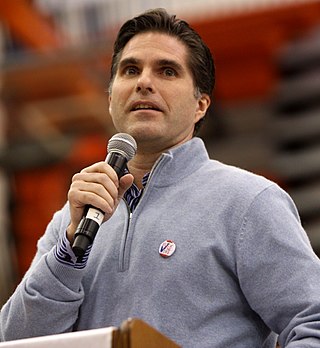

Taggart Mitt Romney is an American management consultant, businessman, venture capitalist and political advisor. He is the eldest son of businessman and U.S. Senator Mitt Romney.

Rodger Russell Krouse is an American businessperson who co-founded Sun Capital Partners, Inc., an American investment firm based in Boca Raton, Florida, United States.

David Scott Blitzer is an American investor and sports team owner. He is the chairman of the private equity firm Blackstone and managing partner of the NHL's New Jersey Devils and NBA's Philadelphia 76ers. Blitzer also manages several association football clubs under Global Football Holdings, owns 25% of the MLB's Cleveland Guardians, and is a limited partner of the NFL's Washington Commanders, making him the first person to own team equity in the five major sports leagues of North America.

Arthur Mitchell Wrubel is an American private equity investor who founded Wesley Capital Management, LLC and is a minority owner of the Philadelphia 76ers of the National Basketball Association.

Regent, L.P. is a multi-sector private equity firm based in Beverly Hills, California. Many of Regent's investments have been in the software, technology, consumer products, retail and media space. Its founder and chairman is Michael Reinstein.

David B. Heller is an American businessman, former Goldman Sachs executive, and minority owner in the Philadelphia Sixers.

Martin J. Geller is an American businessman and founder of Geller & Company. He is also a limited partner of Harris Blitzer Sports & Entertainment, which owns the Philadelphia 76ers and New Jersey Devils.

Harris Blitzer Sports & Entertainment LLC (HBSE) is an American sports and venue management company founded by investors Josh Harris and David Blitzer in September 2017. HBSE owns and operates the Philadelphia 76ers of the National Basketball Association (NBA) and the New Jersey Devils of the National Hockey League (NHL), as well as other properties such as their minor league affiliates, the Prudential Center, and the esports organization Dignitas. HBSE also holds a minority stake in the NASCAR team Joe Gibbs Racing. The company is headquartered in Camden, New Jersey, and was valued at $11.86 billion in 2024.

David J. Adelman is an American businessman and entrepreneur. He is the CEO of Campus Apartments, the Co-Founder and Vice Chairman of FS Investments, and the Founder of Darco Capital Chair. Adelman is also a limited partner of Harris Blitzer Sports & Entertainment, which owns and operates the Philadelphia 76ers and New Jersey Devils. His net worth was estimated by Forbes to be $2 billion in May 2023.

Blue Owl Capital Inc. is an American alternative investment asset management company. It is listed on the New York Stock Exchange under the ticker symbol: "OWL".