Barings Bank was a British merchant bank based in London, and one of England's oldest merchant banks after Berenberg Bank, Barings' close collaborator and German representative. It was founded in 1762 by Francis Baring, a British-born member of the German–British Baring family of merchants and bankers.

Nicholas William Leeson is an English former derivatives trader whose fraudulent, unauthorised and speculative trades resulted in the 1995 collapse of Barings Bank, the United Kingdom's second oldest merchant bank. He was convicted of financial crime in a Singapore court and served over four years in Changi Prison.

Proprietary trading occurs when a trader trades stocks, bonds, currencies, commodities, their derivatives, or other financial instruments with the firm's own money to make a profit for itself. Proprietary trading can create potential conflicts of interest such as insider trading and front running.

Edward John Whitley is a British financial advisor and philanthropist.

A rogue trader is person who makes financial trades in an unauthorised manner.

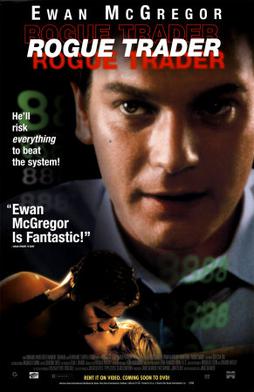

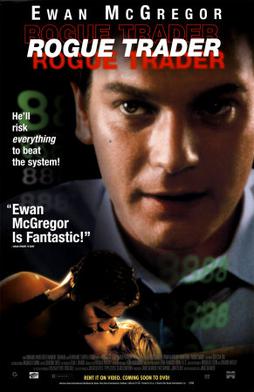

Rogue Trader is a 1999 British biographical drama film written and directed by James Dearden and starring Ewan McGregor and Anna Friel. The film centers on the life of former derivatives broker Nick Leeson and the 1995 collapse of Barings Bank.

Ugly Americans: The True Story of the Ivy League Cowboys Who Raided the Asian Markets for Millions is a book by Ben Mezrich that recounts the exploits of an American called John Malcolm arbitraging index futures in Japan in the 1990s. The book was released on May 4, 2004 by William Morrow and Company.

Re Barings plc [2000] 1 BCLC 523 is a leading UK company law case, concerning company directors' duties of care and skill. The case is formally identified and cited as "No 5", though some observers regard it as the sixth in the saga of litigation concerning Barings Bank.

Jérôme Kerviel is a French rogue trader who was convicted and imprisoned in the 2008 Société Générale trading loss for breach of trust, forgery and unauthorized use of the bank's computers, resulting in losses valued at €4.9 billion.

In financial trading, a rogue trader is an employee authorized to make trades on behalf of their employer who makes unauthorized trades. It can also involve mismarking of securities. The perpetrator is a legitimate employee of a company, but enters into transactions on behalf of their employer, or mismarks securities held by their employer, without their employer's permission.

In January 2008, the bank Société Générale lost approximately €4.9 billion closing out positions over three days of trading beginning January 21, 2008, a period in which the market was experiencing a large drop in equity indices. The bank states these positions were fraudulent transactions created by Jérôme Kerviel, a trader with the company. The police stated they lacked evidence to charge him with fraud and charged him with breach of trust and illegally accessing computers. Kerviel states his actions were known to his superiors and that the losses were caused by panic selling by the bank. Société Générale's own wrongs were later established by a French jurisdiction, which led the Cour de cassation to cancel the €4.9 billion sanction on Kerviel.

Inside Story Special: £830,000,000 – Nick Leeson and the Fall of the House of Barings, sometimes referred to as 25 Million Pounds, is a 1996 British television documentary by filmmaker Adam Curtis. It details the collapse of Barings Bank in the mid-1990s due to the machinations of Nick Leeson, who lost £827 million primarily by speculating on futures contracts.

The 2011 UBS rogue trader scandal caused a loss of over US$2 billion at Swiss bank UBS, as a result of unauthorized trading performed by Kweku Adoboli, a director of the bank's Global Synthetic Equities Trading team in London in early September 2011.

Kweku Adoboli is a Ghanaian investment manager and former stock trader. He was convicted of illegally trading away US$2 billion as a trader for Swiss investment bank UBS. While at the bank he primarily worked on UBS' Global Synthetic Equities Trading team in London, where he engaged in what would later be known as the 2011 UBS rogue trader scandal. After serving a prison sentence, he lost several appeals against the UK Home Office decision to deport him to Ghana.

Barings LLC, known as Barings, is a global investment management firm owned by Massachusetts Mutual Life Insurance Company (MassMutual). It operates as a subsidiary of MassMutual Financial Group, a diversified financial services organization.

The Wolf of Wall Street is a memoir by former stockbroker and trader Jordan Belfort, first published in September 2007 by Bantam Books, then adapted into a 2013 film of the same name. Belfort's autobiographical account was continued by Catching the Wolf of Wall Street, published in 2009.

Catching the Wolf of Wall Street: More Incredible True Stories of Fortunes, Schemes, Parties, and Prison is the second non-fiction book by former stockbroker and trader Jordan Belfort. The text was initially published on February 24, 2009, by Bantam Books.

Tom Hayes is a former trader for UBS and Citigroup who was convicted for conspiracy to defraud and sentenced to 14 years in prison for conspiring with others to dishonestly manipulate the London Interbank Offered Rate (Libor) as part of the Libor scandal. Hayes, in the course of his defence, asserted managers were aware of his actions, and even condoned them. At trial Hayes was diagnosed with mild Asperger syndrome.