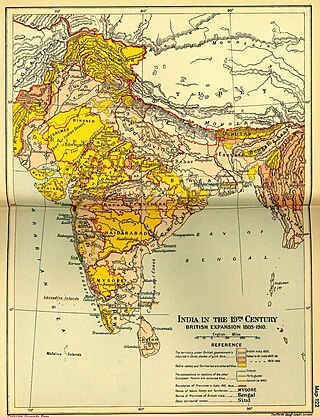

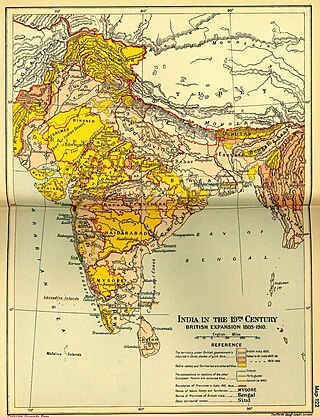

Company rule in India refers to regions of the Indian subcontinent under the control of the British East India Company (EIC). The EIC, founded in 1600, established their first trading post in India in 1612, and gradually expanded their presence in the region over the following decades. During the Seven Years' War, the East India Company began a process of rapid expansion in India which resulted in most of the subcontinent falling under their rule by 1857, when the Indian Rebellion of 1857 broke out. After the rebellion was suppressed, the Government of India Act 1858 resulted in the EIC's territories in India being administered by the Crown instead. The India Office managed the EIC's former territories, which became known as the British Raj.

A zamindar in the Indian subcontinent was an autonomous or semi-autonomous feudal ruler of a zamindari. The term itself came into use during the reign of Mughals, and later the British began using it as a native synonym for "estate". The term means landowner in Persian. They were typically hereditary and held the right to collect tax on behalf of imperial courts or for military purposes.

The Madras Presidency or Madras Province, officially called the Presidency of Fort St. George until 1937, was an administrative subdivision (province) of British India and later the Dominion of India. At its greatest extent, the presidency included most of southern India, including all of present-day Andhra Pradesh, almost all of Tamil Nadu and parts of Kerala, Karnataka, Odisha and Telangana in the modern day. The city of Madras was the winter capital of the presidency and Ooty was the summer capital.

The Permanent Settlement, also known as the Permanent Settlement of Bengal, was an agreement between the East India Company and landlords of Bengal to fix revenues to be raised from land that had far-reaching consequences for both agricultural methods and productivity in the entire British Empire and the political realities of the Indian countryside. It was concluded in 1793 by the Company administration headed by Charles, Earl Cornwallis. It formed one part of a larger body of legislation, known as the Cornwallis Code. The Cornwallis Code of 1793 divided the East India Company's service personnel into three branches: revenue, judicial, and commercial. Revenues were collected by zamindars, native Indians who were treated as landowners. This division created an Indian landed class that supported British authority.

Deshmukh (IAST:Dēśamukh) is a historical Maratha title conferred to the rulers of a Dēśamukhi. It is used as a surname in certain regions of India, especially in the states of Maharashtra, Karnataka and Telangana and also in Andhra Pradesh and northern parts of Madhya Pradesh and Gujarat, Goa whose family received it as a title.

Major-General Sir Thomas Munro, 1st Baronet KCB was a Scottish soldier and British colonial administrator. He served as an East India Company Army officer and statesman, in addition to also being the governor of Madras Presidency.

Ryot was a general economic term used throughout India for peasant cultivators but with variations in different provinces. While zamindars were landlords, raiyats were tenants and cultivators, and served as hired labour.

The Singranatore family is the consanguineous name given to a noble family in Rajshahi of landed aristocracy in erstwhile East Bengal and West Bengal that were prominent in the nineteenth century till the fall of the monarchy in India by Royal Assent in 1947 and subsequently abolished by the newly formed democratic Government of East Pakistan in 1950 by the State Acquisition Act.

The Kingdom of Mysore was a kingdom in southern India founded in 1399 by Yaduraya in the region of the modern city of Mysore, in the Karnataka state. The Wodeyar dynasty ruled the Southern Karnataka region until Indian independence in 1947, when the kingdom was merged with the Union of India.

Taxation of salt has occurred in India since the earliest times. However, this tax was greatly increased when the British East India Company began to establish its rule over provinces in India. In 1835, special taxes were imposed on Indian salt to facilitate its import. This paid huge dividends for the traders of the British East India Company. When the Crown took over the administration of India from the Company in 1858, the taxes were not revoked.

Numbardar or Lambardar was the village headman responsible for tax collection in the village during the British Raj. They were appointed under the Mahalwari system.

The Great Famine of 1876–1878 was a famine in India under British Crown rule. It began in 1876 after an intense drought resulted in crop failure in the Deccan Plateau. It affected south and Southwestern India—the British-administered presidencies of Madras and Bombay, and the princely states of Mysore and Hyderabad—for a period of two years. In 1877, famine came to affect regions northward, including parts of the Central Provinces and the North-Western Provinces, and a small area in Punjab. The famine ultimately affected an area of 670,000 square kilometres (257,000 sq mi) and caused distress to a population totalling 58,500,000. The excess mortality in the famine has been estimated in a range whose low end is 5.6 million human fatalities, high end 9.6 million fatalities, and a careful modern demographic estimate 8.2 million fatalities. The famine is also known as the Southern India famine of 1876–1878 and the Madras famine of 1877.

The Great Depression in India was a period of economic depression in the Indian subcontinent, then under British colonial rule. Beginning in 1929 in the United States, the Great Depression soon began to spread to countries around the globe. A global financial crisis, combined with protectionist policies adopted by the colonial government resulted in a rapid increase in the price of commodities in British India. During the period 1929–1937, exports and imports in India fell drastically, crippling seaborne international trade in the region; the Indian railway and agricultural sectors were the most affected by the depression. Discontent from farmers resulted in riots and rebellions against colonial rule, while increasing Indian nationalism led to the Salt Satyagraha of 1930, in which Mahatma Gandhi undertook marches to the sea in order to protest against the British salt tax.

The Economy of India under Company rule describes the economy of those regions that fell under Company rule in India during the years 1757 to 1858. The British East India Company began ruling parts of the Indian subcontinent beginning with the Battle of Plassey, which led to the conquest of Bengal Subah and the founding of the Bengal Presidency, before the Company expanded across most of the subcontinent up until the Indian Rebellion of 1857.

Zerat is a land ownership system in early colonial India. The zerat system was particularly common in Bengal and Bihar. It refers to the private land of the landlord, which would often be cultivated by peasants. Zerat was mainly responsible for a change in traditional forms of agricultural organization in some parts of India, replacing the ryot system. It produced a strain on the peasant economy, despite peasants being free to grow their own crops.

The East Bengal State Acquisition and Tenancy Act of 1950 was a law passed by the newly formed democratic Government of East Bengal in the Dominion of Pakistan. The bill was drafted on 31 March 1948 during the early years of Pakistan and passed on 16 May 1951. Before passage of the legislature, landed revenue laws of Bengal consisted of the Permanent Settlement Regulations of 1793 and the Bengal Tenancy Act of 1885.

The Zamindars of Bengal were zamindars of the Bengal region of the Indian subcontinent. They governed an ancient system of land ownership.

The Mahalwari system was used in India to protect village-level-autonomy. It was introduced by Holt Mackenzie in 1822. The word "Mahalwari" is derived from the Hindi word Mahal, which means a community made from one or more villages.. Mahalwari consisted of landlords or Lambardars assigned to represent villages or groups of villages. Along with the village communities, the landlords were jointly responsible for the payment of revenue. Revenue was determined on basis of the produce of Mahal. Individual responsibility was not assigned. The land included under this system consisted of all land in the villages, including forestland, pastures etc. This system was prevalent in parts of the Gangetic Valley, Uttar Pradesh, the North Western province, parts of Central India and Punjab.

Dahsala is an Indian system of land taxation which was introduced in A.D. 1580 under the reign of Akbar. This system was introduced by the finance minister of Akbar, Raja Todar Mal, who was appointed in A.D. 1573 in Gujarat, and it helped to make the system of tax collection from non-muslims more organised.