The Nasdaq Stock Market is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc., which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, entertainment, retail, and food businesses, it focuses more on technology stocks. The exchange is made up of both American and foreign firms, with China and Israel being the largest foreign sources.

The DAX is a stock market index consisting of the 40 major German blue chip companies trading on the Frankfurt Stock Exchange. It is a total return index. Prices are taken from the Xetra trading venue. According to Deutsche Börse, the operator of Xetra, DAX measures the performance of the Prime Standard's 40 largest German companies in terms of order book volume and market capitalization. DAX is the equivalent of the UK FTSE 100 and the US Dow Jones Industrial Average, and because of its small company selection it does not necessarily represent the vitality of the German economy as a whole.

Market capitalization, sometimes referred to as market cap, is the total value of a publicly traded company's outstanding common shares owned by stockholders.

The CAC 40 is a benchmark French stock market index. The index represents a capitalization-weighted measure of the 40 most significant stocks among the 100 largest market caps on the Euronext Paris. It is a price return index. It is one of the main national indices of the pan-European stock exchange group Euronext alongside Euronext Amsterdam's AEX, Euronext Brussels' BEL20, Euronext Dublin's ISEQ 20, Euronext Lisbon's PSI-20 and the Oslo Bors OBX Index. It is an index without dividends. Cotation operates every working day from 9:00 a.m. to 5:30 p.m. It is updated every 15 seconds.

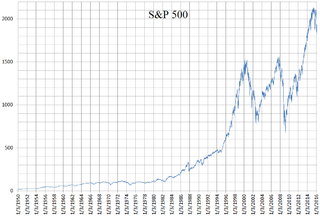

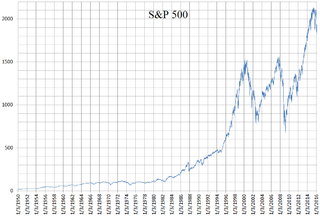

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $43 trillion as of January 2024.

SIX Swiss Exchange, based in Zürich, is Switzerland's principal stock exchange. SIX Swiss Exchange also trades other securities such as Swiss government bonds and derivatives such as stock options.

The NIFTY Next 50 is an stock market index provided and maintained by NSE Indices. It represents the next rung of liquid securities after the NIFTY 50. It consists of 50 companies representing approximately 10% of the traded value of all stocks on the National Stock Exchange of India. It is quoted using the symbol NIFTYJR.

The Korea Composite Stock Price Index or KOSPI (Korean: 한국종합주가지수) is the index of all common stocks traded on the Stock Market Division—previously, Korea Stock Exchange—of the Korea Exchange. It is the representative stock market index of South Korea, analogous to the S&P 500 in the United States.

The IBEX 35 is the benchmark stock market index of the Bolsa de Madrid, Spain's principal stock exchange. Initiated in 1992, the index is administered and calculated by Sociedad de Bolsas, a subsidiary of Bolsas y Mercados Españoles (BME), the company which runs Spain's securities markets. It is a market capitalization weighted index comprising the 35 most liquid Spanish stocks traded in the Madrid Stock Exchange General Index and is reviewed twice annually. Trading on options and futures contracts on the IBEX 35 is provided by MEFF, another subsidiary of BME.

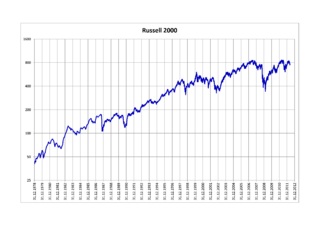

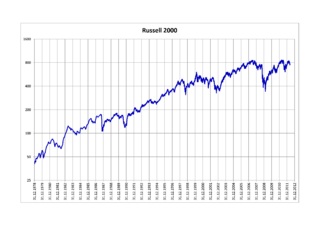

The Russell 2000 Index is a small-cap U.S. stock market index that makes up the smallest 2,000 stocks in the Russell Index. It was started by the Frank Russell Company in 1984. The index is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group (LSEG).

The Swiss Market Index (SMI) is Switzerland's blue-chip stock market index, which makes it the most followed in the country. It is made up of 20 of the largest and most liquid Swiss Performance Index (SPI) stocks. As a price index, the SMI is not adjusted for dividends.

The Swiss Performance Index (SPI) is a wide total-return index that tracks equity primarily listed on SIX Swiss Exchange with a free-float of at least 20%, and excluding investment companies. The index covers large, mid and small caps and is weighted by market capitalization. Most constituents, although not all, are domiciled in Switzerland or the Principality of Liechtenstein.

The Swiss Leader Index (SLI) is an index comprising large and mid-cap companies primarily listed on SIX Swiss Exchange. It is made up of 30 of the largest and most liquid Swiss Performance Index (SPI) large- and mid-cap stocks. As a price index, the SLI is not adjusted for dividends, but there exists a total-return version as well.

Partners Group Holding AG is a Swiss-based global private equity firm with US$149 billion in assets under management in private equity, private infrastructure, private real estate and private debt.

In finance, a stock index, or stock market index, is an index that measures the performance of a stock market, or of a subset of a stock market. It helps investors compare current stock price levels with past prices to calculate market performance.

The TA-125 Index, typically referred to as the Tel Aviv 125 and formerly the TA-100 Index, is a stock market index of the 125 most highly capitalised companies listed on the Tel Aviv Stock Exchange (TASE). The index began on 1 January 1992 with a base level of 100. The highest value reached to date is 2152.16, in January 2022. On 12 February 2017, the index was expanded to include 125 instead of 100 stocks, in an attempt to improve stability and therefore reduce risk for trackers and encourage foreign investment.

The SMI MID (SMIM) is a stock index which lists Switzerland's mid-cap companies. The index is calculated by SIX Swiss Exchange.

The SPI 20 is a capitalization-weighted stock index of large-cap companies listed on the SIX Swiss Exchange.

The SPI Extra is a stock index which tracks mid-cap and small-cap companies primarily listed in Switzerland. The index is calculated by SIX Swiss Exchange.