NYSE American, formerly known as the American Stock Exchange (AMEX), and more recently as NYSE MKT, is an American stock exchange situated in New York City. AMEX was previously a mutual organization, owned by its members. Until 1953, it was known as the New York Curb Exchange.

The New York Stock Exchange is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization. The NYSE trading floor is at the New York Stock Exchange Building on 11 Wall Street and 18 Broad Street and is a National Historic Landmark. An additional trading room, at 30 Broad Street, was closed in February 2007.

Australian Securities Exchange Ltd or ASX, is an Australian public company that operates Australia's primary securities exchange, the Australian Securities Exchange. The ASX was formed on 1 April 1987, through incorporation under legislation of the Australian Parliament as an amalgamation of the six state securities exchanges, and merged with the Sydney Futures Exchange in 2006.

The Pacific Exchange was a regional stock exchange in California, from 1956 to 2006. Its main exchange floor and building were in San Francisco, California, with a branch building in Los Angeles, California.

Nomura Securities Co., Ltd. is a Japanese financial services company and a wholly owned subsidiary of Nomura Holdings, Inc. (NHI), which forms part of the Nomura Group. It plays a central role in the securities business, the group's core business. Nomura is a financial services group and global investment bank. Based in Tokyo, Japan, with regional headquarters in Hong Kong, London, and New York, Nomura employs about 26,000 staff worldwide; it is known as Nomura Securities International in the US, and Nomura International plc. in EMEA. It operates through five business divisions: retail, global markets, investment banking, merchant banking, and asset management.

The Philippine Stock Exchange, Inc. is the national stock exchange of the Philippines. The exchange was created in 1992 from the merger of the Manila Stock Exchange and the Makati Stock Exchange. Including previous forms, the exchange has been in operation since 1927.

Broad Street is a north–south street in the Financial District of Lower Manhattan in New York City. Originally the Broad Canal in New Amsterdam, it stretches from today's South Street to Wall Street.

Intercontinental Exchange, Inc. (ICE) is an American company formed in 2000 that operates global financial exchanges and clearing houses and provides mortgage technology, data and listing services. Listed on the Fortune 500, S&P 500, and Russell 1000, the company owns exchanges for financial and commodity markets, and operates 12 regulated exchanges and marketplaces. This includes ICE futures exchanges in the United States, Canada and Europe, the Liffe futures exchanges in Europe, the New York Stock Exchange, equity options exchanges and OTC energy, credit and equity markets.

A regional stock exchange is a term used in the United States to describe stock exchanges that operate outside of the country's main financial center in New York City. A regional stock exchange operates in the trading of listed and over-the-counter (OTC) equities under the SEC's Unlisted Trading Privileges (UTP) rule.

The Luxembourg Stock Exchange, LuxSE is based in Luxembourg City at 35A boulevard Joseph II.

The phrase curbstone broker or curb-stone broker refers to a broker who conducts trading on the literal curbs of a financial district. Such brokers were prevalent in the 1800s and early 1900s, and the most famous curb market existed on Broad Street in the financial district of Manhattan. Curbstone brokers often traded stocks that were speculative in nature, as well as stocks in small industrial companies such as iron, textiles and chemicals. Efforts to organize and standardize the market started early in the 20th century under notable curb-stone brokers such as Emanuel S. Mendels.

Emanuel S. Mendels, Jr. (1850–1911) was an American businessman and broker. He was a leading curbstone broker who organized the Curb Market Agency in 1908 that developed appropriate trading rules for curbstone brokers. Later he formed the New York Curb Market Association, which supervised curb trading in an effort to prevent fraud. The New York Times called him the "father of the curb, writing "he, perhaps more than any other man, worked for the elevation of business done on the [New York curb market]."

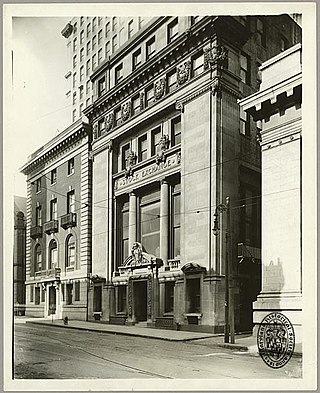

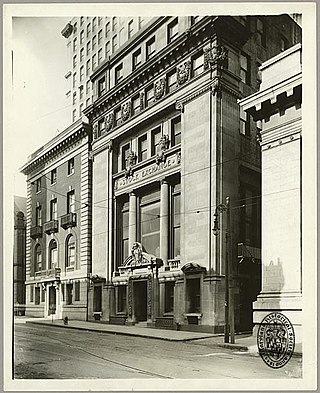

The American Stock Exchange Building, formerly known as the New York Curb Exchange Building and also known as 86 Trinity Place or 123 Greenwich Street, is the former headquarters of the American Stock Exchange. Designed in two sections by Starrett & van Vleck, it is located between Greenwich Street and Trinity Place in the Financial District of Lower Manhattan in New York City, with its main entrance at Trinity Place. The building represents a link to the historical practices of stock trading outside the strictures of the New York Stock Exchange (NYSE), which took place outdoors "on the curb" prior to the construction of the structure.

The Consolidated Stock Exchange of New York, also known as the New York Consolidated Stock Exchange or Consolidated, was a stock exchange in New York City, New York in direct competition to the New York Stock Exchange (NYSE) from 1885–1926. It was formed from the merger of other smaller exchanges, and was referred to in the industry and press as the "Little Board." By its official formation in 1885, its membership of 2403 was considered the second largest membership of any exchange in the United States.

The Baltimore Stock Exchange was a regional stock exchange based in Baltimore, Maryland. Opened prior to 1881, The exchange's building was destroyed by the Great Baltimore Fire of 1904, and was then located at 210 East Redwood Street in Baltimore's old financial district. In 1918, the exchange had 87 members, with six or seven members at the time serving the United States in World War I. The Baltimore Stock Exchange was acquired by the Philadelphia Stock Exchange in 1949, becoming the Philadelphia-Baltimore Stock Exchange. The Baltimore Stock Exchange Building was sold and renamed the Totman Building.

The San Francisco Curb Exchange was a curb exchange opened in 1928, formed out of a re-organization of the San Francisco Stock and Bond Exchange and the San Francisco Mining Exchange. The San Francisco Curb Exchange replaced the Mining Exchange at the 350 Bush Street building. The Curb Exchange later left the building in 1938, when the Curb Exchange was absorbed by the San Francisco Stock Exchange.

The San Francisco Mining Exchange was a regional stock exchange in San Francisco. Formed in 1862 to facilitate the trading of mining stocks as the San Francisco Stock Exchange, the Chicago Tribune described the exchange as "once the West's most flamboyant financial institution." It sold the name San Francisco Stock Exchange to the San Francisco Stock and Bond Exchange in December 1927 and was renamed the San Francisco Mining Exchange. The exchange agreed to deal solely in mining securities as part of the same deal, and also sold its building at 350 Bush Street to the San Francisco Curb Exchange. After years of ups and downs in the mining market, the exchange had "a second life" during the uranium boom of the 1950s. By August 1967, it was located in second-floor offices on Montgomery Street, at which point it was the smallest securities market in the United States and had suffered "years of lingering legal and money ailments." The exchange closed at the age of 105 in August 1967.

The Chicago Curb Exchange was an organized securities market and curb exchange located in Chicago, Illinois. It was alternately known as the Chicago Market.