A government bond or sovereign bond is a form of bond issued by a government to support public spending. It generally includes a commitment to pay periodic interest, called coupon payments, and to repay the face value on the maturity date.

The Morgenthau Plan was a proposal to weaken Germany following World War II by eliminating its arms industry and removing or destroying other key industries basic to military strength. This included the removal or destruction of all industrial plants and equipment in the Ruhr. It was first proposed by United States Secretary of the Treasury Henry Morgenthau Jr. in a 1944 memorandum entitled Suggested Post-Surrender Program for Germany.

War bonds are debt securities issued by a government to finance military operations and other expenditure in times of war without raising taxes to an unpopular level. They are also a means to control inflation by removing money from circulation in a stimulated wartime economy. War bonds are either retail bonds marketed directly to the public or wholesale bonds traded on a stock market. Exhortations to buy war bonds have often been accompanied by appeals to patriotism and conscience. Retail war bonds, like other retail bonds, tend to have a yield which is below that offered by the market and are often made available in a wide range of denominations to make them affordable for all citizens.

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending, in addition to taxation. Since 2012, the U.S. government debt has been managed by the Bureau of the Fiscal Service, succeeding the Bureau of the Public Debt.

Henry Morgenthau Jr. was the United States Secretary of the Treasury during most of the administration of Franklin D. Roosevelt. He played a major role in designing and financing the New Deal. After 1937, while still in charge of the Treasury, he played the central role in financing United States participation in World War II. He also played an increasingly major role in shaping foreign policy, especially with respect to Lend-Lease, support for China, helping Jewish refugees, and proposing measures to deindustrialise Germany.

A liberty bond or liberty loan was a war bond that was sold in the United States to support the Allied cause in World War I. Subscribing to the bonds became a symbol of patriotic duty in the United States and introduced the idea of financial securities to many citizens for the first time.

The Revenue Act of 1862, was a bill the United States Congress passed to help fund the American Civil War. President Abraham Lincoln signed the act into law on July 1, 1862. The act established the office of the Commissioner of Internal Revenue, a department in charge of the collection of taxes, and levied excise taxes on most items consumed and traded in the United States. The act also introduced the United States' first progressive tax with the intent of raising millions of dollars for the Union.

The Canada Savings Bond was an investment instrument offered by the Government of Canada from 1945 to 2017, sold between early October and December 1 of every year. It was issued by the Bank of Canada and was intended to offer a competitive interest rate, and had a guaranteed minimum interest rate.

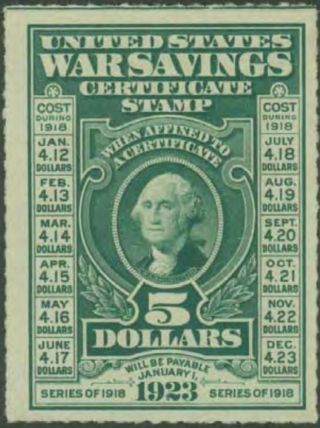

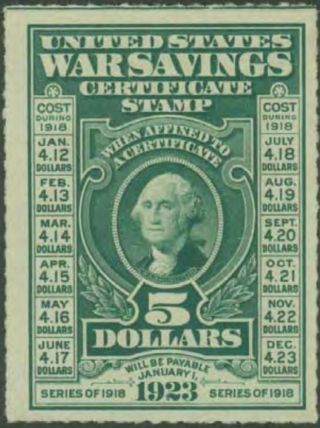

War savings stamps were issued by the United States Treasury Department to help fund participation in World War I and World War II. Although these stamps were distinct from the postal savings stamps issued by the United States Post Office Department, the Post Office nevertheless played a major role in promoting and distributing war savings stamps. In contrast to Liberty Bonds, which were purchased primarily by financial institutions, war savings stamps were principally aimed at common citizens. During World War I, 25-cent Thrift stamps were offered to allow individuals to accumulate enough over time to purchase the standard 5-dollar War Savings Certificate stamp. When the Treasury began issuing war savings stamps during World War II, the lowest denomination was a 10-cent stamp, enabling ordinary citizens to purchase them. In many cases, collections of war savings stamps could be redeemed for Treasury Certificates or War Bonds.

"Any Bonds Today?" is a song written by Irving Berlin, featured in a 1942 animated propaganda film starring Bugs Bunny. Both were used to sell war bonds during World War II.

TreasuryDirect is a website run by the Bureau of the Fiscal Service under the United States Department of the Treasury that allows US individual investors to purchase treasury securities, such as savings bonds, directly from the US government. It enables people to manage their investments online, including connecting their TreasuryDirect account to a bank account for deposits and withdrawals.

The War Refugee Board, established by President Franklin D. Roosevelt in January 1944, was a U.S. executive agency to aid civilian victims of the Axis powers. The Board was, in the words of historian Rebecca Erbelding, "the only time in American history that the US government founded a non-military government agency to save the lives of civilians being murdered by a wartime enemy."

Israel Bonds, the commonly known name of Development Corporation for Israel (DCI), is the U.S. underwriter of debt securities issued by the State of Israel. DCI is headquartered in New York City and is a broker-dealer and member of the Financial Industry Regulatory Authority (FINRA). Dani Naveh is president and CEO.

United States Savings Bonds are debt securities issued by the United States Department of the Treasury to help pay for the U.S. government's borrowing needs. They are considered one of the safest investments because they are backed by the full faith and credit of the United States government. The savings bonds are nonmarketable treasury securities issued to the public, which means they cannot be traded on secondary markets or otherwise transferred. They are redeemable only by the original purchaser, a recipient or a beneficiary in case of the original holder's death.

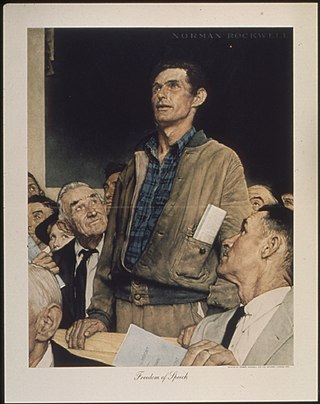

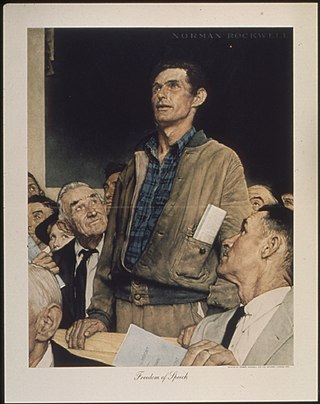

The Four Freedoms is a series of four oil paintings made in 1943 by the American artist Norman Rockwell. The paintings—Freedom of Speech, Freedom of Worship, Freedom from Want, and Freedom from Fear—are each approximately 45.75 by 35.5 inches, and are now in the Norman Rockwell Museum in Stockbridge, Massachusetts. The four freedoms refer to President Franklin D. Roosevelt's January 1941 Four Freedoms State of the Union address, in which he identified essential human rights that should be universally protected. The theme was incorporated into the Atlantic Charter, and became part of the Charter of the United Nations. The paintings were reproduced in The Saturday Evening Post over four consecutive weeks in 1943, alongside essays by prominent thinkers of the day. They became the highlight of a touring exhibition sponsored by The Post and the U.S. Department of the Treasury. The exhibition and accompanying sales drives of war bonds raised over $132 million.

The Third Liberty Loan Act was a liberty bond sold during World War I that helped cover the war expenses of the United States. In effect, the bonds were loans from citizens to the US Government which would be repaid with interest in the future. There were two previous loan acts, The Liberty Loan Act and The Second Liberty Loan Act, each providing additional money to the US Government to fund the war. The Third Liberty Loan Act was enacted on April 5, 1918. The third act specifically allowed the US government to issue $3 billion worth of war bonds at a rate of 4.5% interest for up to 10 years with an individual aggregate limit of $45,000. The bonds produced by the Third Liberty Loan Act were not redeemable until September 15, 1928.

Cecil Calvert Beall (1892–1970) was an American commercial illustrator and portrait painter. He did watercolor art and drawings for magazines and comic books. Beall designed posters for the United States government for war loan drives during World War II.

The presidency of Franklin D. Roosevelt began on March 4, 1933.

CenTrust Bank, A State Savings Bank was an American savings and loan association based in Miami, Florida that failed in 1990. Its failure in 1990 was one of the largest and costliest failures of the savings and loan crisis.

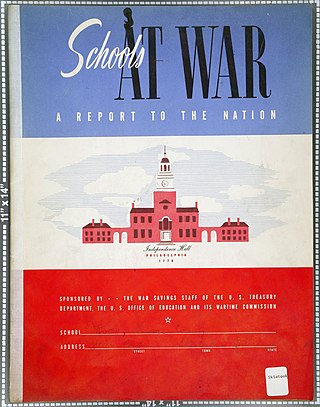

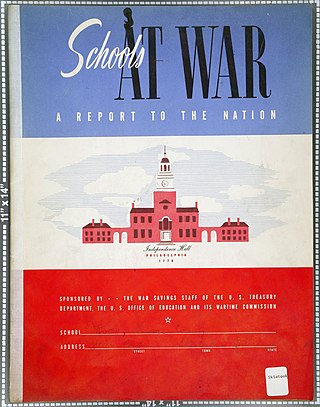

The American Schools at War program was a program during World War II run by the U.S. Treasury Department, in which schoolchildren set goals to sell stamps and bonds to help the war effort. The program was also administered by the U.S. Office of Education, the Federal government agency that interfaced with the nation's school systems and its thirty-two million students. The Office, however, allowed the Treasury to work with the schools directly as the main objective of the program was raising money.