Related Research Articles

James Tobin was an American economist who served on the Council of Economic Advisers and consulted with the Board of Governors of the Federal Reserve System, and taught at Harvard and Yale Universities. He contributed to the development of key ideas in the Keynesian economics of his generation and advocated government intervention in particular to stabilize output and avoid recessions. His academic work included pioneering contributions to the study of investment, monetary and fiscal policy and financial markets. He also proposed an econometric model for censored dependent variables, the well-known tobit model.

Keynesian economics are the various macroeconomic theories and models of how aggregate demand strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. It is influenced by a host of factors that sometimes behave erratically and impact production, employment, and inflation.

In economics, stagflation is a situation in which the inflation rate is high or increasing, the economic growth rate slows, and unemployment remains steadily high. Stagflation, once thought impossible, poses a dilemma for economic policy, as measures to reduce inflation may exacerbate unemployment.

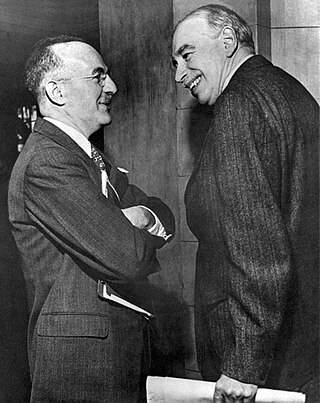

John Maynard Keynes, 1st Baron Keynes, was an English economist and philosopher whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in mathematics, he built on and greatly refined earlier work on the causes of business cycles. One of the most influential economists of the 20th century, he produced writings that are the basis for the school of thought known as Keynesian economics, and its various offshoots. His ideas, reformulated as New Keynesianism, are fundamental to mainstream macroeconomics. He is known as the "father of macroeconomics".

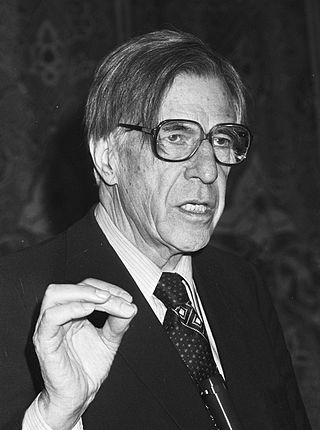

John Kenneth Galbraith, also known as Ken Galbraith, was a Canadian-American economist, diplomat, public official, and intellectual. His books on economic topics were bestsellers from the 1950s through the 2000s. As an economist, he leaned toward post-Keynesian economics from an institutionalist perspective.

Nicholas Kaldor, Baron Kaldor, born Káldor Miklós, was a Hungarian economist. He developed the "compensation" criteria called Kaldor–Hicks efficiency for welfare comparisons (1939), derived the cobweb model, and argued for certain regularities observable in economic growth, which are called Kaldor's growth laws. Kaldor worked alongside Gunnar Myrdal to develop the key concept Circular Cumulative Causation, a multicausal approach where the core variables and their linkages are delineated.

Paul Anthony Samuelson was an American economist who was the first American to win the Nobel Memorial Prize in Economic Sciences. When awarding the prize in 1970, the Swedish Royal Academies stated that he "has done more than any other contemporary economist to raise the level of scientific analysis in economic theory".

Nicholas Gregory Mankiw is an American macroeconomist who is currently the Robert M. Beren Professor of Economics at Harvard University. Mankiw is best known in academia for his work on New Keynesian economics.

Edmund Strother Phelps is an American economist and the recipient of the 2006 Nobel Memorial Prize in Economic Sciences.

Alvin Harvey Hansen was an American economist who taught at the University of Minnesota and was later a chair professor of economics at Harvard University. Often referred to as "the American Keynes", he was a widely read popular author on economic issues, and an influential advisor to the government on economic policy. Hansen helped create the Council of Economic Advisors and the Social Security system. He is best remembered today for introducing Keynesian economics in the United States in the 1930s and 40s.

The neoclassical synthesis (NCS), or neoclassical–Keynesian synthesis is an academic movement and paradigm in economics that worked towards reconciling the macroeconomic thought of John Maynard Keynes in his book The General Theory of Employment, Interest and Money (1936) with neoclassical economics.

New classical macroeconomics, sometimes simply called new classical economics, is a school of thought in macroeconomics that builds its analysis entirely on a neoclassical framework. Specifically, it emphasizes the importance of rigorous foundations based on microeconomics, especially rational expectations.

Paul Davidson was an American macroeconomist who has been one of the leading spokesmen of the American branch of the post-Keynesian school in economics. He has actively intervened in important debates on economic policy from a position critical of mainstream economics.

Lorie Tarshis was a Canadian economist who taught mostly at Stanford University. He is credited with writing the first introductory textbook that brought Keynesian thinking into American university classrooms, the 1947 Elements of Economics. The work swiftly lost popularity after it was charged with excessive sympathy to communism by McCarthyist activists. Instead, the 1948 Economics by Paul Samuelson brought the Keynesian revolution to the United States.

Following the global 2007–2008 financial crisis, there was a worldwide resurgence of interest in Keynesian economics among prominent economists and policy makers. This included discussions and implementation of economic policies in accordance with the recommendations made by John Maynard Keynes in response to the Great Depression of the 1930s, most especially fiscal stimulus and expansionary monetary policy.

The Keynesian Revolution was a fundamental reworking of economic theory concerning the factors determining employment levels in the overall economy. The revolution was set against the then orthodox economic framework, namely neoclassical economics.

Macroeconomic theory has its origins in the study of business cycles and monetary theory. In general, early theorists believed monetary factors could not affect real factors such as real output. John Maynard Keynes attacked some of these "classical" theories and produced a general theory that described the whole economy in terms of aggregates rather than individual, microeconomic parts. Attempting to explain unemployment and recessions, he noticed the tendency for people and businesses to hoard cash and avoid investment during a recession. He argued that this invalidated the assumptions of classical economists who thought that markets always clear, leaving no surplus of goods and no willing labor left idle.

The post-war displacement of Keynesianism was a series of events which from mostly unobserved beginnings in the late 1940s, had by the early 1980s led to the replacement of Keynesian economics as the leading theoretical influence on economic life in the developed world. Similarly, the allied discipline known as development economics was largely displaced as the guiding influence on economic policies adopted by developing nations.

Geoffrey Walter Maynard was a British economist.

Tyler Beck Goodspeed is an American economist and economic historian who was the acting chairman of the Council of Economic Advisers from June 2020 to January 2021. He resigned from his position on January 7 in the wake of the 2021 storming of the United States Capitol.

References

- ↑ "Seymour E. Harris, Economist And Adviser to Presidents, Dies". New York Times . October 29, 1974. Archived from the original on 11 February 2023. Retrieved 29 January 2024.

- ↑ Ross B. Emmett, ed. (2010). The Biographical Dictionary of American Economists. OROPrint Publication. ISBN 9780199754748.

- 1 2 "Seymour E. Harris Personal Papers". JFK Library. Archived from the original on 2016-08-22. Retrieved 2024-01-21.

- ↑ Ware, Susan m (2004). Notable American Women: A Biographical Dictionary Completing the Twentieth Century. Harvard University Press. p. 72. ISBN 978-0-674-01488-6.

- ↑ "Seymour Edwin Harris, 1897-1975". HET. Archived from the original on 2023-11-19. Retrieved 2024-01-22.

- ↑ Wapshott, Nicholas (2011). Keynes Hayek: The Clash that Defined Modern Economics. W. W. Norton & Company. ISBN 978-0-393-08311-8.

- ↑ Galbraith, John Kenneth (2017). Money: Whence It Came, Where It Went. Princeton University Press. p. 310. ISBN 978-0-691-17166-1.

- ↑ Palermo, Joseph A. (2002-07-06). In His Own Right: The Political Odyssey of Senator Robert F. Kennedy. Columbia University Press. ISBN 978-0-231-12069-2.

- ↑ Klein, Lawrence (1947). "Reviewed work: Inflation and the American Economy, Seymour E. Harris". The Review of Economics and Statistics. 29 (3). The MIT Press: 206–209. doi:10.2307/1928634. JSTOR 1928634.