Related Research Articles

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms "national deficit" and "national surplus" usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

Fidelity Investments, formerly known as Fidelity Management & Research (FMR), is an American multinational financial services corporation based in Boston, Massachusetts. Established in 1946, the company is one of the largest asset managers in the world, with $4.9 trillion in assets under management, and, as of December 2023, $12.6 trillion in assets under administration. Fidelity Investments operates a brokerage firm, manages a large family of mutual funds, provides fund distribution and investment advice, retirement services, index funds, wealth management, securities execution and clearance, asset custody, and life insurance.

CITIC Group Corporation Ltd., formerly the China International Trust Investment Corporation (CITIC), is a state-owned investment company of the People's Republic of China, established by Rong Yiren in 1979 with the approval of Deng Xiaoping. Its headquarters are in Chaoyang District, Beijing. As of 2019, it is China's biggest state-run conglomerate with one of the largest pools of foreign assets in the world. In 2023, the company was ranked 71st in the Forbes Global 2000.

China Development Bank (CDB) is a policy bank of China under the State Council. Established in 1994, it has been described as the engine that powers the national government's economic development policies. It has raised funds for numerous large-scale infrastructure projects, including the Three Gorges Dam and the Shanghai Pudong International Airport.

The Shanghai Stock Exchange is a stock exchange based in the city of Shanghai, China. It is one of the three stock exchanges operating independently in mainland China, the others being the Beijing Stock Exchange and the Shenzhen Stock Exchange. The Shanghai Stock Exchange is the world's third largest stock market by market capitalization. It is also Asia's biggest stock exchange. Unlike the Hong Kong Stock Exchange, the Shanghai Stock Exchange is still not entirely open to foreign investors and often affected by the decisions of the central government, due to capital account controls exercised by the Chinese mainland authorities.

The State Administration of Foreign Exchange (SAFE) of the People's Republic of China is an administrative agency under the State Council tasked with drafting rules and regulations governing foreign exchange market activities, and managing the state foreign-exchange reserves, which at the end of December 2016 stood at $3.01 trillion for the People's Bank of China. The current director is Zhu Hexin.

Jinjiang District is a central urban district of Chengdu and the provincial seat of Sichuan, China. Jinjiang District is the geographical, economic, trade, cultural, and political center of Chengdu, Sichuan, and Southwestern China. It is the seat of the Sichuan Provincial People's Congress and the Sichuan Provincial Government.

The China Evergrande Group was a Chinese property developer, and it was the second largest in China by sales. It was founded in 1996 by Hui Ka Yan. It sold apartments mostly to upper- and middle-income dwellers.

The shadow banking system is a term for the collection of non-bank financial intermediaries (NBFIs) that legally provide services similar to traditional commercial banks but outside normal banking regulations. Examples of NBFIs include hedge funds, insurance firms, pawn shops, cashier's check issuers, check cashing locations, payday lending, currency exchanges, and microloan organizations. The phrase "shadow banking" is regarded by some as pejorative, and the term "market-based finance" has been proposed as an alternative.

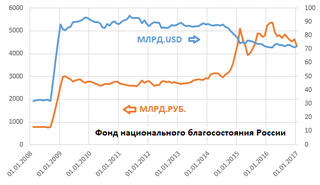

The Russian National Wealth Fund is Russia's sovereign wealth fund. It was created after the Stabilization Fund of the Russian Federation was split into two separate investment funds on 30 January 2008.

China has an upper middle income, developing, mixed, socialist market economy incorporating industrial policies and strategic five-year plans. It is the world's second largest economy by nominal GDP, behind the United States, and the world's largest economy since 2016 when measured by purchasing power parity (PPP). China accounted for 19% of the global economy in 2022 in PPP terms, and around 18% in nominal terms in 2022. The economy consists of public sector enterprises, state-owned enterprises (SOEs) and mixed-ownership enterprises, as well as a large domestic private sector and openness to foreign businesses in their system. According to the annual data of major economic indicators released by the National Bureau of Statistics since 1952, China's GDP grew by an average of 6.17% per year in the 26 years from 1953 to 1978. China implemented economic reform in 1978, and from 1979 to 2023, the country's GDP growth rate grew by an average of 8.93% per year in the 45 years since its implementing economic reform. According to preliminary data released by the authorities, China's GDP in 2023 was CN¥126.06 trillion with a real increase of 5.2% than the last year.

The 2008–09 Chinese economic stimulus plan was a RMB¥ 4 trillion stimulus package aiming to minimize the impact of the financial crisis of 2007–2008 on the Chinese economy. It was announced by the State Council of the People's Republic of China on 9 November 2008. The economic stimulus plan was seen as a success: While China's economic growth fell to almost 6% by the end of 2008, it had recovered to over 10% by in mid-2009. Critics of China's stimulus package have blamed it for causing a surge in Chinese debt since 2009, particularly among local governments and state-owned enterprises. The World Bank subsequently went on to recommend similar public works spending campaigns to western governments experiencing the effects of the financial crisis, but the US and EU instead decided to pursue long-term policies of quantitative easing.

Since the late-2000s, the People's Republic of China (PRC) has sought to internationalize its official currency, the Renminbi (RMB). RMB internationalization accelerated in 2009 when China established the dim sum bond market and expanded Cross-Border Trade RMB Settlement Pilot Project, which helps establish pools of offshore RMB liquidity. The RMB was the 8th-most-traded currency in the world in 2013 and the 7th-most-traded in early 2014.

Ezubao was a peer-to-peer lending scheme based in the eastern Chinese province of Anhui. It was set up as an online scheme in July 2014, attracted funds of about 50 billion yuan from 900,000 investors, and ceased to trade in December 2015. On 1 February 2016, the scheme was closed down and 21 involved people were arrested. Zhang Min, the president of the parent company, Yucheng Global, told investigators that the company operated as a Ponzi scheme. Following its establishment, Ezubao grew rapidly, masquerading as a legitimate investment opportunity while operating under the guise of peer-to-peer lending. Revelations about the fraudulent nature of Ezubao’s operations emerged after an exposé in late 2015, leading to public outcry and intensified scrutiny by regulatory authorities. The scale of Ezubao’s Ponzi scheme, which orchestrated a sophisticated ruse involving fake projects and returns, was unprecedented in China, contributing to an estimated loss of billions of yuan for investors. The scandal not only devastated the finances of nearly a million individuals but also prompted a nationwide tightening of regulations on the peer-to-peer lending industry, aiming to close loopholes and restore investor confidence.

The national debtof the People's Republic of China is the total amount of money owed by the central government, local governments, government branches and state organizations of China. Standard & Poor's Global Ratings has stated Chinese local governments may have an additional CN¥ 40 trillion in off-balance sheet debt. Debt owed by state-owned industrial firms is another 74% of GDP according to the International Monetary Fund. The three government-owned banks owe a further 29% of GDP. China's debt level increased during the 2010s, continuing as an economic issue into the 2020s.

Chen Feng is a Chinese businessman and founder of business conglomerate HNA Group and Hainan Airlines.

Chinese shadow banking refers to underground financial activity that takes place outside of traditional banking regulations and systems. China has one of the largest shadow banking industries with approximately 40% of the country's outstanding loans tied up in shadow banking activities. Shadow banking in China arose after the People's Bank of China became the central bank in 1983. This encouraged commercial enterprises and private investors to place more of their money in financial products, causing the banking industry to grow.

Digital renminbi, or Digital Currency Electronic Payment, is a central bank digital currency issued by China's central bank, the People's Bank of China. It is the first digital currency to be issued by a major economy, undergoing public testing as of April 2021. The digital RMB is legal tender and has equivalent value with other forms of renminbi, also known as the Chinese yuan (CNY), such as bills and coins.

The Chinese property sector crisis is a current financial crisis sparked by the 2021 default of Evergrande Group. Evergrande, and other Chinese property developers, experienced financial stress in the wake of overbuilding and subsequent new Chinese regulations on these companies' debt limits. The crisis spread beyond Evergrande in 2021 to such major property developers as Country Garden, Kaisa Group, Fantasia Holdings, Sunac, Sinic Holdings, and Modern Land.

A series of economic crises have affected China since the country enacted its zero-COVID policy during the COVID-19 pandemic.

References

- 1 2 3 "What are shadow banks and why are they failing in China?". euronews. 2024-02-27. Retrieved 2024-05-09.

- 1 2 3 "Elderly retirees face big losses after Chinese trust goes bust, reflecting turbulent economy". AP News. 2024-03-13. Retrieved 2024-05-09.

- 1 2 Hawkins, Amy; correspondent, Amy Hawkins Senior China (2024-02-18). "'It's legalised robbery': anger grows at China's struggling shadow banks". The Observer. ISSN 0029-7712 . Retrieved 2024-05-09.