Related Research Articles

Welfare is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance programs, which provide support only to those who have previously contributed, as opposed to social assistance programs, which provide support on the basis of need alone. The International Labour Organization defines social security as covering support for those in old age, support for the maintenance of children, medical treatment, parental and sick leave, unemployment and disability benefits, and support for sufferers of occupational injury.

Workers' compensation or workers' comp is a form of insurance providing wage replacement and medical benefits to employees injured in the course of employment in exchange for mandatory relinquishment of the employee's right to sue his or her employer for the tort of negligence. The trade-off between assured, limited coverage and lack of recourse outside the worker compensation system is known as "the compensation bargain". One of the problems that the compensation bargain solved is the problem of employers becoming insolvent as a result of high damage awards. The system of collective liability was created to prevent that, and thus to ensure security of compensation to the workers. Individual immunity is the necessary corollary to collective liability.

Unemployment benefits, also called unemployment insurance, unemployment payment, unemployment compensation, or simply unemployment, are payments made by authorized bodies to unemployed people. In the United States, benefits are funded by a compulsory governmental insurance system, not taxes on individual citizens. Depending on the jurisdiction and the status of the person, those sums may be small, covering only basic needs, or may compensate the lost time proportionally to the previous earned salary.

The U.S. Railroad Retirement Board (RRB) is an independent agency in the executive branch of the United States government created in 1935 to administer a social insurance program providing retirement benefits to the country's railroad workers.

The Labour Party governed the United Kingdom of Great Britain and Northern Ireland from 1974 to 1979. During this period, Harold Wilson and James Callaghan were successively appointed as Prime Minister of the United Kingdom by Queen Elizabeth II. The end of the Callaghan ministry was presaged by the Winter of Discontent, a period of serious industrial discontent. This was followed by the election of Conservative leader Margaret Thatcher in 1979.

The International Social Security Association (ISSA) is an international organization bringing together national social security administrations and agencies. Founded in 1927, the ISSA has more than 330 member organizations in 158 countries. It has its headquarters in Geneva, Switzerland, in the International Labour Office (ILO). The ISSA President, elected in 2016, is Joachim Breuer (Germany) and the Secretary General since 2019 is Marcelo Abi-Ramia Caetano (Brazil).

Social security is divided by the French government into four branches: illness; old age/retirement; family; work accident; and occupational disease. From an institutional point of view, French social security is made up of diverse organismes. The system is divided into three main Regimes: the General Regime, the Farm Regime, and the Self-employed Regime. In addition there are numerous special regimes dating from prior to the creation of the state system in the mid-to-late 1940s.

Welfare in France includes all systems whose purpose is to protect people against the financial consequences of social risks.

Social protection, as defined by the United Nations Research Institute for Social Development, is concerned with preventing, managing, and overcoming situations that adversely affect people's well-being. Social protection consists of policies and programs designed to reduce poverty and vulnerability by promoting efficient labour markets, diminishing people's exposure to risks, and enhancing their capacity to manage economic and social risks, such as unemployment, exclusion, sickness, disability, and old age. It is one of the targets of the United Nations Sustainable Development Goal 10 aimed at promoting greater equality.

The Social Security System is a state-run, social insurance program in the Philippines to workers in the private, professional and informal sectors. SSS is established by virtue of Republic Act No. 1161, better known as the Social Security Act of 1954. This law was later amended by Republic Act No. 8282 in 1997. Government employees, meanwhile, are covered under a separate state-pension fund by the Government Service Insurance System (GSIS).

Social security in Finland, or welfare in Finland, is very comprehensive compared to other countries. In the late 1980s, Finland had one of the world's most advanced welfare systems, one that guaranteed decent living conditions for all Finns. Since then social security has been cut back, but still the system is one of the most comprehensive in the world. Created almost entirely during the first three decades after World War II, the social security system was an outgrowth of the traditional Nordic belief that the state was not inherently hostile to the well-being of its citizens, but could intervene benevolently on their behalf. According to some social historians, the basis of this belief was a relatively benign history that had allowed the gradual emergence of a free and independent peasantry in the Nordic countries and had curtailed the dominance of the nobility and the subsequent formation of a powerful right wing. Finland's history has been harsher than the histories of the other Nordic countries, but not harsh enough to bar the country from following their path of social development.

The right to social security is recognized as a human right and establishes the right to social security assistance for those unable to work due to sickness, disability, maternity, employment injury, unemployment or old age. Social security systems provided for by states consist of social insurance programs, which provide earned benefits for workers and their families by employment contributions, and/or social assistance programs which provide non-contributory benefits designed to provide minimum levels of social security to persons unable to access social insurance.

Unemployment benefits in Spain are contributory and non-contributory. They are part of social security system in Spain and are managed by the State Public Employment Service (SEPE). Employers and employees contribute to the unemployment contingency fund and if an unemployed person fulfills certain criteria they can claim an allowance which is based on the time they have contributed and their average wage. A non-contributory benefit is also available to those who no longer receive a contributory benefit dependent on a maximum level of income.

The Social Security Institution is the governing authority of the Turkish social security system. It was established by the Social Security Institution Law No:5502, which was published in the Official Gazette No: 26173 on June 20, 2006. This brought five different retirement systems that affected civil servants, contractual paid workers, agricultural paid workers, and self-employed workers into a single retirement system offering equal actuarial rights and obligations.

National Assistance was the main means-tested benefit in the United Kingdom from 1948 to 1966.

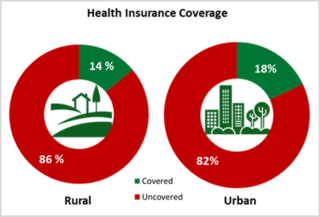

Health insurance in India is a growing segment of India's economy. The Indian health system is one of the largest in the world, with the number of people it concerns: nearly 1.3 billion potential beneficiaries. The health industry in India has rapidly become one of the most important sectors in the country in terms of income and job creation. In 2018, one hundred million Indian households do not benefit from health coverage. In 2011, 3.9% of India's gross domestic product was spent in the health sector. According to the World Health Organization (WHO), this is among the lowest of the BRICS economies. Policies are available that offer both individual and family cover. Out of this 3.9%, health insurance accounts for 5-10% of expenditure, employers account for around 9% while personal expenditure amounts to an astounding 82%. In the year 2016, the NSSO released the report “Key Indicators of Social Consumption in India: Health” based on its 71st round of surveys. The survey carried out in the year 2014 found out that, more than 80% of Indians are not covered under any health insurance plan, and only 18% of the urban population and 14% of the rural population was covered under any form of health insurance.

Luxembourg has an extensive welfare system. It comprises a social security, health, and pension funds. The labour market is highly regulated, and Luxembourg is a corporatist welfare state. Enrollment is mandatory in one of the welfare schemes for any employed person. Luxembourg's social security system is the Centre Commun de la Securite Sociale (CCSS). Both employees and employers make contributions to the fund at a rate of 25% of total salary, which cannot eclipse more than five times the minimum wage. Social spending accounts for 21.8% of GDP.

The Caixa Andorrana de Seguretat Social (CASS) is the public institution in charge of the Social Security system system in Andorra. It was established in April 1968. Since the Constitution of Andorra was approved in 1993, the objective of the Andorran system is to make prevail Article 30: «The right to health protection and to receive benefits to meet other personal needs is recognized. To these ends, the State will guarantee a Social Security system ». That is to say, guarantee protection, in its contributory and non-contributory modality, of insured persons, direct or indirect, through the appropriate benefits. It is compulsory for salaried workers and also for those who develop an economic activity.

The Istituto nazionale della previdenza sociale is the main entity of the Italian public retirement system. All waged labourers and most of self-employed, without a proper autonomous social security fund, must be subscribed to INPS. The entity is under the supervision of the Ministry of Labour and Social Policies.

In Ireland three main types of payments make up the social security system. These are: