A pension is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. A pension may be a "defined benefit plan", where a fixed sum is paid regularly to a person, or a "defined contribution plan", under which a fixed sum is invested that then becomes available at retirement age. Pensions should not be confused with severance pay; the former is usually paid in regular amounts for life after retirement, while the latter is typically paid as a fixed amount after involuntary termination of employment before retirement.

Unemployment benefits, also called unemployment insurance, unemployment payment, unemployment compensation, or simply unemployment, are payments made by authorized bodies to unemployed people. In the United States, benefits are funded by a compulsory governmental insurance system, not taxes on individual citizens. Depending on the jurisdiction and the status of the person, those sums may be small, covering only basic needs, or may compensate the lost time proportionally to the previous earned salary.

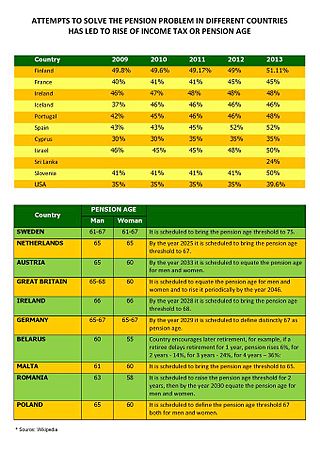

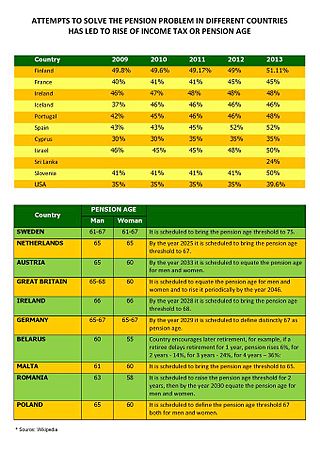

The pensions crisis or pensions timebomb is the predicted difficulty in paying for corporate or government employment retirement pensions in various countries, due to a difference between pension obligations and the resources set aside to fund them. The basic difficulty of the pension problem is that institutions must be sustained over far longer than the political planning horizon. Shifting demographics are causing a lower ratio of workers per retiree; contributing factors include retirees living longer, and lower birth rates. An international comparison of pension institution by countries is important to solve the pension crisis problem. There is significant debate regarding the magnitude and importance of the problem, as well as the solutions. One aspect and challenge of the "Pension timebomb" is that several countries' governments have a constitutional obligation to provide public services to its citizens, but the funding of these programs, such as healthcare are at a lack of funding, especially after the 2008 recession and the strain caused on the dependency ratio by an ageing population and a shrinking workforce, which increases costs of elderly care.

A private pension is a plan into which individuals contribute from their earnings, which then will pay them a private pension after retirement. It is an alternative to the state pension. Usually, individuals invest funds into saving schemes or mutual funds, run by insurance companies. Often private pensions are also run by the employer and are called occupational pensions. The contributions into private pension schemes are usually tax-deductible. This is similar to the regular pension.

In France employees of some government-owned corporations enjoy a special retirement plan, collectively known as régimes spéciaux de retraite. These professions include employees of the SNCF, the RATP, the electrical and gas companies which used to be government-owned; as well as some employees whose functions are directly related to the State such as the military, French National Police, sailors, Civil law notaries' assistants, employees of the Opéra de Paris, etc. The main differences between the special retirement plan and the usual private sector retirement plans are the retirement age and the number of years a worker must contribute to the fund before being allowed a full pension. In the private sector the minimum retirement age is 62 and the minimum number of quarters of contribution to the retirement fund in order to receive a full pension is between 166 and 172 quarters depending on date of birth. Employees who are enrolled in the special retirement plan can retire earlier.

Defined benefit (DB) pension plan is a type of pension plan in which an employer/sponsor promises a specified pension payment, lump-sum, or combination thereof on retirement that depends on an employee's earnings history, tenure of service and age, rather than depending directly on individual investment returns. Traditionally, many governmental and public entities, as well as a large number of corporations, provide defined benefit plans, sometimes as a means of compensating workers in lieu of increased pay.

Mexico reformed its pension system in 1997, transforming it from a pay as you go (PAYG), defined benefit (DB) scheme to a fully funded, private and mandatory defined contribution (DC) scheme. The reform was modeled after the pension reforms in Chile in the early 1980s, and was a result of recommendations from the World Bank. On December 10, 2020, the Mexican pension system would again undergo a major reform.

Pensions in Norway fall into three major divisions; State Pensions, Occupational Pensions and Individual or personal Pensions.

A social pension is a stream of payments from state to an individual that starts when someone retires and continues in payment until death. It is a part of a pension system of most developed countries, specifically the so-called zero or first pillar of the pension system, which is a part of state social security system. The social pension is different from other types of pension since its eligibility criteria do not require former contributions of an individual, but citizenship or residency and age or other criteria set by government.

Pensions in France fall into five major divisions;

Pensions in Germany are based on a “three pillar system”.

India operates a complex pension system. There are however three major pillars to the Indian pension system: the solidarity social assistance called the National Social Assistance Programme (NSAP) for the elderly poor, the civil servants pension and the mandatory defined contribution pension programs run by the Employees' Provident Fund Organisation of India for private sector employees and employees of state owned companies, and several voluntary plans.

Unemployment benefits in Spain are contributory and non-contributory. They are part of social security system in Spain and are managed by the State Public Employment Service (SEPE). Employers and employees contribute to the unemployment contingency fund and if an unemployed person fulfills certain criteria they can claim an allowance which is based on the time they have contributed and their average wage. A non-contributory benefit is also available to those who no longer receive a contributory benefit dependent on a maximum level of income.

Pensions in Ukraine provide income for retirees in Ukraine. They are provided pursuant to the Law of Ukraine on Compulsory State Pension Insurance that specifies a three-tiered pension provision system.

There are various types of Pensions in Armenia, including social pensions, mandatory funded pensions, or voluntary funded pensions. Currently, Amundi-ACBA and Ampega act as the mandatory pension fund managers within Armenia.

Compared to other liberal democracies, Ireland's pension policies have average coverage, which includes 78 percent of the workforce, and it offers different types of pensions for employees to choose from. The Irish pension system is designed as a pay-as-you-go program and is based on both public and private pension programs.

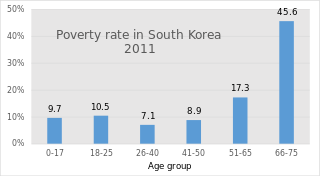

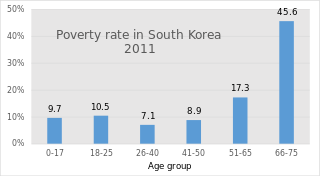

South Korea's pension scheme was introduced relatively recently, compared to other democratic nations. Half of the country's population aged 65 and over lives in relative poverty, or nearly four times the 13% average for member countries of the Organisation for Economic Co-operation and Development (OECD). This makes old age poverty an urgent social problem. Public social spending by general government is half the OECD average, and is the lowest as a percentage of GDP among OECD member countries.

Pensions in Denmark consist of both private and public programs, all managed by the Agency for the Modernisation of Public Administration under the Ministry of Finance. Denmark created a multipillar system, consisting of an unfunded social pension scheme, occupational pensions, and voluntary personal pension plans. Denmark's system is a close resemblance to that encouraged by the World Bank in 1994, emphasizing the international importance of establishing multifaceted pension systems based on public old-age benefit plans to cover the basic needs of the elderly. The Danish system employed a flat-rate benefit funded by the government budget and available to all Danish residents. The employment-based contribution plans are negotiated between employers and employees at the individual firm or profession level, and cover individuals by labor market systems. These plans have emerged as a result of the centralized wage agreements and company policies guaranteeing minimum rates of interest. The last pillar of the Danish pension system is income derived from tax-subsidized personal pension plans, established with life insurance companies and banks. Personal pensions are inspired by tax considerations, desirable to people not covered by the occupational scheme.

Public pensions in Greece are designed to provide incomes to Greek pensioners upon reaching retirement. For decades pensions in Greece were known to be among the most generous in the European Union, allowing many pensioners to retire earlier than pensioners in other European countries. This placed a heavy burden on Greece's public finances which made the Greek state increasingly vulnerable to external economic shocks, culminating in a recession due to the 2008 financial crisis and subsequent European debt crisis. This series of crises has forced the Greek government to implement economic reforms aimed at restructuring the pension system and eliminating inefficiencies within it. Measures in the Greek austerity packages imposed upon Greek citizens by the European Central Bank have achieved some success at reforming the pension system despite having stark ramifications for standards of living in Greece, which have seen a sharp decline since the beginning of the crisis.

The Caixa Andorrana de Seguretat Social (CASS) is the public institution in charge of the Social Security system in Andorra. It was established in April 1968. Since the Constitution of Andorra was approved in 1993, the objective of the Andorran system is to implement Article 30: «The right to health protection and to receive benefits to meet other personal needs is recognized. To these ends, the State will guarantee a Social Security system ». That is to say, guarantee protection, in its contributory and non-contributory modality, of insured persons, direct or indirect, through the appropriate benefits. It is compulsory for salaried workers and also for those who develop an economic activity.