A pension is a fund into which amounts are paid regularly during an individual's working career, and from which periodic payments are made to support the person's retirement from work. A pension may be:

In the United States, Social Security is the commonly used term for the federal Old-Age, Survivors, and Disability Insurance (OASDI) program and is administered by the Social Security Administration (SSA). The Social Security Act was passed in 1935, and the existing version of the Act, as amended, encompasses several social welfare and social insurance programs.

PAYGO is the practice of financing expenditures with funds that are currently available rather than borrowed.

Pensions in the United States consist of the Social Security system, public employees retirement systems, as well as various private pension plans offered by employers, insurance companies, and unions.

The Chile pension system refers to old-age, disability and survivor pensions for workers in Chile. The pension system was changed by José Piñera, during Augusto Pinochet's dictatorship, on November 4, 1980 from a PAYGO-system to a fully funded capitalization system run by private sector pension funds. Many critics and supporters see the reform as an important experiment under real conditions, that may give conclusions about the impact of the full conversion of a PAYGO-system to a capital funded system. The development was therefore internationally observed with great interest. Under Michelle Bachelet's government the Chile Pension system was reformed again.

Defined benefit (DB) pension plan is a type of pension plan in which an employer/sponsor promises a specified pension payment, lump-sum, or combination thereof on retirement that depends on an employee's earnings history, tenure of service and age, rather than depending directly on individual investment returns. Traditionally, many governmental and public entities, as well as a large number of corporations, provide defined benefit plans, sometimes as a means of compensating workers in lieu of increased pay.

Pensions in Norway fall into three major divisions; State Pensions, Occupational Pensions and Individual or personal Pensions.

According to the International Labour Organization, social security is a human right that aims at reducing and preventing poverty and vulnerability throughout the life cycle of individuals. Social security includes different kinds of benefits A social pension is a stream of payments from the state to an individual that starts when someone retires and continues to be paid until death. This type of pension represents the non-contributory part of the pension system, the other being the contributory pension, as per the most common form of composition of these systems in most developed countries.

In France, pensions fall into five major divisions;

Pensions in Spain consist of a mandatory state pension scheme, and voluntary company and individual pension provision.

India operates a complex pension system. There are however three major pillars to the Indian pension system: the solidarity social assistance called the National Social Assistance Programme (NSAP) for the elderly poor, the civil servants pension and the mandatory defined contribution pension programs run by the Employees' Provident Fund Organisation of India for private sector employees and employees of state owned companies, and several voluntary plans.

Taxation in Estonia consists of state and local taxes. A relatively high proportion of government revenue comes from consumption taxes whilst revenue from capital taxes is one of the lowest in the European Union.

The Pension Fund of the Russian Federation (PFR) is the principal national pension fund in Russia. It is the largest organization of Russia to provide socially important public services to Russian citizens. Founded December 22, 1990 decision of the Supreme Soviet of the RSFSR No. 442-1 "On the organization of the Pension Fund of the Russian Federation". The fund has branches across all Federal Subjects of Russia. The labor collective FIU - is more than 133 thousand social workers.

The Swiss pension system rests on three pillars:

- the state-run pension scheme for the aged, orphans, and surviving spouses ;

- the pension funds run by investment foundations, which are tied to employers ;

- voluntary, private investments.

Pensions in Ukraine provide income for retirees in Ukraine. They are provided pursuant to the Law of Ukraine on Compulsory State Pension Insurance that specifies a three-tiered pension provision system.

As the unemployed according to the art. 2 of the Ukrainian Law on Employment of Population are qualified citizens capable of work and of employable age, who, due to lack of a job, do not have any income or other earnings laid down by the law and are registered in the State Employment Center as looking for work, ready and able to start working. This definition also includes persons with disabilities who have not attained retirement age and are registered as seeking employment.

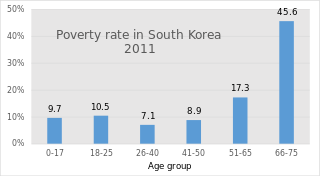

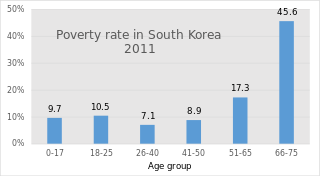

South Korea's pension scheme was introduced relatively recently, compared to other democratic nations. Half of the country's population aged 65 and over lives in relative poverty, or nearly four times the 13% average for member countries of the Organisation for Economic Co-operation and Development (OECD). This makes old age poverty an urgent social problem. Public social spending by general government is half the OECD average, and is the lowest as a percentage of GDP among OECD member countries.

The Pension Fund of Ukraine is a central executive body that manages a solidarity system of compulsory state pension provision, collects, accumulates and records insurance premiums, allocates pensions and prepares documents for their payment, provides timely and full financing and payment pensions, burial assistance and other social benefits.

Public pensions in Greece are designed to provide incomes to Greek pensioners upon reaching retirement. For decades pensions in Greece were known to be among the most generous in the European Union, allowing many pensioners to retire earlier than pensioners in other European countries. This placed a heavy burden on Greece's public finances which, coupled with an aging workforce, made the Greek state increasingly vulnerable to external economic shocks, culminating in a recession due to the 2008 financial crisis and subsequent European debt crisis. This series of crises has forced the Greek government to implement economic reforms aimed at restructuring the pension system and eliminating inefficiencies within it. Measures in the Greek austerity packages imposed upon Greek citizens by the European Central Bank have achieved some success at reforming the pension system despite having stark ramifications for standards of living in Greece, which have seen a sharp decline since the beginning of the crisis.