Soft commodities, or softs, [1] [2] are commodities such as coffee, cocoa, sugar, corn, wheat, soybean, fruit and livestock. [3] The term generally refers to commodities that are grown, rather than mined; the latter (such as oil, copper and gold) are known as hard commodities. [4] [3]

In economics, a commodity is an economic good or service that has full or substantial fungibility: that is, the market treats instances of the good as equivalent or nearly so with no regard to who produced them. Most commodities are raw materials, basic resources, agricultural, or mining products, such as iron ore, sugar, or grains like rice and wheat. Commodities can also be mass-produced unspecialized products such as chemicals and computer memory.

Coffee is a brewed drink prepared from roasted coffee beans, the seeds of berries from certain Coffea species. The genus Coffea is native to tropical Africa and Madagascar, the Comoros, Mauritius, and Réunion in the Indian Ocean. Coffee plants are now cultivated in over 70 countries, primarily in the equatorial regions of the Americas, Southeast Asia, Indian subcontinent, and Africa. The two most commonly grown are C. arabica and C. robusta. Once ripe, coffee berries are picked, processed, and dried. Dried coffee seeds are roasted to varying degrees, depending on the desired flavor. Roasted beans are ground and then brewed with near-boiling water to produce the beverage known as coffee.

![Cocoa bean Fatty seed of [[Theobroma cacao]] which is the basis of chocolate](https://upload.wikimedia.org/wikipedia/commons/thumb/e/e0/Cocoa_Pods.JPG/213px-Cocoa_Pods.JPG)

The cocoa bean or simply cocoa, which is also called the cacao bean or cacao, is the dried and fully fermented seed of Theobroma cacao, from which cocoa solids and cocoa butter can be extracted. Cocoa beans are the basis of chocolate, and Mesoamerican foods including tejate, a pre-Hispanic drink that also includes maize.

Soft commodities play a major part in the futures market. They are used by farmers wishing to lock-in the future prices of their crops, by commercial purchasers of the products, and by speculative investors seeking a profit. Sometimes the term soft is restricted to commodities which are identified as primarily tropical, such as coffee, cocoa, sugar, cotton, and orange juice.

A farmer is a person engaged in agriculture, raising living organisms for food or raw materials. The term usually applies to people who do some combination of raising field crops, orchards, vineyards, poultry, or other livestock. A farmer might own the farmed land or might work as a laborer on land owned by others, but in advanced economies, a farmer is usually a farm owner, while employees of the farm are known as farm workers, or farmhands. However, in the not so distant past, a farmer was a person who promotes or improves the growth of by labor and attention, land or crops or raises animals.

A crop is a plant or animal product that can be grown and harvested extensively for profit or subsistence. Crop may refer either to the harvested parts or to the harvest in a more refined state. Most crops are cultivated in agriculture or aquaculture. A crop is usually expanded to include macroscopic fungus, or alga (algaculture).

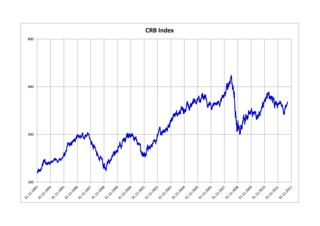

Soft commodities have been known to adopt a backwardation trend until the late 1990s when futures were actively traded. Speculation and investment requirements later shaped the common contango trend.

Contango, also sometimes called forwardation, is a situation where the futures price of a commodity is higher than the anticipated spot price at maturity of the futures contract. In a contango situation, arbitrageurs/speculators, are "willing to pay more [now] for a commodity at some point in the future than the actual expected price of the commodity [at that future point]. This may be due to people's desire to pay a premium to have the commodity in the future rather than paying the costs of storage and carry costs of buying the commodity today." On the other side of the trade, hedgers are happy to sell futures contracts and accept the higher-than-expected returns. A contango market is also known as a normal market, or carrying-cost market.