Rio Tinto Group is a British-Australian multinational company that is the world's second largest metals and mining corporation. It was founded in 1873 when a group of investors purchased a mine complex on the Rio Tinto, in Huelva, Spain, from the Spanish government. It has grown through a long series of mergers and acquisitions. Although primarily focused on extraction of minerals, it also has significant operations in refining, particularly the refining of bauxite and iron ore. It has joint head offices in London, England and Melbourne, Australia.

Robert Martin Friedland is an American-Canadian billionaire financier in the mining industry. Since the early 1980s, he has specialized in securing funding for the exploration and development of mineral and energy resources and technology ventures. He is the founder and chairman of his private, family-owned firm, Ivanhoe Capital Corporation, which is active in capital markets, focused on emerging markets. He is the founder and co-chairman of Ivanhoe Mines – a Canadian public company listed on the Toronto and OTCQX exchanges.

Aluminum Corporation of China Limited, is a state-owned multinational aluminium company headquartered in Beijing, People's Republic of China. It is a publicly-traded company, listed in Hong Kong and in Shanghai. In 2021, it was the world's largest aluminum producer, ahead of China Hongqiao Group, Rusal and Shandong Xinfa.

Tavan Tolgoi is one of the world's largest untapped coking and thermal coal deposits, located in the Ömnögovi Province in southern Mongolia. It has a total estimated resource of 6.4 billion tonnes, one quarter of which is high quality coking coal. It is divided into six sections: Tsankhi, Ukhaa Khudag, Bor tolgoi, Borteeg, and Southwest and Eastern coalfields. The Tsankhi section is the largest part, and is divided into East and West Tsankhi - these have had the most focus recently.

Mongolia Energy Corporation Limited (MEC) is a mining and energy development holding company operating in Mongolia and Xinjiang in northwestern China. It was incorporated in Bermuda and listed on the Hong Kong Stock Exchange. MEC became a constituent to the MSCI Hong Kong Index from June 2008.

The Oyu Tolgoi mine, also Oyuutolgoi, is a combined open pit and underground mining project in Khanbogd sum within the south Gobi Desert, approximately 235 kilometres (146 mi) east of the Ömnögovi Province capital Dalanzadgad. The site was discovered in 2001 and is being developed as a joint venture between Turquoise Hill Resources with 66% ownership and the Government of Mongolia with 34%. The mine began construction as of 2010 and shipped its first batch of copper on 9 July 2013.

The Nariin Sukhait or Ovoot Tolgoi mining complex is located in the Gurvan tes sum (district) of Ömnögovi Province in Southern Mongolia. The site is 25 km SE from sum center and 56 km north of Shivee Khüren - Ceke crossing point on the Mongolian-Chinese border.

China National Gold Group Corporation (中国黄金集团有限公司) is a centrally state owned Chinese gold corporation primarily engaged in the mining and refining of gold, silver, copper, and molybdenum.

Turquoise Hill Resources was a Canadian mineral exploration and development company headquartered in Montreal, Quebec, and since December 2022, a wholly owned subsidiary of Rio Tinto Group. The company was called Ivanhoe Mines until August 2, 2012 when a financing agreement was completed with Rio Tinto. Rio Tinto acquired full ownership of Turquoise Hill in December 2022.

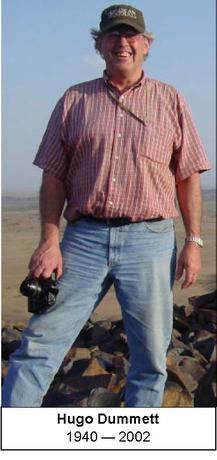

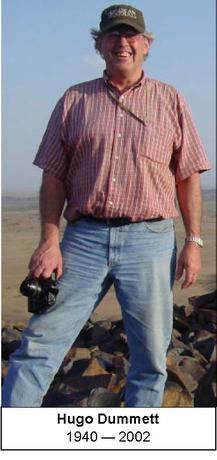

Hugo T. Dummett (1940–2002) was a South African mineral-exploration geologist who is best known for his role in the discovery of the Ekati Diamond Mine in the Barren Lands of Canada's Northwest Territories. Dummett has been described as "the brains, the ideas and the energy" behind the discovery of Ekati, which led to the creation of a new Canadian diamond-mining industry.

Hunnu Coal Limited is a mining company that is incorporated in Australia for the purpose of acquiring and developing coal projects in Mongolia.

Khanbumbat Airport, also Oyu Tolgoi Airport, is an airport in Khanbogd, Ömnögovi, Mongolia. The airport's construction was funded by the adjacent Oyu Tolgoi mine. It is the second airport in passenger traffic in Mongolia after Buyant-Ukhaa International Airport. The airport serves nearly 100,000 passengers annually.

Mining is important to the national economy of Mongolia. Mongolia is one of the 29 resource-rich developing countries identified by the International Monetary Fund and exploration of copper and coal deposits are generating substantial additional revenue.

The Windfall tax or windfall profits tax in Mongolia was a taxation on the profits made by mining companies operating in Mongolia. It was implemented in 2006 and was the highest windfall profits tax in the world. It was a tax on unsmelted copper and gold concentrate that was produced in Mongolia. The tax was repealed in 2009 and phased out over two years. Repealing the 68% tax law was considered essential to enable foreign mining companies to invest in mineral resources development of Mongolia.

In Mongolia, copper mining is a major industry and source of income for the country. There are only two companies that produce copper concentrate, Erdenet Mining Corporation, a Mongolian-Russian joint venture, and the Oyu Tolgoi mine, a joint venture between Rio Tinto Group, Turquoise Hill Resources, and the Government of Mongolia. Until 2010 copper was Mongolia's largest export.

South32 Limited is a mining and metals company headquartered in Perth, Western Australia. It was spun out of BHP Billiton on 18 May 2015. It is listed on the Australian Securities Exchange with secondary listings on the Johannesburg and London Stock Exchanges.

Mongolian Mining Corporation (MMC) is a Mongolian coking coal producer listed in the Hong Kong Stock Exchange. It is the largest coal mining company in Mongolia, owning two coal mines located in the Gobi Desert, namely the Ukhaa Khudag mine and the Baruu Naran mine.

China Cinda Asset Management Co., Ltd. known as China Cinda or just Cinda is a Chinese merchant bank and asset management company. The corporation was founded as a state-owned enterprise and a bad bank for China Construction Bank in 1999. The bank received shares by debt-to-equity swap on non-performing loans. In 2010, the corporation became a "company limited by shares".

Taiyuan Coal Gasification (Group) Co., Ltd. is a Chinese state-owned coal mining conglomerate based in Taiyuan, Shanxi. The company was owned by State-owned Assets Supervision and Administration Commission (SASAC) of Shanxi Provincial People's Government. However, Shanxi SASAC granted fellow state-owned enterprise Jincheng Anthracite Mining Group (JAMG) to manage their stake since 2011.

Mongolia's relations with the International Monetary Fund became official on February 14, 1991 when Mongolia became a member.