Spar- und Leihkasse Thun  A 500 Swiss francs share of the Spar- und Leihkasse Thun (1912), 6th issue |

| Industry | savings and loan bank |

|---|

| Founded | 1866 |

|---|

| Defunct | 1993 |

|---|

| Headquarters | Thun, Switzerland |

|---|

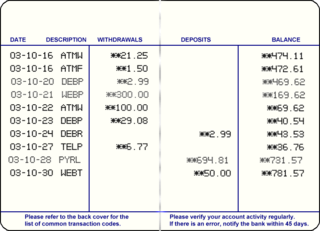

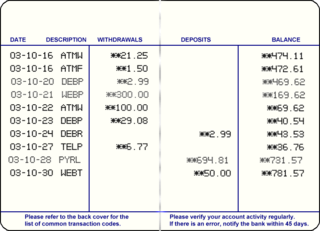

The Spar- und Leihkasse Thun (SLT) was a regional savings and loan bank located in Thun, Switzerland. When it collapsed in the autumn of 1991, it was the first notable bank run in that country. [1] The failure of SLT eclipsed all previous troubles of Swiss banks: Though some Swiss banks experienced troubles in the 1970ies, the Swiss deposit insurance only had to pay out a total of 700'000 Swiss francs in two bank failures before the collapse of the Spar- und Leihkasse Thun. [2]

During the late 1980ies, the Swiss economy overheated and real estate prices skyrocketed. The SLT, whose portfolio contained an oversized amount of mortgages, was not prepared for a burst of the real-estate bubble. [1]

After local media reported on the bank's financial situation on October 3rd, 1991, throngs of people converged on the SLT main office, and an SLT customer suffered a deadly cardiac infarction. After a few days, the customers were allowed to withdraw 500 Swiss francs each (639 CHF in 2023, adjusted for inflation). [3] [1]

In the end, more than 6300 persons lost more than a third of their wealth, and the collapse destroyed more than 220 million Swiss francs of savings and investition funds. [1] After the bank's assets were legally liquidated in January 1993, the Swiss deposit insurance paid out the then-time maximum sum of 30'000 Swiss francs per account. Following the SLT debacle, the payouts were then lowered to 30'000 Swiss francs per bank customer, and raised to 100'000 CHF per bank customer in 2008. [4]

The economy of Liechtenstein is based on industry, with a small but significant agricultural sector, and services. The country participates in a customs union with Switzerland and uses the Swiss franc as its national currency. It imports more than 85% of its energy requirements. Liechtenstein has been a member of the European Free Trade Association (EFTA) since 1991. It also has been a member of the European Economic Area (EEA) since May 1995 and participates in the Schengen Agreement for passport-free intra-European travel.

The economy of Switzerland is one of the world's most advanced and highly-developed free-market economies. The service sector has come to play a significant economic role, particularly the Swiss banking industry and tourism. The economy of Switzerland has ranked first in the world since 2015 on the Global Innovation Index and third in the 2020 Global Competitiveness Report. According to United Nations data for 2016, Switzerland is the third richest landlocked country in the world after Liechtenstein and Luxembourg. Together with the latter and Norway, they are the only three countries in the world with a GDP per capita (nominal) above US$90,000 that are neither island nations nor ministates.

The Federal Deposit Insurance Corporation (FDIC) is a United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. The FDIC was created by the Banking Act of 1933, enacted during the Great Depression to restore trust in the American banking system. More than one-third of banks failed in the years before the FDIC's creation, and bank runs were common. The insurance limit was initially US$2,500 per ownership category, and this was increased several times over the years. Since the enactment of the Dodd–Frank Wall Street Reform and Consumer Protection Act in 2010, the FDIC insures deposits in member banks up to $250,000 per ownership category. FDIC insurance is backed by the full faith and credit of the government of the United States of America, and according to the FDIC, "since its start in 1933 no depositor has ever lost a penny of FDIC-insured funds".

In the United States, banking began by the 1780s along with the country's founding and has developed into highly influential and complex system of banking and financial services. Anchored by New York City and Wall Street, it is centered on various financial services namely private banking, asset management, and deposit security.

The Swiss franc is the currency and legal tender of Switzerland and Liechtenstein. It is also legal tender in the Italian exclave of Campione d'Italia which is surrounded by Swiss territory. The Swiss National Bank (SNB) issues banknotes and the federal mint Swissmint issues coins.

Thun is a town and a municipality in the administrative district of Thun in the canton of Bern in Switzerland. It is located where the Aare flows out of Lake Thun (Thunersee), 30 kilometres southeast of Bern.

The savings and loan crisis of the 1980s and 1990s was the failure of 32% savings and loan associations (S&Ls) in the United States from 1986 to 1995. An S&L or "thrift" is a financial institution that accepts savings deposits and makes mortgage, car and other personal loans to individual members.

A savings account is a bank account at a retail bank. Common features include a limited number of withdrawals, a lack of cheque and linked debit card facilities, limited transfer options and the inability to be overdrawn. Traditionally, transactions on savings accounts were widely recorded in a passbook, and were sometimes called passbook savings accounts, and bank statements were not provided; however, currently such transactions are commonly recorded electronically and accessible online.

The Canada Deposit Insurance Corporation is a Canadian federal Crown Corporation created by Parliament in 1967 to provide deposit insurance to depositors in Canadian commercial banks and savings institutions. CDIC insures Canadians' deposits held at Canadian banks up to C$100,000 in case of a bank failure. CDIC automatically insures many types of savings against the failure of a financial institution. However, the bank must be a CDIC member and not all savings are insured. CDIC is also Canada's resolution authority for banks, federally regulated credit unions, trust and loan companies as well as associations governed by the Cooperative Credit Associations Act that take deposits.

Deposit insurance or deposit protection is a measure implemented in many countries to protect bank depositors, in full or in part, from losses caused by a bank's inability to pay its debts when due. Deposit insurance systems are one component of a financial system safety net that promotes financial stability.

The Swiss National Bank is the central bank of Switzerland, responsible for the nation's monetary policy and the sole issuer of Swiss franc banknotes. The primary goal of its mandate is to ensure price stability, while taking economic developments into consideration.

The Swiss Life Group is the largest life insurance company of Switzerland and one of Europe’s leading comprehensive life and pensions and financial services providers, with approximately CHF 276.3 bn of assets under management. Founded in 1857 in Zurich as the Schweizerische Lebensversicherungs und Rentenanstalt cooperative, the company entered the Swiss stock market in 1997 and adopted its current name in 2002. In 2022 the group declared an adjusted profit from operations of CHF 2.06 billion, a 17% decrease compared to the previous year. Net profit increased by 16% to CHF 1.46 billion. Swiss Life is one of the twenty companies listed under the Swiss Market Index, as SLHN.

Steffisburg is a municipality in the administrative district of Thun in the canton of Bern in Switzerland. On 1 January 2020 the former municipality of Schwendibach merged into the municipality of Steffisburg.

Sigriswil is a municipality in the administrative district of Thun in the canton of Bern in Switzerland.

mBank SA, set up in 1986, and originally BRE – Bank Rozwoju Eksportu, is Poland's fourth largest universal banking group in terms of total assets and loans, and fifth by deposits at the end of September 2016. It offers retail, corporate and investment banking as well as other financial services such as leasing, factoring, insurance, financing of commercial real property, brokerage operations, wealth management, corporate finance and advisory in the scope of capital markets.

Forst-Längenbühl is a municipality in the administrative district of Thun in the canton of Bern in Switzerland. It was formed on January 1, 2007 through the uniting of Längenbühl and Forst.

In German-speaking jurisdictions, Landesbank, lit. 'bank of the Land', generally refers to a bank operating within a territorial subdivision that has autonomy but not full sovereignty. It is occasionally translated as "provincial bank".

VP Bank AG is a Liechtenstein-based bank headquartered in Vaduz and specialized in private banking. It was founded on April 6, 1956 by Princely Councillor of Commerce Guido Feger and is one of the three major banks in Liechtenstein along with the LGT Group and the LLB.

The Swiss pension system rests on three pillars:

Alternative Bank Switzerland (ABS) is a sustainability-oriented bank based in Olten, Canton of Solothurn, in Switzerland.