Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor.

A bailiff is a manager, overseer or custodian – a legal officer to whom some degree of authority or jurisdiction is given. Bailiffs are of various kinds and their offices and duties vary greatly.

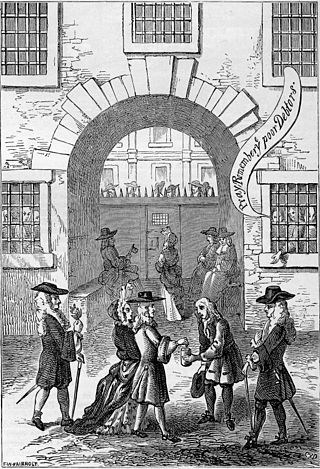

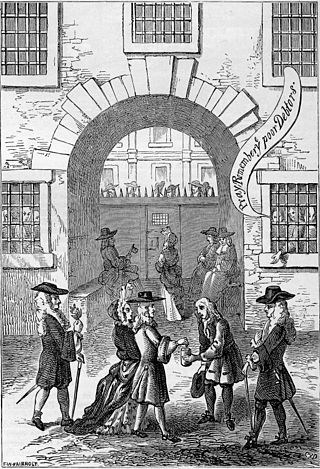

Fleet Prison was a notorious London prison by the side of the River Fleet. The prison was built in 1197, was rebuilt several times, and was in use until 1844. It was demolished in 1846.

A debtors' prison is a prison for people who are unable to pay debt. Until the mid-19th century, debtors' prisons were a common way to deal with unpaid debt in Western Europe. Destitute people who were unable to pay a court-ordered judgment would be incarcerated in these prisons until they had worked off their debt via labour or secured outside funds to pay the balance. The product of their labour went towards both the costs of their incarceration and their accrued debt. Increasing access and lenience throughout the history of bankruptcy law have made prison terms for unaggravated indigence obsolete over most of the world.

Nexum was a debt bondage contract in the early Roman Republic. A debtor pledged his person as collateral if he defaulted on his loan. Details as to the contract are obscure and some modern scholars dispute its existence. It was allegedly abolished either in 326 or 313 BC.

Distraint or distress is "the seizure of someone’s property in order to obtain payment of rent or other money owed", especially in common law countries. Distraint is the act or process "whereby a person, traditionally even without prior court approval, seizes the personal property of another located upon the distrainor's land in satisfaction of a claim, as a pledge for performance of a duty, or in reparation of an injury." Distraint typically involves the seizure of goods (chattels) belonging to the tenant by the landlord to sell the goods for the payment of the rent. In the past, distress was often carried out without court approval. Today, some kind of court action is usually required, the main exception being certain tax authorities – such as HM Revenue and Customs in the United Kingdom and the Internal Revenue Service in the United States – and other agencies that retain the legal power to levy assets without a court order.

Debt collection or cash collection is the process of pursuing payments of money or other agreed-upon value owed to a creditor. The debtors may be individuals or businesses. An organization that specializes in debt collection is known as a collection agency or debt collector. Most collection agencies operate as agents of creditors and collect debts for a fee or percentage of the total amount owed. Historically, debtors could face debt slavery, debtor's prison, or coercive collection methods. In the 21st century in many countries, legislation regulates debt collectors, and limits harassment and practices deemed unfair.

An individual voluntary arrangement (IVA) is a formal alternative in England and Wales for individuals wishing to avoid bankruptcy. In Scotland, the equivalent statutory debt solution is known as a protected trust deed.

The Parable of the Unforgiving Servant is a parable of Jesus which appears in the Gospel of Matthew. According to Matthew 18:21–35 it is important to forgive others as we are forgiven by God, as illustrated by the negative example of the unforgiving servant.

Basil Montagu was a British jurist, barrister, writer and philanthropist. He was educated at Charterhouse and studied law at Cambridge. He was significantly involved in reforms to bankruptcy laws of Britain. He served as Accountant-General in Bankruptcy between 1835 and 1846. He was highly influenced by the writings of Francis Bacon. He was the son of John Montagu, 4th Earl of Sandwich, and his mistress, singer Martha Ray.

Poultry Compter was a small prison that stood at Poultry, part of Cheapside in the City of London. The compter was used to lock up minor criminals and prisoners convicted under civil law and was run by one of the City's sheriffs. It operated from the 16th century until 1815. It was pulled down in 1817 and replaced with a chapel.

The Marshalsea (1373–1842) was a notorious prison in Southwark, just south of the River Thames. Although it housed a variety of prisoners—including men accused of crimes at sea and political figures charged with sedition—it became known, in particular, for its incarceration of the poorest of London's debtors. Over half of England's prisoners in the 18th century were in jail because of debt.

United Kingdom insolvency law regulates companies in the United Kingdom which are unable to repay their debts. While UK bankruptcy law concerns the rules for natural persons, the term insolvency is generally used for companies formed under the Companies Act 2006. Insolvency means being unable to pay debts. Since the Cork Report of 1982, the modern policy of UK insolvency law has been to attempt to rescue a company that is in difficulty, to minimise losses and fairly distribute the burdens between the community, employees, creditors and other stakeholders that result from enterprise failure. If a company cannot be saved it is liquidated, meaning that the assets are sold off to repay creditors according to their priority. The main sources of law include the Insolvency Act 1986, the Insolvency Rules 1986, the Company Directors Disqualification Act 1986, the Employment Rights Act 1996 Part XII, the EU Insolvency Regulation, and case law. Numerous other Acts, statutory instruments and cases relating to labour, banking, property and conflicts of laws also shape the subject.

In re Selectmove Ltd[1993] EWCA Civ 8 is an English contract law case concerning the legal doctrine of consideration and partial payment of a debt.

The history of bankruptcy law begins with the first legal remedies available for recovery of debts. Bankruptcy is the legal status of a legal person unable to repay debts.

The Debtors Act 1869 was an Act of the Parliament of the United Kingdom of Great Britain and Ireland that aimed to reform the powers of courts to detain debtors.

A series of parliamentary reports describe the scope of the problem of debt in Upper Canada; as early as 1827, the eleven district jails in the province had a capacity of 298 cells, of which 264 were occupied, 159 by debtors. In the Home District, 379 of 943 prisoners between 1833 and 1835 were being held for debt. Over the province as a whole, 48% or 2304 of 4726 prisoners were being held in jail for debt in 1836. The number of debtors jailed was the result of both widespread poverty, and the small amounts for which debtors could be indefinitely detained.

Samuel Keimer (1689–1742) was originally an English printer and emigrant who came to America and became an Early American printer. He was the original founder of The Pennsylvania Gazette. On October 2, 1729, Benjamin Franklin bought this newspaper.

Sir John Peter De Gex (1809–1887) was an English barrister and law reporter.

The Bankruptcy Act of 1800 was the first piece of federal legislation in the United States surrounding bankruptcy. The act was passed in response to a decade of periodic financial crises and commercial failures. It was modeled after English practice. The act placed the bankrupt estate under the control of a commissioner chosen by the district judge. The debt would be forgiven if two-thirds of creditors agreed to forgive the remaining debt. Only merchants could petition a creditor to file a case under the provisions of the act.