Berkshire Hathaway Inc. is an American multinational conglomerate holding company headquartered in Omaha, Nebraska. Founded in 1839 as a textile manufacturer, it transitioned into a major conglomerate starting in 1965 under the management of chairman and CEO Warren Buffett and vice chairman Charlie Munger.

Strayer University is a private for-profit university headquartered in Washington, D.C. It was founded in 1892 as Strayer's Business College and later became Strayer College, before being granted university status in 1998.

Expeditors International of Washington, Inc. is an American worldwide logistics and freight forwarding company headquartered in Seattle, Washington.

Singapore Exchange Limited is a Singapore-based exchange conglomerate, operating equity, fixed income, currency and commodity markets. It provides a range of listing, trading, clearing, settlement, depository and data services. SGX Group is also a member of the World Federation of Exchanges and the Asian and Oceanian Stock Exchanges Federation. it is ASEAN's second largest market capitalization after Indonesia Stock Exchange at US$609.653 billion as of September 2023.

Capella University is a private for-profit, online university headquartered in Minneapolis, Minnesota. The school is owned by the publicly traded Strategic Education, Inc. and delivers most of its education online.

Soros Fund Management, LLC is a privately held American investment management firm. It is currently structured as a family office, but formerly as a hedge fund. The firm was founded in 1970 by George Soros and, in 2010, was reported to be one of the most profitable firms in the hedge fund industry, averaging a 20% annual rate of return over four decades. It is headquartered at 250 West 55th Street in New York. As of 2023, Soros Fund Management, LLC had $25 billion in AUM.

A reverse takeover (RTO), reverse merger, or reverse IPO is the acquisition of a public company by a private company so that the private company can bypass the lengthy and complex process of going public. Sometimes, conversely, the public company is bought by the private company through an asset swap and share issue. The transaction typically requires reorganization of capitalization of the acquiring company.

New Oriental Education & Technology Group Inc., more commonly New Oriental, is a provider of private educational services in China. The headquarters of New Oriental is located in Haidian District, Beijing. It is currently the largest comprehensive private educational company in China based on the number of program offerings, total student enrollments, and geographic presence. The business of New Oriental includes pre-school education, general courses for students of various age levels, online education, overseas study consulting, and textbook publishing. New Oriental was the first Chinese educational institution to enter the New York Stock Exchange in the United States, holding its IPO in 2006. As of 2016, New Oriental has built 67 short-time language educational schools, 20 book stores, 771 learning centers, and more than 5,000 third-party bookstores in 56 cities in China. New Oriental has had over 26.6 million student enrollments, including over 1.3 million enrollments in first quarter 2017. The company's market capitalization was approximately US$14 billion.

Executive compensation is composed of both the financial compensation and other non-financial benefits received by an executive from their employing firm in return for their service. It is typically a mixture of fixed salary, variable performance-based bonuses and benefits and other perquisites all ideally configured to take into account government regulations, tax law, the desires of the organization and the executive.

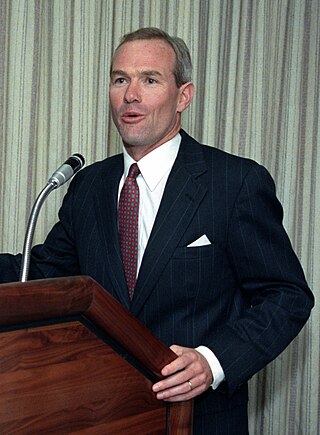

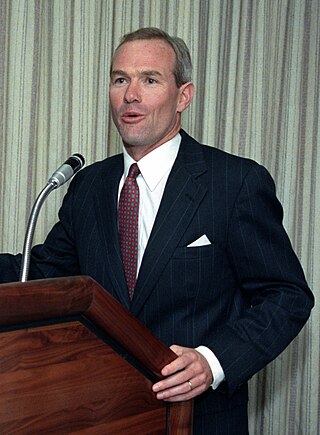

Robert Stephen Silberman is an American businessman and former United States Assistant Secretary of the Army from 1992 to 1993. He was previously assistant to the chief executive officer of International Paper from 1993 to 1995 and CEO of Strayer Education, Inc. from 2001 to 2013. Silberman was named executive chairman of the board of Strayer Education Inc. in 2013. He is the son of Judge Laurence Silberman.

Pershing Square Capital Management is an American hedge fund management company founded and run by Bill Ackman, headquartered in New York City.

In the United States, the compensation of company executives is distinguished by the forms it takes and its dramatic rise over the past three decades. Within the last 30 years, executive compensation or pay has risen dramatically beyond what can be explained by changes in firm size, performance, and industry classification. This has received a wide range of criticism leveled against it.

2U, Inc. is an American educational technology company that contracts with non-profit colleges and universities to build, deliver and support online degree and non-degree programs. It is also the parent company of edX. On February 12, 2024, 2U announced "there is substantial doubt about its ability to continue as a going concern."

Matomy Media Group Ltd., a publicly traded company since July 2014, is a shell corporation which was the former owner and operator of a number of performance-based and programmatic advertising solutions, which were all sold or closed by the end of 2019.

For-profit higher education in the United States refers to the commercialization and privatization of American higher education institutions. For-profit colleges have been the most recognizable for-profit institutions, and more recently with online program managers, but commercialization has been part of US higher education for centuries. Privatization of public institutions has been increasing since at least the 1980s.

Green Bay Packers, Inc. is the publicly held nonprofit corporation that owns the National Football League (NFL)'s Green Bay Packers football franchise, based in Green Bay, Wisconsin. The corporation was established in 1923 as the Green Bay Football Corporation, and received its current legal name in 1935.

Willis Towers Watson plc, branded as WTW and stylised in its logo as wtw, is a British-American multinational company that provides commercial insurance brokerage services, strategic risk management services, employee benefits and compensation management, and actuarial analysis and investment management for pension plans and financial endowments. Insurance brokerage and risk management services account for 40% of the company's revenues, while employee benefit and wealth-related services account for 60% of revenues. The company operates in more than 140 countries. Customers include 95% of FTSE 100 companies, 89% of Fortune 1000 companies, and 91% of Fortune Global 500 companies. The company is the largest administrator among the 200 largest pension plans in the U.K. and one of the largest in Germany. The company is domiciled in Ireland, with its principal executive offices at the Willis Building in London.

Terren Scott Peizer is an American businessperson. On June 21, 2024, he was found guilty by a California federal jury of three counts of insider trading and securities fraud, following a nine-day trial. Peizer faces a maximum penalty of 65 years in prison.

Arden University is a private, for-profit teaching university in the United Kingdom. It offers a variety of undergraduate and post-graduate programmes with both blended and online distance learning delivery options. Its head office is in Coventry with study centres in Birmingham, Manchester, London and Berlin. Originally established as Resource Development International (RDI) in 1990, it was later bought by Capella Education and awarded university status by the British government in 2015. Since August 2016, it has been owned by Global University Systems. It is named after the Arden area of England, where its Coventry headquarters are situated.

Ryan Cohen is a Canadian entrepreneur and activist investor. He founded e-commerce company Chewy in 2011, and was the company's chief executive officer (CEO) until 2018. Cohen is the chairman and CEO of GameStop.