Related Research Articles

Mark Jonathan Pincus is an American Internet entrepreneur known as the founder of Zynga, a mobile social gaming company. Pincus also founded the startups Freeloader, Inc., Tribe Networks, and Support.com. Pincus served as the CEO of Zynga until July 2013, then again from 2015 to 2016.

Dennis Bennie is an entrepreneur and early-stage investor based in Toronto, Canada. He co-founded Mission Electronics in 1979; co-founded Aviva Software in 1982; co-founded Delrina in 1988; raised two venture funds under XDL Group and is currently a mentor, advisor and angel investor to early-stage technology companies.

Brightmail Inc. was a San Francisco–based technology company focused on anti-spam filtering. Brightmail's system has a three-pronged approach to stopping spam, the Probe Network is a massive number of e-mail addresses established for the sole purpose of receiving spam. The Brightmail Logistics and Operations Center (BLOC) evaluates newly detected spam and issues rules for ISPs. The third approach is the Spam Wall, a filtering engine that identifies and screens out spam based on the updates from the BLOC.

01918791272 Bkash 500 Global is an early-stage venture fund and seed accelerator founded in 2010 by Dave McClure and Christine Tsai. The fund admitted a first "class" of twelve startups to its incubator office in Mountain View, California in February 2011. They expanded to a second class of 21 in June 2011 and a third class of 34 in October 2011.

New Enterprise Associates (NEA) is an American-based venture capital firm. NEA focuses investment stages ranging from seed stage through growth stage across an array of industry sectors. With over $25 billion in committed capital, NEA is one of the world's largest venture capital firms.

Getaround is an online car sharing or peer-to-peer carsharing service that connects drivers who need to reserve cars with car owners who share their cars in exchange for payment.

Wingz, Inc. is a vehicle for hire company that provides private, scheduled, and fixed-price rides in 30 major cities across the United States via mobile app. The service provides rides anywhere in the cities it serves, with a focus on airports. Wingz offers the ability to request specific drivers for rides and allows users to build a list of their favorite drivers for future bookings.

AngelList is an American software company for fundraising and connecting startups, angel investors, and limited partners. Founded in 2010, it started as an online introduction board for tech startups that needed seed funding. Since 2015, the site allows startups to raise money from angel investors free of charge. Created by serial entrepreneur Naval Ravikant and Babak Nivi in 2010, Avlok Kohli has been leading AngelList as its CEO since 2019.

Sidecar was a US-based vehicle for hire company that provided transportation and delivery services. It was founded in 2011 in San Francisco and closed on December 31, 2015.

StartX is a non-profit startup accelerator and founder community associated with Stanford University.

A ridesharing company, ride-hailing service, is a company that, via websites and mobile apps, matches passengers with drivers of vehicles for hire that, unlike taxis, cannot legally be hailed from the street.

Ritu Raj is an entrepreneur based in California. Raj is the founder of Avasta, OrchestratorMail and Objectiveli, as well as Wag Hotels, a chain of luxury hotels for dogs and cats.

Blockchain.com is a cryptocurrency financial services company. The company began as the first Bitcoin blockchain explorer in 2011 and later created a cryptocurrency wallet that accounted for 28% of bitcoin transactions between 2012 and 2020. It also operates a cryptocurrency exchange and provides institutional markets lending business and data, charts, and analytics.

Mindbody, Inc. is a San Luis Obispo, California-based software-as-a-service company that provides cloud-based online scheduling and other business management software for the wellness services industry. Founded in 2001, the company services over 58,000 health and wellness businesses with about 35 million consumers in over 130 countries and territories. Since October 2021, the company has owned ClassPass. It is majority owned by Vista Equity Partners, a private equity firm.

Founders Circle Capital is an American growth capital firm based in the San Francisco Bay Area. Founders Circle Capital invests in private companies and specializes in growth stage investments providing preferred stock and common stock purchases, institutional liquidity and other unique structures to founders and long-term employees.

Enrique Salem was the president and CEO of software company Symantec from 2009 until 2012, and was a member of the U.S. President's Management Advisory Board. Prior to being CEO of Symantec he was the COO of Symantec.

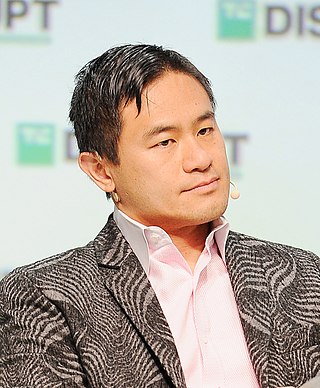

Justin Yoshimura is an American technology entrepreneur and investor. He is the founder, chairman, and CEO of the holding company CSC Generation.

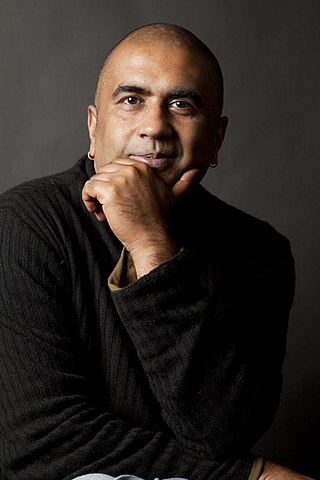

Arjun Sethi is an American internet entrepreneur, investor and executive. He is co-founder and partner at venture capital firm Tribe Capital. He previously was partner at Social Capital and served as an executive at Yahoo! where he launched Yahoo! Livetext. Before that, he was co-founder and CEO of MessageMe and he was CEO of Lolapps, the developer behind Ravenwood Fair. In December 2023, he became Tribe Capital's chairman and CIO.

Jeremy Liew is a venture capitalist, best known for making the initial seed investment in Snapchat.

Republic is an American investment platform headquartered in New York City that allows individuals to invest in startups, growth-stage pre-IPO companies, real estate, video games, and crypto companies. It allows individuals to invest small amounts of money in these type of investments that are normally reserved for big investors.

References

- 1 2 "Ride-Share Pioneer Has a New Company to Spur Electric Cars". Bloomberg.com. 20 September 2021. Retrieved 2022-03-28.

- 1 2 "General Motors confirms acquisition of Sidecar's technology and assets (updated)". VentureBeat. 2016-01-19. Retrieved 2022-12-07.

- ↑ Constine, Josh (26 June 2012). "Hail A Fellow Human, Not A Taxi With "SideCar" – The New P2P Uber". TechCrunch . Retrieved 26 June 2012.

- ↑ Fones, Mardy. "From Startups to Success: VUSE engineers thrive as entrepreneurs in businesses large and small". Vanderbilt Magazine. Retrieved 23 March 2013.

- ↑ Sreenivasan, Sreenath (30 September 1996). "The World Wide Wait: Don't Get Mad, Get Off". The New York Times . Retrieved 31 December 2015.

- ↑ Kincaid, Jason (2009-10-25). "Startup School: Mark Pincus Talks About Becoming A Great CEO, With Tony Robbins' Help". TechCrunch. Retrieved 2022-12-07.

- ↑ "Individual buys FreeLoader for $38 million". Advertising Age . 4 June 1996. Retrieved 31 December 2015.

- ↑ Fordahl, Matthew (20 May 2004). "Symantec to acquire anti-spam firm Brightmail for $370M". USA Today . Retrieved 20 May 2004.

- ↑ Riddell, Lindsay. "Entrepreneur Sunil Paul launches ride-sharing app". San Francisco Business Times . Retrieved 26 June 2012.

- ↑ Geron, Tomio. "Sidecar Raises $10 Million From Google Ventures, Lightspeed". Forbes . Retrieved 10 October 2012.

- ↑ Gannes, Liz. "Sunil Paul's Sidecar Ride-Sharing App Will Flag a Stranger's Car for You". All Things D . Retrieved 26 June 2012.

- ↑ Parkhurst, Emily. "Sidecar launches ridesharing service in Seattle". Puget Sound Business Journal . Retrieved 2 November 2012.

- ↑ Geron, Tomio. "Sidecar Acquires Austin's HeyRide, Launches In Los Angeles, Austin, Philadelphia". Forbes . Retrieved 14 February 2013.

- ↑ Robertson, Adi (15 March 2013). "After suing Austin for the right to operate and failing, Sidecar expands ride-sharing to Brooklyn, Boston, and Chicago". The Verge . Retrieved 15 March 2013.

- ↑ SLOANE, Garett. "Upstart Sidecar zips into Big Apple traffic". New York Post . Retrieved 15 March 2013.

- ↑ "General Motors Salvages Ride-Hailing Company Sidecar for Parts". Bloomberg.com. 2016-01-19. Retrieved 2023-02-01.