Related Research Articles

Keynesian economics are the various macroeconomic theories and models of how aggregate demand strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. It is influenced by a host of factors that sometimes behave erratically and impact production, employment, and inflation.

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes national, regional, and global economies. Macroeconomists study topics such as output/GDP and national income, unemployment, price indices and inflation, consumption, saving, investment, energy, international trade, and international finance.

Neoclassical economics is an approach to economics in which the production, consumption, and valuation (pricing) of goods and services are observed as driven by the supply and demand model. According to this line of thought, the value of a good or service is determined through a hypothetical maximization of utility by income-constrained individuals and of profits by firms facing production costs and employing available information and factors of production. This approach has often been justified by appealing to rational choice theory.

In economics, stagflation is a situation in which the inflation rate is high or increasing, the economic growth rate slows, and unemployment remains steadily high. Stagflation, once thought impossible, poses a dilemma for economic policy, as measures to reduce inflation may exacerbate unemployment.

Jean-Baptiste Say was a liberal French economist and businessman who argued in favor of competition, free trade and lifting restraints on business. He is best known for Say's law—also known as the law of markets—which he popularized, although scholars disagree as to whether it was Say who first articulated the theory. Moreover, he was one of the first economists to study entrepreneurship and conceptualized entrepreneurs as organizers and leaders of the economy. He was also closely involved in the development of the École spéciale de commerce et d'industrie, historically the first business school to be established.

Post-Keynesian economics is a school of economic thought with its origins in The General Theory of John Maynard Keynes, with subsequent development influenced to a large degree by Michał Kalecki, Joan Robinson, Nicholas Kaldor, Sidney Weintraub, Paul Davidson, Piero Sraffa and Jan Kregel. Historian Robert Skidelsky argues that the post-Keynesian school has remained closest to the spirit of Keynes' original work. It is a heterodox approach to economics.

Classical economics, classical political economy, or Smithian economics is a school of thought in political economy that flourished, primarily in Britain, in the late 18th and early-to-mid-19th century. Its main thinkers are held to be Adam Smith, Jean-Baptiste Say, David Ricardo, Thomas Robert Malthus, and John Stuart Mill. These economists produced a theory of market economies as largely self-regulating systems, governed by natural laws of production and exchange.

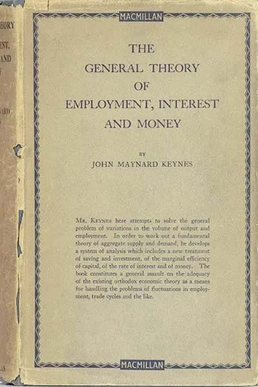

The General Theory of Employment, Interest and Money is a book by English economist John Maynard Keynes published in February 1936. It caused a profound shift in economic thought, giving macroeconomics a central place in economic theory and contributing much of its terminology – the "Keynesian Revolution". It had equally powerful consequences in economic policy, being interpreted as providing theoretical support for government spending in general, and for budgetary deficits, monetary intervention and counter-cyclical policies in particular. It is pervaded with an air of mistrust for the rationality of free-market decision making.

In classical economics, Say's law, or the law of markets, is the claim that the production of a product creates demand for another product by providing something of value which can be exchanged for that other product. So, production is the source of demand. In his principal work, A Treatise on Political Economy, Jean-Baptiste Say wrote: "A product is no sooner created, than it, from that instant, affords a market for other products to the full extent of its own value." And also, "As each of us can only purchase the productions of others with his/her own productions – as the value we can buy is equal to the value we can produce, the more men can produce, the more they will purchase."

In economics, effective demand (ED) in a market is the demand for a product or service which occurs when purchasers are constrained in a different market. It contrasts with notional demand, which is the demand that occurs when purchasers are not constrained in any other market. In the aggregated market for goods in general, demand, notional or effective, is referred to as aggregate demand. The concept of effective supply parallels the concept of effective demand. The concept of effective demand or supply becomes relevant when markets do not continuously maintain equilibrium prices.

The history of economic thought is the study of the philosophies of the different thinkers and theories in the subjects that later became political economy and economics, from the ancient world to the present day.

In macroeconomics, a general glut is an excess of supply in relation to demand, specifically, when there is more production in all fields of production in comparison with what resources are available to consume (purchase) said production. This exhibits itself in a general recession or depression, with high and persistent underutilization of resources, notably unemployment and idle factories. The Great Depression is often cited as an archetypal example of a general glut.

The neoclassical synthesis (NCS), or neoclassical–Keynesian synthesis is an academic movement and paradigm in economics that worked towards reconciling the macroeconomic thought of John Maynard Keynes in his book The General Theory of Employment, Interest and Money (1936) with neoclassical economics.

Axel Leijonhufvud was a Swedish economist and professor emeritus at the University of California, Los Angeles (UCLA), and professor at the University of Trento, Italy. Leijonhufvud focused his studies on macroeconomic monetary theory. In his defining book On Keynesian Economics and the Economics of Keynes (1968) he focuses on a critique of the interpretation of Keynesian economic theory by Keynesian economists. He goes on to call the standard neoclassical synthesis interpretation of the Keynes' General Theory as having misunderstood and misinterpreted Keynes. In one of his papers, "Life Among the Econ" (1973), he takes a comical yet critical look at the inherent clannish nature of economists; the paper was considered a devastating takedown of economics and economists.

Macroeconomic theory has its origins in the study of business cycles and monetary theory. In general, early theorists believed monetary factors could not affect real factors such as real output. John Maynard Keynes attacked some of these "classical" theories and produced a general theory that described the whole economy in terms of aggregates rather than individual, microeconomic parts. Attempting to explain unemployment and recessions, he noticed the tendency for people and businesses to hoard cash and avoid investment during a recession. He argued that this invalidated the assumptions of classical economists who thought that markets always clear, leaving no surplus of goods and no willing labor left idle.

Robert Wayne Clower was an American economist. He is credited with having largely created the field of stock-flow analysis in economics and with seminal works on the micro-foundations of monetary theory and macroeconomics.

Throughout modern history, a variety of perspectives on capitalism have evolved based on different schools of thought.

Disequilibrium macroeconomics is a tradition of research centered on the role of disequilibrium in economics. This approach is also known as non-Walrasian theory, equilibrium with rationing, the non-market clearing approach, and non-tâtonnement theory. Early work in the area was done by Don Patinkin, Robert W. Clower, and Axel Leijonhufvud. Their work was formalized into general disequilibrium models, which were very influential in the 1970s. American economists had mostly abandoned these models by the late 1970s, but French economists continued work in the tradition and developed fixprice models.

Principles of Political Economy Considered with a View to their Applications, simply referred to as Principles of Political Economy, was written by the nineteenth-century British political economist Thomas Malthus in 1820. Malthus wrote Principles of Political Economy as a rebuttal to David Ricardo's On the Principles of Political Economy and Taxation. While the main focus of their work is to explain economic depressions in Europe and the reasons why they occur, Malthus uses his scholarship to explore price determination and the value of goods.

Marxism and Keynesianism is a method of understanding and comparing the works of influential economists John Maynard Keynes and Karl Marx. Both men's works has fostered respective schools of economic thought that have had significant influence in various academic circles as well as in influencing government policy of various states. Keynes' work found popularity in developed liberal economies following the Great Depression and World War II, most notably Franklin D. Roosevelt's New Deal in the United States in which strong industrial production was backed by strong unions and government support. Marx's work, with varying degrees of faithfulness, led the way to a number of socialist states, notably the Soviet Union and the People's Republic of China. The immense influence of both Marxian and Keynesian schools has led to numerous comparisons of the work of both economists along with synthesis of both schools.

References

- 1 2 ( Clower 2004 , p. 92 )

- ↑ Kates, Steven (2009). Sya's Law and the Keynesian Revolution. Cheltenham, UK: Edward Elgar. ISBN 978 1 84844 826 1.

- 1 2 3 ( Clower 2004 , p. 91 )

- ↑ ( Clower 2004 , p. 91–92 )