In the United States, a 401(k) plan is an employer-sponsored, defined-contribution, personal pension (savings) account, as defined in subsection 401(k) of the U.S. Internal Revenue Code. Periodic employee contributions come directly out of their paychecks, and may be matched by the employer. This pre-tax option is what makes 401(k) plans attractive to employees, and many employers offer this option to their (full-time) workers. 401(k) payable is a general ledger account that contains the amount of 401(k) plan pension payments that an employer has an obligation to remit to a pension plan administrator. This account is classified as a payroll liability, since the amount owed should be paid within one year.

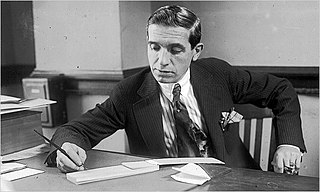

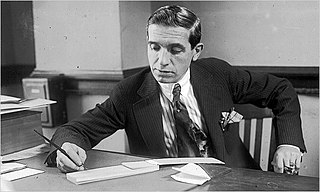

A Ponzi scheme is a form of fraud that lures investors and pays profits to earlier investors with funds from more recent investors. Named after Italian businessman Charles Ponzi, this type of scheme misleads investors by either falsely suggesting that profits are derived from legitimate business activities, or by exaggerating the extent and profitability of the legitimate business activities, leveraging new investments to fabricate or supplement these profits. A Ponzi scheme can maintain the illusion of a sustainable business as long as investors continue to contribute new funds, and as long as most of the investors do not demand full repayment or lose faith in the non-existent assets they are purported to own.

A pyramid scheme is a business model which, rather than earning money by sale of legitimate products to an end consumer, mainly earns money by recruiting new members with the promise of payments. As the number of members multiplies, recruiting quickly becomes increasingly difficult until it is impossible, and therefore most of the newer recruits do not make a profit. As such, pyramid schemes are unsustainable. The unsustainable nature of pyramid schemes has led to most countries outlawing them as a form of fraud.

A consortium is an association of two or more individuals, companies, organizations, or governments with the objective of participating in a common activity or pooling their resources for achieving a common goal.

The Caribbean Development Bank (CDB) is a development bank that helps Caribbean countries finance social and economic programs in its member countries through loans, grants, and technical assistance. The CDB was established by an Agreement signed on October 18, 1969, in Kingston, Jamaica, which entered into force on January 26, 1970. The idea for the bank originated from the 1966 Canada/Commonwealth Caribbean Conference.

A traditional IRA is an individual retirement arrangement (IRA), established in the United States by the Employee Retirement Income Security Act of 1974 (ERISA). Normal IRAs also existed before ERISA.

A high-yield investment program (HYIP) is a type of Ponzi scheme, an investment scam that promises unsustainably high return on investment by paying previous investors with the money invested by new investors.

The 'Economy of the Caribbean' is varied, but depends heavily on natural resources, agriculture and travel and tourism.

Susu collectors are a traditional form of financial intermediaries in Africa, predominantly in Ghana. For a small fee they provide an informal means for Ghanaians to securely save and access their own money, and gain some limited access to credit, a form of microfinance. Money looked after for an individual by a Susu collector is held in a Susu account.

Multi-level marketing (MLM), also called network marketing or pyramid selling, is a controversial and sometimes illegal marketing strategy for the sale of products or services in which the revenue of the MLM company is derived from a non-salaried workforce selling the company's products or services, while the earnings of the participants are derived from a pyramid-shaped or binary compensation commission system.

A rotating savings and credit association (ROSCA) is a group of individuals who agree to meet for a defined period in order to save and borrow together, a form of combined peer-to-peer banking and peer-to-peer lending. Members all chip in regularly and take turns withdrawing accumulated sums.

Kibwezi is a town in Makueni County, Kenya.

In South Africa, a stokvel is an invitation-only club of twelve or more people serving as a rotating credit union or saving scheme. Members contribute fixed sums of money to a central fund on a weekly, fortnightly or monthly basis. The name stokvel originates from the concept of "stock fairs", as the rotating cattle auctions of English settlers in the Eastern Cape during the early 19th century were known.

The airplane game, also known as the plane game, is a style of pyramid scheme first recorded in the 1980s in North America and later Western Europe.

Success University, founded in January 2005 by Matt Morris, is a privately held company based in Dallas, Texas. It has also been identified as a pyramid scheme. Success University does not employ any professors and does not have any premises; instead members are offered online courses on topics such as success in business, or physical wellbeing. Members have to pay an introduction fee, and are then encouraged to invite other people to join in exchange for a part of the benefits.

Collaborative finance is a category of financial transaction that occurs directly between individuals without the intermediation of a traditional financial institution. This new way to manage informal financial transactions has been enabled by advances in social media and peer-to-peer online platforms. The wide variety of collaborative finance resources may vary not only in their organizational and operational aspects but also by geographical region, share of the financial market, etc. It is precisely this heterogeneity that enables the informal savings and credit activity to profitably reach those income-groups not served by commercial banks and other financial institutions. It is their informality, adaptability and flexibility of operations – characteristics which reduce their transaction costs and confers upon them their comparative advantage and economic rationale. Collaborative Finance is characterized by highly personalized loan transactions entailing face-to-face dealings with borrowers and flexibility in respect to loan purpose, interest rates, collateral requirements, maturity periods and debt rescheduling.

In Latin America, a tanda is the regional version of a rotating savings and credit association (ROSCA). It is a form of a short-term no-interest loan among a group of friends and family.

A chama is an informal cooperative society that is normally used to pool and invest savings by people in East Africa, and particularly Kenya. The chama phenomenon is also referred to as "micro-savings groups". "Chama" is the Kiswahili word for "group" or "body". The chama phenomenon arose out of the idea of harambee, which means "all together", in the late 1980s and 1990s. Originally, chamas tended to be exclusively women's groups, but as chamas started to grow in sophistication and success, men started participating in chamas as well. The chama structure is used throughout Africa, but is particularly popular in Kenya where the word originated. In Kenya there are estimated to be 300,000 chamas managing a total of KSH 300 billion in assets. Chamas are known for their exclusivity. In order to join, new members are typically subjected to extensive interviews and must have assurances or guarantees made for them by an existing member. Some sources have estimated that one in three Kenyans is a chama member.

Hui refers to a group-based rotating saving and credit scheme that is popular among many immigrant and migrant communities throughout the United States, Taiwan. Biao Hui is the Chinese verb when someone is engaging or participating in Hui.

MMM Global is a Ponzi scheme launched in 2011 by Sergei Mavrodi, with subsidiaries in up to 110 countries. MMM Global is a new avatar of the Russian company MMM, also created by Mavrodi and which operated from 1989 to 2004. The difference between the two is that MMM Global targets developing countries. MMM Global became widely popular in various African countries such as South Africa, Nigeria, Zimbabwe, Kenya and Ghana, with some attributing this popularity to poverty and poor government regulation or law enforcement.