Visa Inc. is an American multinational payment card services corporation headquartered in San Francisco, California. It facilitates electronic funds transfers throughout the world, most commonly through Visa-branded credit cards, debit cards and prepaid cards. Visa is one of the world's most valuable companies.

The Canadian Imperial Bank of Commerce is a Canadian multinational banking and financial services corporation headquartered at CIBC Square in the Financial District of Toronto, Ontario. The Canadian Imperial Bank of Commerce was formed through the 1961 merger of the Canadian Bank of Commerce and the Imperial Bank of Canada, in the largest merger between chartered banks in Canadian history. It is one of two "Big Five" banks founded in Toronto, the other being the Toronto-Dominion Bank.

Toronto-Dominion Bank, doing business as TD Bank Group, is a Canadian multinational banking and financial services corporation headquartered in Toronto, Ontario. The bank was created on February 1, 1955, through the merger of the Bank of Toronto and The Dominion Bank, which were founded in 1855 and 1869; respectively. It is one of two Big Five banks of Canada founded in Toronto, the other being the Canadian Imperial Bank of Commerce. The TD Bank SWIFT code is TDOMCATTTOR and the TD institution number is 004.

Mastercard Inc. is the second-largest payment-processing corporation worldwide. It offers a range of payment transaction processing and other related-payment services. Its headquarters are in Purchase, New York. Throughout the world, its principal business is to process payments between the banks of merchants and the card-issuing banks or credit unions of the purchasers who use the Mastercard-brand debit, credit and prepaid cards to make purchases. Mastercard has been publicly traded since 2006.

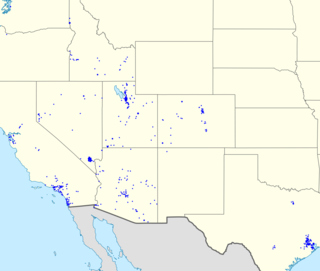

U.S. Bancorp is an American bank holding company based in Minneapolis, Minnesota, and incorporated in Delaware. It is the parent company of U.S. Bank National Association, and is the fifth largest banking institution in the United States. The company provides banking, investment, mortgage, trust, and payment services products to individuals, businesses, governmental entities, and other financial institutions. As of 2019, it had 3,106 branches and 4,842 automated teller machines, primarily in the Western and Midwestern United States. In 2023 it ranked 149th on the Fortune 500, and it is considered a systemically important bank by the Financial Stability Board. The company also owns Elavon, a processor of credit card transactions for merchants, and Elan Financial Services, a credit card issuer that issues credit card products on behalf of small credit unions and banks across the U.S.

Fiserv, Inc. is an American multinational company headquartered in Brookfield, Wisconsin, that provides financial technology services to clients across the financial services sector, including banks, thrifts, credit unions, securities broker dealers, mortgage, insurance, leasing and finance companies, and retailers.

Old National Bank is an American regional bank with nearly 200 retail branches operated by Old National Bancorp and based in Chicago and Evansville, Indiana. With assets at $23.0 billion and 162 banking centers, Old National Bancorp is the largest financial services bank holding company headquartered in Indiana and one of the top 100 banking companies in the U.S. Its primary banking footprint is in Illinois, Indiana, Kentucky, Michigan, Minnesota, and Wisconsin.

First Data Corporation is a financial services company headquartered in Atlanta, Georgia, United States. The company's STAR Network provides nationwide domestic debit acceptance at more than 2 million retail POS, ATM, and at online outlets for nearly a third of all U.S. debit cards.

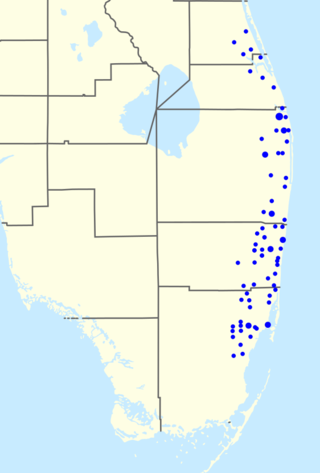

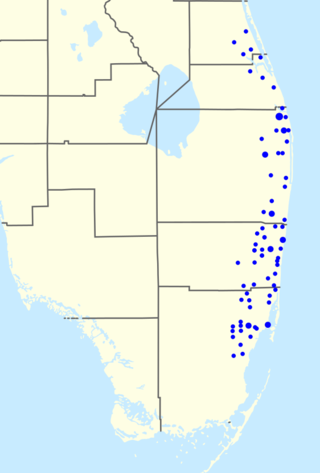

BankAtlantic was a US bank that operated in the state of Florida until it was acquired in 2012 by BB&T Corporation. It provided consumer and business banking services to communities throughout Florida.

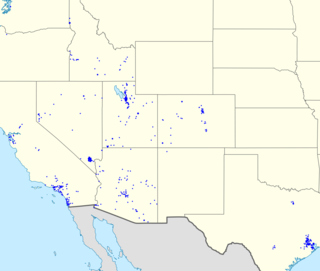

Zions Bancorporation is a national bank headquartered in Salt Lake City, Utah. It operates as a national bank rather than as a bank holding company and does business under the following seven brands: Zions Bank, Amegy Bank of Texas, California Bank and Trust, National Bank of Arizona, Nevada State Bank, Vectra Bank Colorado, and the Commerce Bank of Washington. It has 416 branches and over 1 million customers. It was founded by the Church of Jesus Christ of Latter-day Saints in 1873, although the church divested its interest in the bank in 1960.

Stuart A. Levey was the first Under Secretary for Terrorism and Financial Intelligence within the United States Department of the Treasury. He was sworn in on July 21, 2004 as a political appointee of President George W. Bush. President Barack Obama asked Levey to remain in his position and Levey was one of only a small number of Senate-confirmed Bush appointees who served in the Obama Administration. After leaving the government, Levey joined the private sector as chief legal officer of HSBC, CEO of Diem Association and chief legal officer of Oracle.

Nacha, originally the National Automated Clearinghouse Association, manages the ACH Network, the backbone for the electronic movement of money and data in the United States, and is an association for the payments industry. The ACH Network serves as a network for direct consumer, business, and government payments, and annually facilitates billions of payments such as Direct Deposit and Direct Payment. The ACH Network is governed by the Nacha Operating Rules.

Commerce Bancorp was a Cherry Hill, New Jersey–based bank created in 1973. In 2007, it was purchased by Toronto-Dominion Bank, which merged Commerce with TD Banknorth to form TD Bank, N.A.; all of its banks and branches were given the TD Bank logo.

EagleBank is a community bank headquartered in Bethesda, Maryland, with assets of more than $10 billion, with operations in the Washington, D.C. metropolitan area. EagleBank conducts full service commercial banking through small footprint of 20 branches in Montgomery County, Maryland; Washington, D.C.; and Northern Virginia. EagleBank is primarily known for Commercial Real Estate (CRE) loans with CRE comprising two thirds of the bank's loan portfolio as of September 2019. The bank was founded in 1998 under the holding company Eagle Bancorp Inc, which was established in 1997.

Pathward is a United States bank with retail branches in Iowa and South Dakota. It offers traditional banking services designed to serve the needs of individual, agricultural, and business depositors and borrowers.

Infibeam Avenues Limited is an Indian payment infrastructure and software as a service (SaaS) fintech company that provides digital payment services, eCommerce platforms, digital lending, data cloud storage and omnichannel enterprise software to businesses across industries in India and globally.

Worldpay, Inc. was an American payment processing company and technology provider. In June 2019 it was acquired and merged into Fidelity National Information Services (FIS). Before its acquisition, it was headquartered in the greater Cincinnati, Ohio area. Worldpay, Inc., was the largest U.S. merchant acquirer ranked by general-purpose transaction volume.

TradeCard, Inc. was an American software company. Its main product, also called TradeCard, was a SaaS collaboration product that was designed to allow companies to manage their extended supply chains including tracking movement of goods and payments. TradeCard software helped to improve visibility, cash flow and margins for over 10,000 retailers and brands, factories and suppliers, and service providers operating in 78 countries.

Monitise Plc was a British company in financial services technology.

Chain Bridge Bank, National Association (N.A.) is a nationally chartered bank organized under the laws of the United States. The bank is headquartered in McLean, Virginia, and serves trade associations, think tanks, lobbying firms, political committees, nonprofit organizations, businesses, and individuals across the country.