Related Research Articles

Bank One Corporation was an American bank founded in 1968 and at its peak the sixth-largest bank in the United States. It traded on the New York Stock Exchange under the stock symbol ONE. The company merged with JPMorgan Chase & Co. on July 1, 2004, with its CEO Jamie Dimon taking the lead at the combined company. The company had its headquarters in the Bank One Plaza in the Chicago Loop in Chicago, Illinois, now the headquarters of Chase's retail banking division.

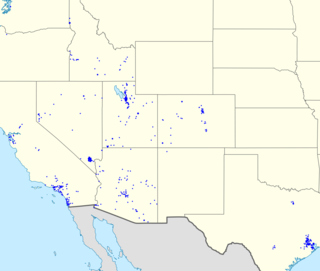

U.S. Bancorp is an American bank holding company based in Minneapolis, Minnesota, and incorporated in Delaware. It is the parent company of U.S. Bank National Association, and is the fifth largest banking institution in the United States. The company provides banking, investment, mortgage, trust, and payment services products to individuals, businesses, governmental entities, and other financial institutions. As of 2019, it had 3,106 branches and 4,842 automated teller machines, primarily in the Western and Midwestern United States. In 2023 it ranked 149th on the Fortune 500, and it is considered a systemically important bank by the Financial Stability Board. The company also owns Elavon, a processor of credit card transactions for merchants, and Elan Financial Services, a credit card issuer that issues credit card products on behalf of small credit unions and banks across the U.S.

National City Corporation was a regional bank holding company based in Cleveland, Ohio, founded in 1845; it was once one of the ten largest banks in America in terms of deposits, mortgages and home equity lines of credit. Subsidiary National City Mortgage is credited for doing the first mortgage in America. The company operated through an extensive banking network primarily in Ohio, Illinois, Indiana, Kentucky, Michigan, Missouri, Pennsylvania, Florida, and Wisconsin, and also served customers in selected markets nationally. Its core businesses included commercial and retail banking, mortgage financing and servicing, consumer finance, and asset management. The bank reached out to customers primarily through mass advertising and offered comprehensive banking services online. In its last years, the company was commonly known in the media by the abbreviated NatCity, with its investment banking arm even bearing the official name NatCity Investments.

The National Bank of Detroit (NBD), later renamed NBD Bank, was a bank that operated mostly in the Midwestern United States. Following its merger with First National Bank of Chicago, the bank was ultimately acquired and merged into Bank One, at which point the NBD name was discontinued. Today, what was once NBD is owned by JPMorgan Chase & Co.

Firstar Corporation was a Milwaukee, Wisconsin-based regional bank holding company that existed from 1853 to 2001. In 2001, Firstar acquired U.S. Bancorp and assumed its name, moving its headquarters to Minneapolis.

Zions Bancorporation is a national bank headquartered in Salt Lake City, Utah. It operates as a national bank rather than as a bank holding company and does business under the following seven brands: Zions Bank, Amegy Bank of Texas, California Bank and Trust, National Bank of Arizona, Nevada State Bank, Vectra Bank Colorado, and the Commerce Bank of Washington. It has 416 branches and over 1 million customers. It was founded by the Church of Jesus Christ of Latter-day Saints in 1873, although the church divested its interest in the bank in 1960.

WesBanco, Inc., is a bank holding company headquartered in Wheeling, West Virginia, United States. It has over 200 branches in West Virginia, Ohio, Western Pennsylvania, Kentucky, Maryland, and Southern Indiana.

Boatmen's Bancshares Inc. was one of the 30 largest bank holding companies in the United States when it was acquired by NationsBank in 1996. Until its acquisition, Boatmen's traded on NASDAQ with the ticker BOAT.

FirstMerit Corporation was a diversified financial services company headquartered in Akron, Ohio, with assets of approximately $26.2 billion as of June 30, 2016, and 359 banking offices and 400 ATM locations in Ohio, Michigan, Wisconsin, Illinois and Pennsylvania. FirstMerit provided a range of banking and other financial services to consumers and businesses. Principal affiliates included: FirstMerit Bank, N.A., and FirstMerit Mortgage Corporation. It was acquired by Huntington Bancshares in August 2016.

Cadence Bank is a commercial bank with dual headquarters in Tupelo, Mississippi, and Houston, Texas, with operations in Alabama, Arkansas, Florida, Georgia, Louisiana, Mississippi, Missouri, Oklahoma, Tennessee, Texas, and Illinois. In 1876, Raymond Trice and Company received a charter to create a bank in its hardware store in Verona, Mississippi. In 1886, the banking operation was moved to Tupelo, Mississippi and the company was renamed to Bank of Lee County, Mississippi. Soon after, it was renamed to the Bank of Tupelo. The bank was renamed to Bank of Mississippi in 1966. In 1997, the bank changed its name to BancorpSouth. In October 2021, the bank changed its name to Cadence Bank. It has the naming rights to Cadence Bank Amphitheatre in Atlanta and Cadence Bank Arena in Tupelo.

United Community Banks, Inc. is an American bank. United is one of the largest full-service financial institutions in the Southeast, with $27.3 billion in assets, and 203 offices in Alabama, Florida, Georgia, North Carolina, South Carolina and Tennessee.

Northwest Bank is a bank headquartered in Warren, Pennsylvania. It is the leading subsidiary of Northwest Bancshares, Inc., a bank holding company, and operates 170 branches in central and Western Pennsylvania, Western New York, Northeast Ohio, Appalachian Ohio, and Indiana.

The Dime Savings Bank of New York, originally the Dime Savings Bank of Brooklyn, was a bank headquartered in Brooklyn, New York City. It operated from 1859 to 2002.

First Bank System was a Minneapolis, Minnesota-based regional bank holding company that operated from 1864 to 1997. What was once First Bank forms the core of today's U.S. Bancorp; First Bank merged with the old U.S. Bancorp in 1997 and took the U.S. Bancorp name.

California Bank & Trust (CB&T) is a full-service bank specializing in consumer, commercial and wealth management services headquartered in San Diego, California. With more than 80 branches located across California and assets totaling about $91 billion, CB&T is a subsidiary of Zions Bancorporation, one of the nation's top 50 bank holding companies.

Simmons Bank is a bank with operations in Arkansas, Kansas, Missouri, Oklahoma, Tennessee, and Texas. It is the primary subsidiary of Simmons First National Corporation, a bank holding company.

INB Financial Corporation was an Indianapolis-based statewide bank holding company that was the largest Indiana-based financial institution at the time it was acquired by Michigan-based NBD Bancorp in 1992. Its primary subsidiary was the Indianapolis-based INB National Bank, formerly the Indiana National Bank, which can trace its origins to the founding of the Second State Bank of Indiana in 1834.

Star Banc Corporation was a Cincinnati, Ohio-based regional bank holding company that acquired Firstar in 1998 and took the Firstar name; the merged bank acquired U.S. Bancorp in 2001 and took the U.S. Bancorp name. The company can trace its origins back to 1863 when it was first founded as the First National Bank of Cincinnati.

Merchants National Corporation (MNC) was an Indianapolis-based statewide bank holding company that was one of the largest Indiana-based financial institutions at the time it was acquired by Ohio-based National City Corporation in 1992. Its primary subsidiary was the Indianapolis-based Merchants National Bank and Trust Company, which was founded in 1865.

Equity Bank is a $5 billion community bank with more than 70 locations across Kansas, Missouri, Oklahoma, and Arkansas. Founded in 2002, the bank held its Initial Public Offering in 2015. In 2023, it was traded on the New York Stock Exchange for the very first time.

References

- ↑ profile in International Directory of Company Histories, Vol. 33. St. James Press, 2000 - via fundinguniverse.com

- ↑ O'Brien, Timothy L. (May 1, 1999). "Mercantile Bancorporation, Long a Buyer, Will Be Bought". New York Times .

- ↑ McCarthy, Michael J. (October 29, 1996). "Mercantile Bancorp. to Acquire Mark Twain for $792 Million" . Wall Street Journal . ISSN 0099-9660 . Retrieved August 11, 2016.

- ↑ "St. Louis Mercantile Bank Takes Out National Charter". New York Times . December 26, 1964.

- ↑ "Mercantile Trust Co" . Wall Street Journal . March 31, 1970. p. 26. ProQuest 133480458.

Mercantile Trust Co. formed Mercantile Bancorporation Inc. to carry out the previously announced plan of seeking approval of the Federal Reserve Board and the Comptroller of the Currency to become a registered bank-holding company, John Fox, Mercantile chairman, announced.

- ↑ "Mercantile Bancorporation" . Wall Street Journal . March 11, 1971. p. 18. ProQuest 133620939.

Mercantile Bancorporation became a registered bank holding company. The company is composed of two wholly owned subsidiary banks, Mercantile Trust Co. and Mercantile Commerce Trust Co., with combined assets of $1,351,711,485.

- ↑ Nicklaus, David (February 28, 1989). "New Chairman Taking Over Mercantile" . St. Louis Post-Dispatch . p. 1A.

- ↑ "Company Briefs". New York Times . November 20, 1991.

- ↑ Davis, Mark (November 13, 1991). "Mercantile agrees to buy Ameribanc KC banks to merge ultimately as result of deal, spokesman says" . Kansas City Star . p. B1.

- ↑ "Mercantile, Ameribanc Inc. complete deal" . Kansas City Star . May 1, 1992. p. B3.

- ↑ "Mercantile Plans Acquisition Of United Postal". New York Times . August 18, 1993.

- ↑ Goodman, Adam (August 18, 1993). "Deal Could Make Mercantile Top Home Lender" . St. Louis Post-Dispatch . p. 1C.

Mercantile Bancorporation Inc. is poised to become king of home lending in St. Louis with its planned purchase of United Postal Bancorp Inc. Mercantile, the second-biggest bank in the St. Louis area, is much better known for its commercial loans than its residential mortgages. But by forking over $180 million to buy United Postal, Mercantile could suddenly become the area's top home lender. United Postal is the second-largest savings and loan in the St. Louis area.

- ↑ "Mercantile reports higher net income" . Kansas City Star . April 12, 1994. p. D15.

- ↑ "Mercantile to Acquire Central Mortgage In Stock Deal". New York Times . September 23, 1994.

- ↑ "Business in brief: Mercantile Acquisition announced" . Kansas City Star . January 28, 1995. p. B2.

Mercantile Bancorporation Inc., a $12.2 billion bank holding company, said Friday it will acquire the smaller Southwest Bancshares Inc. of Springfield in a stock swap. Mercantile plans to issue 675,000 shares of its common stock for the outstanding stock of Southwest. That would make the deal worth about $23 million at Mercantile's closing share price Thursday of $34.

- ↑ "Mercantile acquiring Sikeston, Mo., company" . Kansas City Star . February 21, 1995. p. D16.

Mercantile Bancorporation will further expand its presence in southeastern Missouri through a merger with AmeriFirst Bancorporation, based in Sikeston, Mo., the company has announced. St. Louis-based Mercantile said Friday it will issue 661,385 shares of common stock in exchange for the outstanding stock of AmeriFirst, which is privately held. Mercantile's stock closed at $35.75 Friday, putting the value of the deal about $23.6 million. AmeriFirst is the $164 million holding company for AmeriFirst Bank, which operates two offices in Sikeston and a branch in Cape Girardeau.

- ↑ "Adding Another Bank: Mercantile To Acquire Mark Twain". Chicago Tribune . October 29, 1996.

- 1 2 "Mercantile In $855 Million Deal for Mark Twain". New York Times . October 29, 1996.

- ↑ "The Bank of New York acquires former Mark Twain corproate business". Kansas City Business Journal. March 23, 1998.

- ↑ "Going offshore on the Internet". Forbes. September 7, 1997. Retrieved September 28, 2020.

- 1 2 Bagli, Charles V. (December 24, 1996). "St. Louis Bank Acquiring Rival For $1 Billion". New York Times .

- ↑ "$1 Billion Deal Creates Largest Missouri Bank". Fort Lauderdale Sun Sentinel . December 24, 1996. Archived from the original on April 24, 2017.

- ↑ "Another Purchase For Mercantile Bancorporation". Chicago Tribune . December 24, 1996.

- ↑ "Fed approves Mercantile buy of Roosevelt". St. Louis Business Journal . June 4, 1997.

- ↑ "Mercantile wraps up Roosevelt deal, Edison CEO to resiign". St. Louis Business Journal. July 6, 1997.

- ↑ "Mercantile Bancorporation Inc. reached an agreement Friday with the..." . United Press International . August 1, 1986.

Mercantile Bancorporation Inc. reached an agreement Friday with the First Bancshares Corp. of Illinois to acquire that company, which has $137 million in assets. Donald Lasater, the chief executive officer of Mercantile, said the boards of directors of both companies agreed in principle to the deal, which will give First Bancshares stockholders equitable amounts of Mercantile common stock. First Bancshares owns the First National Bank and Trust Company in Alton, the Airport National Bank in Bethalto and Midwest Information Processors Corporation in Alton. Mercantile owns 38 banks in Missouri and has assets of $6.45 billion.

- ↑ "Interstate Merger" . St. Louis Post-Dispatch . February 18, 1987. p. 13 – via Newspapers.com.

Dan Dawson and Cliff Honaker of Maguire Signs Inc. install a "Mercantile Bank" sign outside First National Bank's branch at Mather and State streets in Alton on Tuesday, the day that Mercantile Bancorporation completed its acquisition of First Banc-shares Corp. of Illinois. First Bancshares owned First National, now called Alton Mercantile Bank, and Airport National Bank of Bethalto, now Bethalto Mercantile Bank.

- ↑ Gallagher, Jim (August 14, 1991). "Mercantile Buying Bank With 6 Illinois Offices" . St. Louis Post-Dispatch . p. 1B.

- ↑ "ST. LOUIS - BANKING - Mercantile Buys Old National" . St. Louis Post-Dispatch . December 3, 1991. p. 9C.

- ↑ "Morning Briefing" . St. Louis Post-Dispatch . July 26, 1995. p. 1C.

- ↑ "Morning Briefing" . St. Louis Post-Dispatch . January 3, 1996. p. 1C.

- ↑ "Mergers: Banks Add Up 2 More Acquisitions". Chicago Tribune . March 21, 1996.

- 1 2 "Morning Briefing: Mercantile To Buy Bank Of Alton" . St. Louis Post-Dispatch . August 24, 1996. p. 1C.

- ↑ "Mercantile to merge with HomeCorp in $45 million deal". St. Louis Business Journal . October 29, 1997.

- ↑ "Mercantile wraps $51 million HomeCorp. purchase". St. Louis Business Journal . March 2, 1998.

- 1 2 "Mercantile in $697M merger - Feb. 2, 1998". CNN. February 2, 1998. Retrieved September 28, 2020.

- 1 2 "BUSINESS MEMO: BANK AGREEMENT COMPLETED". Southeast Missourian. July 13, 1998.

- ↑ "Mercantile In $118 Stock Deal for Financial Service". New York Times . August 4, 1998.

- ↑ Pearson, Rita (November 14, 1998). "The Rock Island Bank changes its name today". Moline Daily Dispatch .

- ↑ Carpenter, Tim (July 2, 1992). "Missouri Firm to Acquire 1st National". Lawrence Journal-World . Archived from the original on September 15, 2017. Retrieved May 5, 2017.

- ↑ Davis, Mark (July 2, 1992). "Mercantile outlines deal to buy five Kansas banks Hall family to sell intrests [sic] under state's new banking law" . Kansas City Star . p. A1.

Mercantile Bancorporation Inc. announced a $129 million acquisition of the Donald J. Hall family's Kansas banking interests Wednesday, the first day of interstate banking in the Sunflower State. The agreement covers MidAmerican Bank and Trust in Overland Park, Johnson County Bank in Prairie Village and banks in Topeka and Lawrence.

- ↑ Mellinger, Gwyn (November 17, 1992). "Local Bank Merger Clears Final Hurdle". Lawrence Journal-World . Archived from the original on September 15, 2017. Retrieved May 5, 2017.

- ↑ "Few Changes Likely From Bank Merger". Lawrence Journal-World . January 4, 1993. Archived from the original on September 15, 2017. Retrieved May 5, 2017.

- ↑ "Morning Briefing: Mercantile Adds Kansas Bank" . St. Louis Post-Dispatch . December 20, 1995. p. 01C.

- ↑ "Mercantile Plans to Buy Bank In Iowa" . St. Louis Post-Dispatch . July 30, 1993. p. 16D.

Mercantile Bancorporation dipped a toe into the Iowa banking market Thursday, announcing plans to buy a mid-sized bank in Waterloo. St. Louis' second-largest bank said it will buy Metro Bancorporation. Metro owns Waterloo Savings Bank, a nicely profitable commercial bank with about $378 million in assets. Mercantile plans to pay with 1.12 million shares of its own stock, worth about $55 million at current prices.

- ↑ "Mercantile-Metro complete merger" . Cedar Rapids Gazette . January 4, 1994. p. D5.

Mercantile Bancorporation Inc. of St. Louis has completed its merger with Metro Bancorporation Inc., the $378 million-asset holding company for the Waterloo Savings Bank, officials said Monday. The bank will be renamed Mercantile Bank of Northern Iowa later this spring, said Daniel Watters, president of Waterloo Savings Bank.

- ↑ "Davenport bank to be bought out" . Cedar Rapids Gazette . December 25, 1994. p. 14.

Mercantile Bancorporation Inc. of St. Louis is acquiring First Federal Savings Bank of Iowa, the Davenport institution that is the second-largest Iowa-based savings and loan. Mercantile announced Friday that it has agreed to merge with Plains Spirit Financial Corp., the owner of First Federal Savings Bank.

- ↑ "Mercantile Bancorp Agrees to Purchase Hawkeye". New York Times . August 5, 1995.

- ↑ "Mercantile buys Iowa bank: Bank holding company to buy First Financial in $169 million stock deal". CNN . May 8, 1998.

- ↑ Jones, Dow (May 9, 1998). "Company News; Mercantile Bancorp Agrees to Acquire First Financial". The New York Times. ISSN 0362-4331 . Retrieved September 28, 2020.

- ↑ "Mercantile Bancorporation Inc. Completes Merger With First Financial Bancorporation". PR Newswire (Press release). September 28, 1998.

- ↑ "Mercantile Bancorporation to Acquire Tc Bankshares". New York Times . December 6, 1994.

- ↑ "Mercantile Bancorporatiion plans Arkansas expansion". Kansas City Business Journal. August 20, 1997.

- ↑ Smith, David (January 31, 2014). "Bank of Ozarks agrees to purchase Summit, 11th acquisition since '10". Arkansas Democrat Gazette. Retrieved September 28, 2020.

- ↑ "New Kentucky home: Mercantile Bancorp Inc. said it agreed..." Chicago Tribune . January 12, 1998.

- ↑ O'Brien, Timothy L. (May 1, 1999). "Mercantile Bancorporation, Long a Buyer, Will Be Bought". The New York Times . ISSN 0362-4331 . Retrieved June 26, 2016.

- 1 2 3 Wahl, Melissa (May 1, 1999). "Firstar Corp. Buys Mercantile For $10.6 Billion: Merger Forms 13th-largest Bank". Chicago Tribune .

- ↑ "Fiirstar, Mercantile merger complete". Cincinnati Business Courier. September 20, 1999. Retrieved September 28, 2020.