A Ponzi scheme is a form of fraud that lures investors and pays profits to earlier investors with funds from more recent investors. Named after Italian businessman Charles Ponzi, this type of scheme misleads investors by either falsely suggesting that profits are derived from legitimate business activities, or by exaggerating the extent and profitability of the legitimate business activities, leveraging new investments to fabricate or supplement these profits. A Ponzi scheme can maintain the illusion of a sustainable business as long as investors continue to contribute new funds, and as long as most of the investors do not demand full repayment or lose faith in the non-existent assets they are purported to own.

Trustee is a legal term which, in its broadest sense, is a synonym for anyone in a position of trust and so can refer to any individual who holds property, authority, or a position of trust or responsibility for the benefit of another. A trustee can also be a person who is allowed to do certain tasks but not able to gain income. Although in the strictest sense of the term a trustee is the holder of property on behalf of a beneficiary, the more expansive sense encompasses persons who serve, for example, on the board of trustees of an institution that operates for a charity, for the benefit of the general public, or a person in the local government.

A fiduciary is a person who holds a legal or ethical relationship of trust with one or more other parties. Typically, a fiduciary prudently takes care of money or other assets for another person. One party, for example, a corporate trust company or the trust department of a bank, acts in a fiduciary capacity to another party, who, for example, has entrusted funds to the fiduciary for safekeeping or investment. Likewise, financial advisers, financial planners, and asset managers, including managers of pension plans, endowments, and other tax-exempt assets, are considered fiduciaries under applicable statutes and laws. In a fiduciary relationship, one person, in a position of vulnerability, justifiably vests confidence, good faith, reliance, and trust in another whose aid, advice, or protection is sought in some matter. In such a relation, good conscience requires the fiduciary to act at all times for the sole benefit and interest of the one who trusts.

A fiduciary is someone who has undertaken to act for and on behalf of another in a particular matter in circumstances which give rise to a relationship of trust and confidence.

A mortgage-backed security (MBS) is a type of asset-backed security which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals that securitizes, or packages, the loans together into a security that investors can buy. Bonds securitizing mortgages are usually treated as a separate class, termed residential; another class is commercial, depending on whether the underlying asset is mortgages owned by borrowers or assets for commercial purposes ranging from office space to multi-dwelling buildings.

Structured finance is a sector of finance — specifically financial law — that manages leverage and risk. Strategies may involve legal and corporate restructuring, off balance sheet accounting, or the use of financial instruments.

The Berkman Klein Center for Internet & Society is a research center at Harvard University that focuses on the study of cyberspace. Founded at Harvard Law School, the center traditionally focused on internet-related legal issues. On May 15, 2008, the center was elevated to an interfaculty initiative of Harvard University as a whole. It is named after the Berkman family. On July 5, 2016, the center added "Klein" to its name following a gift of $15 million from Michael R. Klein.

Securities fraud, also known as stock fraud and investment fraud, is a deceptive practice in the stock or commodities markets that induces investors to make purchase or sale decisions on the basis of false information. The setups are generally made to result in monetary gain for the deceivers, and generally result in unfair monetary losses for the investors. They are generally violating securities laws.

Self-dealing is the conduct of a trustee, attorney, corporate officer, or other fiduciary that consists of taking advantage of their position in a transaction and acting in their own interests rather than in the interests of the beneficiaries of the trust, corporate shareholders, or their clients. According to the political scientist Andrew Stark, "[i]n self-dealing, an officeholder's official role allows her to affect one or more of her own personal interests." It is a form of conflict of interest.

Jeffrey Alexander "Jeff" Frankel is an international macroeconomist. He works as the James W. Harpel Professor of Capital Formation and Growth at Harvard Kennedy School.

Principles for Responsible Investment is a United Nations-supported international network of financial institutions working together to implement its six aspirational principles, often referenced as "the Principles". Its goal is to understand the implications of sustainability for investors and support signatories to facilitate incorporating these issues into their investment decision-making and ownership practices. In implementing these principles, signatories contribute to the development of a more sustainable global financial system.

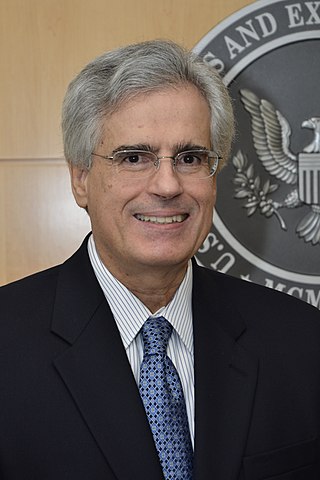

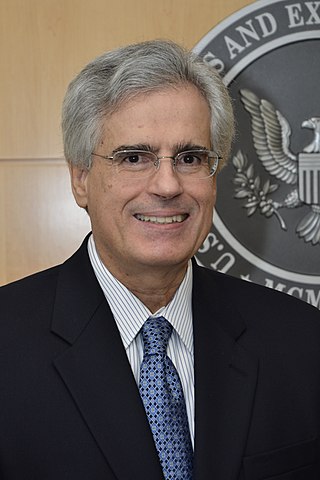

Luis Alberto Aguilar is an American lawyer and former U.S. government official.

The Madoff investment scandal was a major case of stock and securities fraud discovered in late 2008. In December of that year, Bernie Madoff, the former Nasdaq chairman and founder of the Wall Street firm Bernard L. Madoff Investment Securities LLC, admitted that the wealth management arm of his business was an elaborate multi-billion-dollar Ponzi scheme.

The Investor Protections and Improvements to the Regulation of Securities is a United States Act of Congress, which forms Title IX, sections 901 to 991 of the much broader and larger Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. Its main purpose is to revise the powers and structure of the Securities and Exchange Commission, credit rating organizations, and the relationships between customers and broker-dealers or investment advisers. This title calls for various studies and reports from the SEC and Government Accountability Office (GAO). This title contains nine subtitles.

The Fuld-Gilad-Herring Academy of Competitive Intelligence is an educational organization bringing professional training to the field of competitive intelligence (CI). Established in 1996, the academy has expanded its training to thousands of managers from 58 countries and six continents at its campuses in Cambridge, MA and Brussels, Belgium. The academy is the only CI-dedicated institution to be externally accredited by the International Accreditors for Continuing Education and Training (IACET). It grants the Competitive Intelligence Professional (CIP) certification based on a 9-course program, including a course in ethics and a pioneering course in business war gaming. To be certified, managers must complete the required coursework and pass a certification exam. To accommodate managers whose main interest is in using CI tools and managers working as CI professionals, the academy offers two levels of certification: a basic CIP-I, and an advanced CIP-II. The academy is currently the largest training institute in its field.

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations and selling their related cash flows to third party investors as securities, which may be described as bonds, pass-through securities, or collateralized debt obligations (CDOs). Investors are repaid from the principal and interest cash flows collected from the underlying debt and redistributed through the capital structure of the new financing. Securities backed by mortgage receivables are called mortgage-backed securities (MBS), while those backed by other types of receivables are asset-backed securities (ABS).

Personal fiduciary services are fiduciary services provided by a financial institutions or advisors to an individual or family that are typically wealthy or high net worth individual. They are often referred to as private trust, private client, private wealth management, or private banking services in the United States.

Roberta Romano is Sterling Professor of Law at the Yale Law School. She is the first woman at Yale Law School to be named a Sterling Professor. Roberta Romano joined the Yale Law School faculty as a professor of law in 1985. She was named the Allen Duffy/Class of 1960 Professor of Law in 1991 and the Oscar M. Ruebhausen Professor of Law in 2005. She is Director of the Yale Law School Center for the Study of Corporate Law and Professor at the Yale School of Management.

Ezubao was a peer-to-peer lending scheme based in the eastern Chinese province of Anhui. It was set up as an online scheme in July 2014, attracted funds of about 50 billion yuan from 900,000 investors, and ceased to trade in December 2015. On 1 February 2016, the scheme was closed down and 21 involved people were arrested. Zhang Min, the president of the parent company, Yucheng Global, told investigators that the company operated as a Ponzi scheme. Following its establishment, Ezubao grew rapidly, masquerading as a legitimate investment opportunity while operating under the guise of peer-to-peer lending. Revelations about the fraudulent nature of Ezubao’s operations emerged after an exposé in late 2015, leading to public outcry and intensified scrutiny by regulatory authorities. The scale of Ezubao’s Ponzi scheme, which orchestrated a sophisticated ruse involving fake projects and returns, was unprecedented in China, contributing to an estimated loss of billions of yuan for investors. The scandal not only devastated the finances of nearly a million individuals but also prompted a nationwide tightening of regulations on the peer-to-peer lending industry, aiming to close loopholes and restore investor confidence.

Jennifer Taub is an American law professor, advocate, and commentator focusing on corporate governance, financial market regulation, and white collar crime.

John Dirk Morley is an American legal scholar. He is the Augustus E. Lines Professor of Testamentary Law at Yale Law School, where he also serves as Faculty Director of the Chae Initiative in Private Sector Leadership.