In mathematics, the Wiener process is a real-valued continuous-time stochastic process named in honor of American mathematician Norbert Wiener for his investigations on the mathematical properties of the one-dimensional Brownian motion. It is often also called Brownian motion due to its historical connection with the physical process of the same name originally observed by Scottish botanist Robert Brown. It is one of the best known Lévy processes and occurs frequently in pure and applied mathematics, economics, quantitative finance, evolutionary biology, and physics.

In statistical mechanics and information theory, the Fokker–Planck equation is a partial differential equation that describes the time evolution of the probability density function of the velocity of a particle under the influence of drag forces and random forces, as in Brownian motion. The equation can be generalized to other observables as well. The Fokker-Planck equation has multiple applications in information theory, graph theory, data science, finance, economics etc.

A geometric Brownian motion (GBM) (also known as exponential Brownian motion) is a continuous-time stochastic process in which the logarithm of the randomly varying quantity follows a Brownian motion (also called a Wiener process) with drift. It is an important example of stochastic processes satisfying a stochastic differential equation (SDE); in particular, it is used in mathematical finance to model stock prices in the Black–Scholes model.

In mathematics, Itô's lemma or Itô's formula is an identity used in Itô calculus to find the differential of a time-dependent function of a stochastic process. It serves as the stochastic calculus counterpart of the chain rule. It can be heuristically derived by forming the Taylor series expansion of the function up to its second derivatives and retaining terms up to first order in the time increment and second order in the Wiener process increment. The lemma is widely employed in mathematical finance, and its best known application is in the derivation of the Black–Scholes equation for option values.

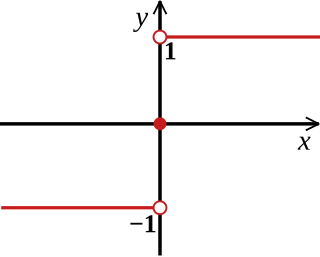

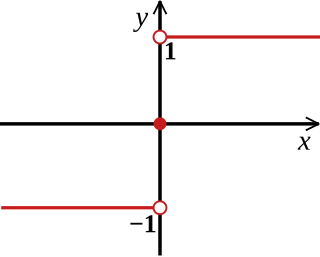

In mathematics, the sign function or signum function is a function that returns the sign of a real number. In mathematical notation the sign function is often represented as .

In probability theory and related fields, Malliavin calculus is a set of mathematical techniques and ideas that extend the mathematical field of calculus of variations from deterministic functions to stochastic processes. In particular, it allows the computation of derivatives of random variables. Malliavin calculus is also called the stochastic calculus of variations. P. Malliavin first initiated the calculus on infinite dimensional space. Then, the significant contributors such as S. Kusuoka, D. Stroock, J-M. Bismut, Shinzo Watanabe, I. Shigekawa, and so on finally completed the foundations.

In probability theory, a Lévy process, named after the French mathematician Paul Lévy, is a stochastic process with independent, stationary increments: it represents the motion of a point whose successive displacements are random, in which displacements in pairwise disjoint time intervals are independent, and displacements in different time intervals of the same length have identical probability distributions. A Lévy process may thus be viewed as the continuous-time analog of a random walk.

Itô calculus, named after Kiyosi Itô, extends the methods of calculus to stochastic processes such as Brownian motion. It has important applications in mathematical finance and stochastic differential equations.

In mathematics, quadratic variation is used in the analysis of stochastic processes such as Brownian motion and other martingales. Quadratic variation is just one kind of variation of a process.

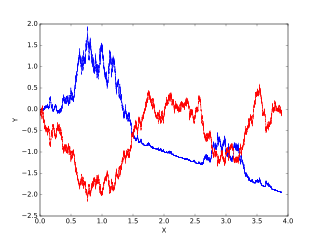

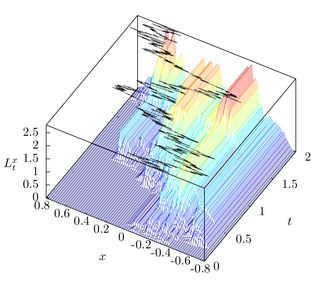

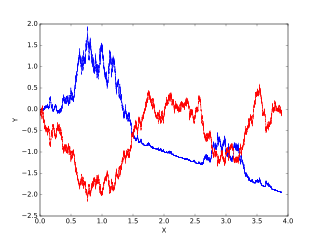

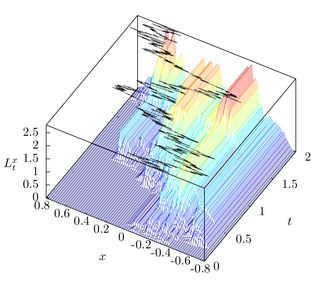

In the mathematical theory of stochastic processes, local time is a stochastic process associated with semimartingale processes such as Brownian motion, that characterizes the amount of time a particle has spent at a given level. Local time appears in various stochastic integration formulas, such as Tanaka's formula, if the integrand is not sufficiently smooth. It is also studied in statistical mechanics in the context of random fields.

In mathematics, a local martingale is a type of stochastic process, satisfying the localized version of the martingale property. Every martingale is a local martingale; every bounded local martingale is a martingale; in particular, every local martingale that is bounded from below is a supermartingale, and every local martingale that is bounded from above is a submartingale; however, a local martingale is not in general a martingale, because its expectation can be distorted by large values of small probability. In particular, a driftless diffusion process is a local martingale, but not necessarily a martingale.

In mathematics, Doob's martingale inequality, also known as Kolmogorov’s submartingale inequality is a result in the study of stochastic processes. It gives a bound on the probability that a submartingale exceeds any given value over a given interval of time. As the name suggests, the result is usually given in the case that the process is a martingale, but the result is also valid for submartingales.

In mathematical analysis, the Russo–Vallois integral is an extension to stochastic processes of the classical Riemann–Stieltjes integral

In probability theory, a real valued stochastic process X is called a semimartingale if it can be decomposed as the sum of a local martingale and a càdlàg adapted finite-variation process. Semimartingales are "good integrators", forming the largest class of processes with respect to which the Itô integral and the Stratonovich integral can be defined.

In mathematics, Tanaka's equation is an example of a stochastic differential equation which admits a weak solution but has no strong solution. It is named after the Japanese mathematician Hiroshi Tanaka.

In mathematics – specifically, in stochastic analysis – an Itô diffusion is a solution to a specific type of stochastic differential equation. That equation is similar to the Langevin equation used in physics to describe the Brownian motion of a particle subjected to a potential in a viscous fluid. Itô diffusions are named after the Japanese mathematician Kiyosi Itô.

In mathematics, Schilder's theorem is a generalization of the Laplace method from integrals on to functional Wiener integration. The theorem is used in the large deviations theory of stochastic processes. Roughly speaking, out of Schilder's theorem one gets an estimate for the probability that a (scaled-down) sample path of Brownian motion will stray far from the mean path. This statement is made precise using rate functions. Schilder's theorem is generalized by the Freidlin–Wentzell theorem for Itō diffusions.

In mathematics, the Freidlin–Wentzell theorem is a result in the large deviations theory of stochastic processes. Roughly speaking, the Freidlin–Wentzell theorem gives an estimate for the probability that a (scaled-down) sample path of an Itō diffusion will stray far from the mean path. This statement is made precise using rate functions. The Freidlin–Wentzell theorem generalizes Schilder's theorem for standard Brownian motion.

In stochastic calculus, the Doléans-Dade exponential or stochastic exponential of a semimartingale X is the unique strong solution of the stochastic differential equation

In probability theory, a branch of mathematics, white noise analysis, otherwise known as Hida calculus, is a framework for infinite-dimensional and stochastic calculus, based on the Gaussian white noise probability space, to be compared with Malliavin calculus based on the Wiener process. It was initiated by Takeyuki Hida in his 1975 Carleton Mathematical Lecture Notes.