A variety of measures of national income and output are used in economics to estimate total economic activity in a country or region, including gross domestic product (GDP), Gross national income (GNI), net national income (NNI), and adjusted national income. All are specially concerned with counting the total amount of goods and services produced within the economy and by various sectors. The boundary is usually defined by geography or citizenship, and it is also defined as the total income of the nation and also restrict the goods and services that are counted. For instance, some measures count only goods & services that are exchanged for money, excluding bartered goods, while other measures may attempt to include bartered goods by imputing monetary values to them.

Comparative advantage in an economic model is the advantage over others in producing a particular good. A good can be produced at a lower relative opportunity cost or autarky price, i.e. at a lower relative marginal cost prior to trade. Comparative advantage describes the economic reality of the gains from trade for individuals, firms, or nations, which arise from differences in their factor endowments or technological progress.

Purchasing power parity (PPP) is a measure of the price of specific goods in different countries and is used to compare the absolute purchasing power of the countries' currencies. PPP is effectively the ratio of the price of a market basket at one location divided by the price of the basket of goods at a different location. The PPP inflation and exchange rate may differ from the market exchange rate because of tariffs, and other transaction costs.

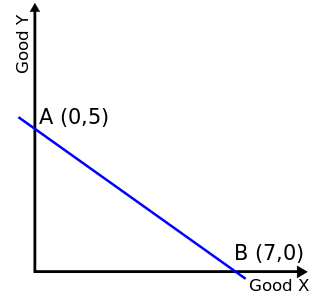

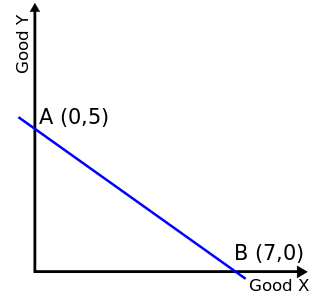

In economics, a budget constraint represents all the combinations of goods and services that a consumer may purchase given current prices within their given income. Consumer theory uses the concepts of a budget constraint and a preference map as tools to examine the parameters of consumer choices. Both concepts have a ready graphical representation in the two-good case. The consumer can only purchase as much as their income will allow, hence they are constrained by their budget. The equation of a budget constraint is where is the price of good X, and is the price of good Y, and m is income.

A cost-of-living index is a theoretical price index that measures relative cost of living over time or regions. It is an index that measures differences in the price of goods and services, and allows for substitutions with other items as prices vary.

In economics, nominalvalue refers to value measured in terms of absolute money amounts, whereas real value is considered and measured against the actual goods or services for which it can be exchanged at a given time. Real value takes into account inflation and the value of an asset in relation to its purchasing power.

In economics, output is the quantity and quality of goods or services produced in a given time period, within a given economic network, whether consumed or used for further production. The economic network may be a firm, industry, or nation. The concept of national output is essential in the field of macroeconomics. It is national output that makes a country rich, not large amounts of money.

A price index is a normalized average of price relatives for a given class of goods or services in a given region, during a given interval of time. It is a statistic designed to help to compare how these price relatives, taken as a whole, differ between time periods or geographical locations.

The Heckscher–Ohlin model is a general equilibrium mathematical model of international trade, developed by Eli Heckscher and Bertil Ohlin at the Stockholm School of Economics. It builds on David Ricardo's theory of comparative advantage by predicting patterns of commerce and production based on the resources of a trading region. The model essentially says that countries export the products which use their relatively abundant and cheap factors of production, and import the products which use the countries' relatively scarce factors.

A commodity currency is a currency that co-moves with the world prices of primary commodity products, due to these countries' heavy dependency on the export of certain raw materials for income. Commodity currencies are most prevalent in developing countries. In the foreign exchange market, commodity currencies generally refer to the New Zealand dollar, Norwegian krone, South African rand, Brazilian real, Russian ruble and the Chilean peso. Commodity currencies' nature can allow foreign exchange traders to more accurately gauge a currency's value, and predict movements within markets based on the perceived value of the correlated commodity.

The Marshall–Lerner condition is satisfied if the absolute sum of a country's export and import demand elasticities is greater than one. If it is satisfied, then if a country begins with a zero trade deficit then when the country's currency depreciates, its balance of trade will improve. The country's imports become more expensive and exports become cheaper due to the change in relative prices, and the Marshall-Lerner condition implies that the indirect effect on the quantity of trade will exceed the direct effect of the country having to pay a higher price for its imports and receive a lower price for its exports.

The EURO STOXX 50 is a stock index of Eurozone stocks designed by STOXX, an index provider owned by Deutsche Börse Group. The index is composed of 50 stocks from 11 countries in the Eurozone.

Unequal exchange is used primarily in Marxist economics, but also in ecological economics, to describe the systemic hidden transfer of labor and ecological value from poor countries in the imperial periphery to rich countries and monopolistic corporations in the imperial core due to structural inequalities in the global economy.

The U.S. Import and Export Price Indexes measure average changes in prices of goods and services that are imported to or exported from the U.S.. The indexes are produced monthly by the International Price Program (IPP) of the Bureau of Labor Statistics. The Import and Export Price Indexes were published quarterly starting in 1974 and monthly since 1989.

An importer is the receiving country in an export from the sending country. Importation and exportation are the defining financial transactions of international trade. Import is part of the International Trade which involves buying and receiving of goods or services produced in another country. The seller of such goods and services is called an exporter, while the foreign buyer is known as an importer.

The international dollar, also known as Geary–Khamis dollar, is a hypothetical unit of currency that has the same purchasing power parity that the U.S. dollar had in the United States at a given point in time. It is mainly used in economics and financial statistics for various purposes, most notably to determine and compare the purchasing power parity and gross domestic product of various countries and markets. The year 1990 or 2000 is often used as a benchmark year for comparisons that run through time. The unit is often abbreviated, e.g. 2000 US dollars or 2000 International$.

The Japan Crude Cocktail (JCC) is the informal nickname given to the pricing index of Crude Oil used in most East Asian countries. The JCC is the average price of customs-cleared crude oil imports into Japan and is published by the Petroleum Association of Japan. The official name of the JCC is the Japan Customs-cleared Crude Oil Price. The valuation of the JCC closely reflects the market state of supply and demand. Clear fluctuations in JCC pricing can be linked to distinct events such as the 2007-08 Global Financial Crisis and the 2011 Fukushima Disaster.

The FAO Food Price Index (FFPI) is a food price index by the Food and Agriculture Organization (FAO) of the United Nations. It records the development of world market prices of 55 agricultural commodities and foodstuffs. The FFPI is considered an indicator of future inflation and cost trends in the food industry.