Related Research Articles

Investment is traditionally defined as the "commitment of resources to achieve later benefits". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broader viewpoint, an investment can be defined as "to tailor the pattern of expenditure and receipt of resources to optimise the desirable patterns of these flows". When expenditures and receipts are defined in terms of money, then the net monetary receipt in a time period is termed cash flow, while money received in a series of several time periods is termed cash flow stream.

In finance, being short in an asset means investing in such a way that the investor will profit if the market value of the asset falls. This is the opposite of the more common long position, where the investor will profit if the market value of the asset rises. An investor that sells an asset short is, as to that asset, a short seller.

A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate, and property.

Preferred stock is a component of share capital that may have any combination of features not possessed by common stock, including properties of both an equity and a debt instrument, and is generally considered a hybrid instrument. Preferred stocks are senior to common stock but subordinate to bonds in terms of claim and may have priority over common stock in the payment of dividends and upon liquidation. Terms of the preferred stock are described in the issuing company's articles of association or articles of incorporation.

An investment trust is a form of investment fund found mostly in the United Kingdom and Japan. Investment trusts are constituted as public limited companies and are therefore closed ended since the fund managers cannot redeem or create shares.

Soros Fund Management, LLC is a privately held American investment management firm. It is currently structured as a family office, but formerly as a hedge fund. The firm was founded in 1970 by George Soros and, in 2010, was reported to be one of the most profitable firms in the hedge fund industry, averaging a 20% annual rate of return over four decades. It is headquartered at 250 West 55th Street in New York. As of 2023, Soros Fund Management, LLC had $25 billion in AUM.

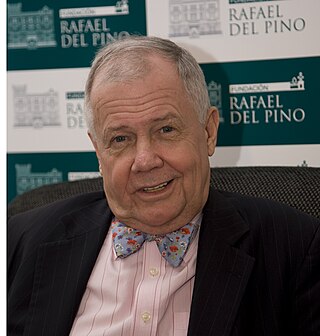

James Beeland Rogers Jr. is an American investor and financial commentator based in Singapore. He is the chairman of Beeland Interests, Inc. He was the co-founder of the Quantum Fund and Soros Fund Management. He was also the creator of the Rogers International Commodities Index (RICI).

James Derrick Slater was a British accountant, investor and business writer. Slater rose to prominence in the 1970s as a businessman and financier, who was the founding Chairman of Slater Walker, an investment bank and conglomerate which collapsed in the secondary banking crisis of 1973–75.

Share repurchase, also known as share buyback or stock buyback, is the reacquisition by a company of its own shares. It represents an alternate and more flexible way of returning money to shareholders. Repurchases allow stockholders to delay taxes which they would have been required to pay on dividends in the year the dividends are paid, to instead pay taxes on the capital gains they receive when they sell the stock, whose price is now proportionally higher because of the smaller number of shares outstanding.

English trust law concerns the protection of assets, usually when they are held by one party for another's benefit. Trusts were a creation of the English law of property and obligations, and share a subsequent history with countries across the Commonwealth and the United States. Trusts developed when claimants in property disputes were dissatisfied with the common law courts and petitioned the King for a just and equitable result. On the King's behalf, the Lord Chancellor developed a parallel justice system in the Court of Chancery, commonly referred as equity. Historically, trusts have mostly been used where people have left money in a will, or created family settlements, charities, or some types of business venture. After the Judicature Act 1873, England's courts of equity and common law were merged, and equitable principles took precedence. Today, trusts play an important role in financial investment, especially in unit trusts and in pension trusts. Although people are generally free to set the terms of trusts in any way they like, there is a growing body of legislation to protect beneficiaries or regulate the trust relationship, including the Trustee Act 1925, Trustee Investments Act 1961, Recognition of Trusts Act 1987, Financial Services and Markets Act 2000, Trustee Act 2000, Pensions Act 1995, Pensions Act 2004 and Charities Act 2011.

The United Kingdom company law regulates corporations formed under the Companies Act 2006. Also governed by the Insolvency Act 1986, the UK Corporate Governance Code, European Union Directives and court cases, the company is the primary legal vehicle to organise and run business. Tracing their modern history to the late Industrial Revolution, public companies now employ more people and generate more of wealth in the United Kingdom economy than any other form of organisation. The United Kingdom was the first country to draft modern corporation statutes, where through a simple registration procedure any investors could incorporate, limit liability to their commercial creditors in the event of business insolvency, and where management was delegated to a centralised board of directors. An influential model within Europe, the Commonwealth and as an international standard setter, UK law has always given people broad freedom to design the internal company rules, so long as the mandatory minimum rights of investors under its legislation are complied with.

Carried interest, or carry, in finance, is a share of the profits of an investment paid to the investment manager specifically in alternative investments. It is a performance fee, rewarding the manager for enhancing performance. Since these fees are generally not taxed as normal income, some believe that the structure unfairly takes advantage of favorable tax treatment, e.g. in the United States.

Stocks consist of all the shares by which ownership of a corporation or company is divided. A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets, or voting power, often dividing these up in proportion to the number of like shares each stockholder owns. Not all stock is necessarily equal, as certain classes of stock may be issued, for example, without voting rights, with enhanced voting rights, or with a certain priority to receive profits or liquidation proceeds before or after other classes of shareholders.

Learoyd v Whiteley[1887] UKHL 1 is an English trusts law case, concerning the duty of care owed by a trustee when exercising the power of investment.

A second bank rescue package totalling at least £50 billion was announced by the British government on 12 January 2009, as a response to the then-ongoing Financial crisis of 2007–2008. The package was designed to increase the amount of money that banks could lend to businesses and private individuals. This aid came in two parts: an initial £50 billion made available to big corporate borrowers, and a second undisclosed amount that formed a form of insurance against banks suffering big losses.

Speight v Gaunt [1883] UKHL 1 is an English trusts law case, concerning the extent of the duty of care owed by a fiduciary.

Nestle v National Westminster Bank plc [1992] EWCA Civ 12 is an English trusts law case concerning the duty of care when a trustee is making an investment.

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group such as reducing the risks of the investment by a significant percentage. These advantages include an ability to:

Mobli was a social mobile photo and video-sharing website founded by Israeli entrepreneurs and brothers Moshe and Oded Hogeg. As of 2016 the service was shut down and the company placed into bankruptcy.

Australian Iron & Steel was an Australian iron and steel manufacturer.

References

- ↑ "Can investors use the Zulu Principle to beat the S&P 500?". Yahoo Finance. Retrieved 2023-05-01.

Bibliography

- Slater, Jim (1992), The Zulu Principle: Making Extraordinary Profits from Ordinary Shares, Orion, ISBN 1-85797-095-0