Related Research Articles

Insider trading is the trading of a public company's stock or other securities based on material, nonpublic information about the company. In various countries, some kinds of trading based on insider information are illegal. This is because it is seen as unfair to other investors who do not have access to the information, as the investor with insider information could potentially make larger profits than a typical investor could make. The rules governing insider trading are complex and vary significantly from country to country. The extent of enforcement also varies from one country to another. The definition of insider in one jurisdiction can be broad and may cover not only insiders themselves but also any persons related to them, such as brokers, associates, and even family members. A person who becomes aware of non-public information and trades on that basis may be guilty of a crime.

The Commodity Futures Trading Commission (CFTC) is an independent agency of the US government created in 1974 that regulates the U.S. derivatives markets, which includes futures, swaps, and certain kinds of options.

Henry McKelvey Blodget is an American businessman, investor and journalist. He is notable for his former career as an equity research analyst who was senior Internet analyst for CIBC Oppenheimer and the head of the global Internet research team at Merrill Lynch during the dot-com era. Blodget was charged with civil securities fraud by the U.S. Securities and Exchange Commission and settled the charges. Blodget is the co-founder and former CEO of Business Insider.

The Dun & Bradstreet Corporation is an American company that provides commercial data, analytics, and insights for businesses. Headquartered in Jacksonville, Florida, the company offers a wide range of products and services for risk and financial analysis, operations and supply, and sales and marketing professionals, as well as research and insights on global business issues. It serves customers in government and industries such as communications, technology, strategic financial services, and retail, telecommunications, and manufacturing markets. Often referred to as D&B, the company's database contains over 500 million business records worldwide.

The Cornell Daily Sun is an independent newspaper published three times a week in Ithaca, New York, by students at Cornell University and hired employees. Founded in 1880, The Sun is the oldest continuously independent college daily in the United States.

Securities fraud, also known as stock fraud and investment fraud, is a deceptive practice in the stock or commodities markets that induces investors to make purchase or sale decisions on the basis of false information. The setups are generally made to result in monetary gain for the deceivers, and generally result in unfair monetary losses for the investors. They are generally violating securities laws.

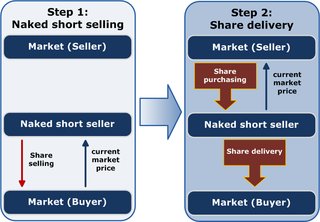

Naked short selling, or naked shorting, is the practice of short-selling a tradable asset of any kind without first borrowing the asset from someone else or ensuring that it can be borrowed. When the seller does not obtain the asset and deliver it to the buyer within the required time frame, the result is known as a "failure to deliver" (FTD). The transaction generally remains open until the asset is acquired and delivered by the seller, or the seller's broker settles the trade on their behalf.

State Street Global Advisors (SSGA) is the investment management division of State Street Corporation and the world's fourth largest asset manager, with nearly $4.14 trillion (USD) in assets under management as of 31 December 2021.

MarketWatch is a website that provides financial information, business news, analysis, and stock market data. It is a subsidiary of Dow Jones & Company, a property of News Corp, along with The Wall Street Journal and Barron's,

Canadian Securities Exchange (CSE), operated by CNSX Inc., is a stock exchange domiciled in Canada. When recognized by the Ontario Securities Commission in 2004, CSE was the first new exchange approved in Ontario in 70 years. The CSE is a rapidly growing stock exchange focused on working with entrepreneurs to access the public capital markets in Canada and internationally. The Exchange's efficient operating model, advanced technology and low fee structure help companies of all sizes minimize their cost of capital and maximize access to liquidity.

The Financial Industry Regulatory Authority (FINRA) is a private American corporation that acts as a self-regulatory organization (SRO) that regulates member brokerage firms and exchange markets. FINRA is the successor to the National Association of Securities Dealers, Inc. (NASD) as well as the member regulation, enforcement, and arbitration operations of the New York Stock Exchange. The U.S. government agency that acts as the ultimate regulator of the U.S. securities industry, including FINRA, is the U.S. Securities and Exchange Commission (SEC).

A bucket shop is a business that allows gambling based on the prices of stocks or commodities. A 1906 U.S. Supreme Court ruling defined a bucket shop as "an establishment, nominally for the transaction of a stock exchange business, or business of similar character, but really for the registration of bets, or wagers, usually for small amounts, on the rise or fall of the prices of stocks, grain, oil, etc., there being no transfer or delivery of the stock or commodities nominally dealt in".

Bankrate, LLC is a consumer financial services company based in New York City. Bankrate.com, perhaps its best-known brand, is a personal finance website. As of November 8, 2017, it became a subsidiary of Red Ventures through an acquisition.

SumTotal Systems, Inc. is a software company based in Gainesville, Florida, that provides human resource management software and services to private and public sector organizations. The company uses multiple cloud-based channels, including software as a service (SaaS), hosted subscription, and premises-based licensure.

Stock market data systems communicate market data—information about securities and stock trades—from stock exchanges to stockbrokers and stock traders.

Huron Consulting Group, commonly known as Huron, is a management consulting firm offering services to the healthcare, life sciences, commercial, and higher education industries.

SIX operates the infrastructure for the Swiss financial centre. The company provides services relating to securities transactions, the processing of financial information, payment transactions and is building a digital infrastructure. The company name SIX is an abbreviation and stands for Swiss Infrastructure and Exchange. SIX is globally active, with its headquarters in Zurich.

Cboe Global Markets is an American company that owns the Chicago Board Options Exchange and the stock exchange operator BATS Global Markets.

Meristem Securities Limited is a Nigerian Capital Market Conglomerate regulated by the Securities and Exchange Commission (SEC), based in Lagos State, Nigeria. Formerly known as Great Africa Securities Limited and founded in 2003, the company had a change of name to Meristem in 2005. The company consists of six subsidiaries: Meristem Stockbrokers, Meristem Wealth, Meristem Registrars and Probate Services, Meristem Capital, Meristem Trustees, and Meristem Finance.

Futu Holdings Limited operates as a holding company in digitized brokerage and wealth management platform in China, Hong Kong, the United States, and internationally. The largest investor of Futu as of 2019 is Tencent. Founder Leaf Li is a former employee of Tencent. The company originally traded as NASDAQ symbol FHL, but changed to FUTU.

References

- 1 2 "Thom Calandra". silverbearcafe.com. Retrieved 2015-07-05.

- ↑ Thom Calandra (March 7, 2014). "The Calandra Report: Everything's coming up Stellar". stockhouse.com. Retrieved 2015-07-05.

- ↑ "Who The H Is Thom? [& Where?]". thomcalandra.com. Retrieved 2015-07-05.

- 1 2 3 4 5 "MarketWatch.com commentator Calandra resigns". MarketWatch . January 22, 2004. Retrieved 2015-07-05.

- 1 2 3 Michael Liedtke (January 22, 2004). "MarketWatch.com's chief commentator quits". USA Today . Retrieved 2015-07-05.

- ↑ Chris Roush (October 12, 2007). "Thom Calandra has seen the light". Talking Biz News. Retrieved 2015-07-05.

- ↑ "Securities and Exchange Commission v. Thom Calandra" (PDF). U.S. Securities and Exchange Commission. January 10, 2005. Retrieved 2015-07-05.

- 1 2 3 "SEC BRINGS FRAUD CHARGES AGAINST FORMER CBS MARKETWATCH COLUMNIST THOM CALANDRA FOR ILLEGAL TRADING SCHEME". U.S. Securities and Exchange Commission. January 10, 2005. Retrieved 2015-07-04.

- ↑ Lawrence Klein; Viktoria Dalko; Michael Wang (2012). Regulating Competition in Stock Markets. John Wiley & Sons. ISBN 978-1118236864 . Retrieved 2015-07-05.

- 1 2 Karen Roche (November 17, 2011). "Thom Calandra: taking calculated yet extreme risks in mining". The Gold Report. Retrieved 2015-07-05.

- ↑ "Stockhouse Launches Ticker Trax by Thom Calandra Service". December 2008. Retrieved 2015-07-05.

- ↑ Thom Calandra (August 11, 2012). "TCR returns".