Toggenburger Bank is one of the original predecessor banks to the Union Bank of Switzerland and ultimately UBS. Established in 1863, the bank merged with the Bank in Winterthur in 1912 to form the Union Bank of Switzerland.

Toggenburger Bank is one of the original predecessor banks to the Union Bank of Switzerland and ultimately UBS. Established in 1863, the bank merged with the Bank in Winterthur in 1912 to form the Union Bank of Switzerland.

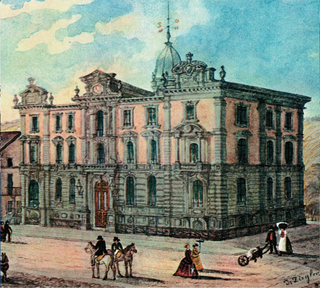

In 1863, the Toggenburger Bank was founded in Lichtensteig, Switzerland (canton of St. Gallen), with an initial share capital of 1.5 million CHF. [1]

The Toggenburger Bank was a savings and mortgage bank for individual customers with a branch office network in Eastern Switzerland. [2] In 1882, Toggenburger Bank opened a branch in St. Gallen in eastern Switzerland and began to shift its operations there through the end of the 19th century. [1]

The Union Bank of Switzerland was formed in 1912 when the Bank in Winterthur merged with the Toggenburger Bank. The combined bank had total assets of 202 million CHF and a total shareholders' equity of 46 million CHF. [1] This combination was part of a larger trend toward concentration in the banking sector in Switzerland at the time. Through the next few years, the bank would begin to shift its operations to Zurich from its historical headquarters in the cities of Winterthur and St. Gallen, Switzerland. In 1917, UBS completed construction of a new headquarters in Zurich on Bahnhofstrasse, considered to be the Wall Street of Switzerland. [3]

The new bank used different names in its three core languages: German, French and English. In German, the bank was Schweizerische Bankgesellschaft and was known by the initials SBG. The original English name for the combined bank was the Swiss Banking Association, but it was later changed to Union Bank of Switzerland in 1921 to mirror the French form of the name: Union de Banques Suisses. The bank's logo, introduced in 1966, would later reflect both the German SBG and the English and French name UBS. [3]

Union Bank of Switzerland (UBS) was a Swiss investment bank and financial services company located in Switzerland. The bank, which at the time was the second largest bank in Switzerland, merged with Swiss Bank Corporation in 1998 to become UBS. This merger formed what was then the largest bank in Europe and the second largest bank in the world.

The Swiss rail network is noteworthy for its density, its coordination between services, its integration with other modes of transport, timeliness and a thriving domestic and trans-alp freight system. This is made necessary by strong regulations on truck transport, and is enabled by properly coordinated intermodal logistics.

Banking in Switzerland dates to the early 18th century through Switzerland's merchant trade and has, over the centuries, grown into a complex, regulated, and international industry. Banking is seen as emblematic of Switzerland. The country has a long history of banking secrecy and client confidentiality reaching back to the early 1700s. Starting as a way to protect wealthy European banking interests, Swiss banking secrecy was codified in 1934 with the passage of a landmark federal law, the Federal Act on Banks and Savings Banks. These laws, which were used to protect assets of persons being persecuted by Nazi authorities, have also been used by people and institutions seeking to illegally evade taxes, hide assets, or generally commit financial crime.

Winterthur is a city in the canton of Zürich in northern Switzerland. With over 110,000 residents, it is the country's sixth-largest city by population, as well as its ninth-largest agglomeration with about 140,000 inhabitants. Located about 20 kilometres (12 mi) northeast of Zürich, Winterthur is a service and high-tech industrial satellite city within Greater Zürich.

Swiss Bank Corporation was a Swiss investment bank and financial services company located in Switzerland. Prior to its merger, the bank was the third largest in Switzerland, with over CHF 300 billion of assets and CHF 11.7 billion of equity.

Credit Suisse Group AG is a global investment bank and financial services firm founded and based in Switzerland. Headquartered in Zürich, it maintains offices in all major financial centers around the world and provides services in investment banking, private banking, asset management, and shared services. It is known for strict bank–client confidentiality and banking secrecy. The Financial Stability Board considers it to be a global systemically important bank. Credit Suisse is also a primary dealer and Forex counterparty of the Federal Reserve in the United States.

Julius Bär Group AG, known alternatively as Julius Baer Group Ltd., is a private banking corporation founded and based in Switzerland. Headquartered in Zürich, it is among the older Swiss banking institutions. In terms of assets under management, Julius Baer is number two among Swiss banks after UBS and the biggest pure-play private bank.

The Polybahn, also known as the UBS Polybahn, is a funicular railway in the city of Zürich, Switzerland. The line links the Central square with the terrace by the main building of ETH Zürich, which was formerly called Eidgenössisches Polytechnikum, and from which the railway derives its name. Previous names for the line include the SBG Polybahn and the Zürichbergbahn. The line is owned by the banking group UBS AG, and operated on their behalf by the municipal transport operator Verkehrsbetriebe Zürich.

The cantonal banks are 24 Swiss government-owned commercial banks. Most of them were founded between 1834 and 1916, although the Banque cantonale du Jura was founded in 1979, as the canton of Jura was not formed until 1978, by its separation from the Canton of Berne. 21 are provided by the canton in which they are based, with a guarantee for the assets held there.

Ulrich Körner is a German-Swiss businessman. In March 2021, he was named CEO Asset Management of Credit Suisse until July 2022, when he was appointed CEO of Credit Suisse AG.

The Swiss Northeastern Railway was an early railway company in Switzerland. It also operated shipping on Lake Constance (Bodensee) and Lake Zürich. Until the merger of the Western Swiss Railways into the Jura–Simplon Railway (JS) in 1890/91, it was the largest Swiss railway company.

The United Swiss Railways was a former railway company in Switzerland. It was the smallest of the five main railways that were nationalised from 1902 to form the Swiss Federal Railways.

Rail 2000 is a large-scale project of the Swiss Federal Railways (SBB CFF FFS) established in 1987 to improve the quality of the Swiss rail network for the New millennium. It includes measures to accelerate a number of existing connections and the modernisation of rolling stock. The federal government decision to support the project in 1986 was approved by a referendum in 1987. In 2004 the first phase was completed consisting of around 130 projects with a budget of around CHF 5.9 billion.

UBS Group AG is a multinational investment bank and financial services company founded and based in Switzerland. Headquartered in Zürich, it maintains a presence in all major financial centres as the largest Swiss banking institution and the largest private bank in the world. UBS client services are known for their strict bank–client confidentiality and culture of banking secrecy. Because of the bank's large positions in the Americas, EMEA, and Asia Pacific markets, the Financial Stability Board considers it a global systemically important bank.

The Bank in Winterthur is one of the original predecessor banks to the Union Bank of Switzerland and ultimately UBS. Established in 1862, the bank merged with Toggenburger Bank in 1912 to form the Union Bank of Switzerland.

Dr. Rudolf Ernst of Winterthur was a Swiss Industrial, Insurance, Banking Pioneer and founding father of UBS. He was also the first CEO and Chairman of the Board of Directors of the Union Bank of Switzerland, now UBS. Following his retirement, at age 77, he was elected Honorary Chairman of the Union Bank of Switzerland for life, but remained on the Board of Directors until 1953, when he retired at age 87.<SBG/UBS Commemorative Book 1862 1912 1962>

Wegelin & Co. is a former private bank that was located in St. Gallen in the Canton of St. Gallen in Switzerland, and specialized in private banking and asset management.

Raiffeisen Switzerland is a cooperative of cooperatives – the union of all independent Swiss Raiffeisen banks. It bears responsibility for the business policy and strategy within the Raiffeisen Group. The 219 independent Raiffeisen banks of Switzerland are organised as cooperatives. With 896 branch offices in total, they make up the densest branch network of any Swiss bank. After the acquisition of Credit Suisse by UBS, the Raiffeisen Group has become the second-largest banking group in Switzerland with client assets under management of 246.6 billion francs. Since June 2014, Raiffeisen has been classified as one of Switzerland's systemically important banks and must therefore meet special requirements in terms of capital. Raiffeisen Switzerland has 3.65 million clients in Switzerland, of whom approximately 1.9 million are cooperative members and thus co-owners of their regional Raiffeisen banks.

Hyposwiss Private Bank Ltd was a Swiss private bank, located in Zurich, that closed in 2013.

The Wil–Ebnat-Kappel railway is a single-track standard-gauge line that runs through the Toggenburg region of Switzerland. It was built by the Toggenburgerbahn. Its 25 kilometre-long, standard gauge line from Wil via Wattwil to Ebnat-Kappel was opened on 24 June 1870. The TB was nationalised as of 1 July 1902 and became part of the Swiss Federal Railways (SBB).