Related Research Articles

A startup or start-up is a company or project undertaken by an entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship includes all new businesses including self-employment and businesses that do not intend to go public, startups are new businesses that intend to grow large beyond the solo-founder. During the beginning, startups face high uncertainty and have high rates of failure, but a minority of them do go on to become successful and influential, such as unicorns.

Venture capital (VC) is a form of private equity financing provided by firms or funds to startup, early-stage, and emerging companies, that have been deemed to have high growth potential or that have demonstrated high growth in terms of number of employees, annual revenue, scale of operations, etc. Venture capital firms or funds invest in these early-stage companies in exchange for equity, or an ownership stake. Venture capitalists take on the risk of financing start-ups in the hopes that some of the companies they support will become successful. Because startups face high uncertainty, VC investments have high rates of failure. Start-ups are usually based on an innovative technology or business model and they are often from high technology industries, such as information technology (IT), clean technology or biotechnology.

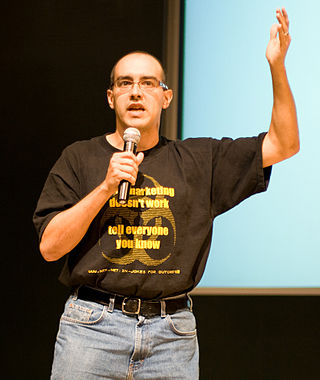

Jason McCabe Calacanis is an American Internet entrepreneur, angel investor, author and podcaster.

An angel investor is an individual who provides capital to a business or businesses, including startups, usually in exchange for convertible debt or ownership equity. Angel investors often provide support to startups at a very early stage, once or in a consecutive manner, and when most investors are not prepared to back them. In a survey of 150 founders conducted by Wilbur Labs, about 70% of entrepreneurs will face potential business failure, and nearly 66% will face this potential failure within 25 months of launching their company. A small but increasing number of angel investors invest online through equity crowdfunding or organize themselves into angel groups or angel networks to share investment capital and provide advice to their portfolio companies. The number of angel investors has greatly increased since the mid-20th century.

Techstars is a pre-seed investor that provides access to capital, mentorship, and other support for early-stage entrepreneurs. It was founded in 2006 in Boulder, Colorado. As of January 2024, the company had accepted over 4,100 companies into its accelerator programs with a combined market capitalization of $106bn USD. Techstars operates accelerator programs in the Americas, Europe, the Middle East, Africa, Asia, and Oceania.

Chris Dixon is an American internet entrepreneur and investor. He is a general partner at the venture capital firm Andreessen Horowitz, and previously worked at eBay. He is also the co-founder and former CEO of Hunch. He was #1 on the Midas List in 2022. Dixon is known as a cryptocurrency and Web3 evangelist.

The Band of Angels was the first high technology specific angel investment group in the United States. Today the group remains very active with more than 160 members who invest their time and money into high tech startup companies. Band members have founded companies such as Cirrus Logic, Symantec, SunPower, National Semiconductor and Logitech, and have been senior executive officers at top Silicon Valley companies including Sun Microsystems, Hewlett Packard, Intel, 3Com and Intuit. Numerous articles have been written about the Band, appearing in periodicals such as The New York Times, The Washington Post, The Wall Street Journal, Upside, Red Herring, Der Spiegel, U.S. News & World Report, and Forbes. The Band has also been featured in two Harvard Business School case studies.

William Klippgen is a Singapore-based Norwegian entrepreneur and technology venture capitalist who co-founded the price comparison portal Zoomit.com. He served as one of the judges on the television series Angel's Gate, which was broadcast on Channel NewsAsia in 2012. Klippgen is a co-founder and serves as the Managing Partner at Cocoon Capital. He holds an MBA from INSEAD where he is an Entrepreneur in Residence.

David "Dave" McClure is an entrepreneur and angel investor based in the San Francisco Bay Area, who founded the business accelerator 500 Startups and served as its CEO until his resignation in 2017. He founded Practical Venture Capital soon after, a new venture capital fund that would continue to work with companies he previously funded through 500 Startups.

David Semel Rose is an American serial entrepreneur and angel investor. He is an investor in startup technology companies and founder of New York Angels, an early-stage technology investment group. He is Managing Partner of Rose Tech Ventures, a venture fund focused on Internet-based business, and CEO of Gust, which operates a collaboration platform for early stage angel investing.

Space Capital LP is an early-stage venture capital firm that invests exclusively in space-based technologies. Formed in 2017 it is based in New York City. Space Capital is the parent brand of Space Angels, an online angel investment platform, and Space Talent, a career platform and central node for space industry jobs.

CircleUp is a financial technology company based in San Francisco that focuses on consumer goods startups. Since its official launch in April 2012, CircleUp has helped several consumer companies raise equity, including Back to the Roots, Halo Top Creamery, Little Duck Organics, Rhythm Superfoods and others. General Mills has an investment fund that is partnered with CircleUp to invest in companies listed on the platform.

AngelList is an American software company for fundraising and connecting startups, angel investors, and limited partners. Founded in 2010, it started as an online introduction board for tech startups that needed seed funding. Since 2015, the site allows startups to raise money from angel investors free of charge. Created by serial entrepreneur Naval Ravikant and Babak Nivi in 2010, Avlok Kohli has been leading AngelList as its CEO since 2019.

Martin "Marty" C. Zwilling is an American business executive, entrepreneur, and author.

In business, a unicorn is a startup company valued at over US$1 billion which is privately owned and not listed on a share market. The term was first published in 2013, coined by venture capitalist Aileen Lee, choosing the mythical animal to represent the statistical rarity of such successful ventures.

A unicorn bubble is a theoretical economic bubble that would occur when unicorn startup companies are overvalued by venture capitalists or investors. This can either occur during the private phase of these unicorn companies, or in an initial public offering. A unicorn company is a startup company valued at, or above, $1 billion US dollars.

Fadi Ghandour is a Lebanese Jordanian entrepreneur, investor, and philanthropist. He is the Executive Chairman of Wamda, a platform that builds and invests in entrepreneurship ecosystems across the Middle East and North Africa, Turkey and East Africa through Ecosystem Development programs and a venture capital fund investing in technology-enabled companies that operate in these markets.

Jennifer Fonstad is an American venture capital investor and entrepreneur. She is the managing partner and a co-founder of the Owl Capital Group, a venture firm based in Silicon Valley. Fonstad was Managing Director of Draper Fisher Jurvetson (DFJ) for 17 years. She is also co-founder of angel investing network Broadway Angels. Fonstad has been recognized as a top 100 tech investor on Forbes’ Midas List twice and was named 2016 Venture Capitalist of the Year by Deloitte. She is also a Founding Member of All Raise.

Icehouse Ventures is a New Zealand-based venture capital firm. The firm is headquartered in Auckland and mainly focuses on the technology industry and has backed 200 companies. The firm also operates a variety of angel groups networks such as Ice Angels and Arc Angels. Icehouse Ventures was formally founded in 2019 as a separate company but had operated as part of the Icehouse group since 2001. In 2019, the founding CEO of the Icehouse stepped down as CEO and joined the board of directors of Icehouse Ventures.

Eric Paley is an American entrepreneur and venture capitalist. He is the co-founder and managing partner of Founder Collective, a seed-stage venture capital fund based in Cambridge, Massachusetts.

References

- ↑ Tucker, Charlotte (2020-11-06). "Berlin-based HR & legaltech twinwin raises €285K to help employers and employees part on good terms". EU-Startups. Retrieved 2021-01-13.

- ↑ Mestrovic-Wattenberg, Astrid (2020-12-17). "LegalTech aus Düsseldorf RightNow erhält €8,5m in Series A Finanzierungsrunde". Spotfolio GmbH & Co. KGaA. Retrieved 2021-01-13.

- ↑ "RightNow Completes $10.5 Million Series A". www.goodwinlaw.com. Retrieved 2021-02-15.

- ↑ "Phillip Eischet: Right-Now-Gründer will jetzt auch Bahn-Kunden zu ihrem Recht verhelfen". www.handelsblatt.com (in German). Retrieved 2021-01-13.

- ↑ "Justice-as-a-Service at RightNow - Case - Faculty & Research - Harvard Business School". pubwww.hbs.edu. Retrieved 2021-01-13.

- ↑ "Do Algorithms Make Better — and Fairer — Investments Than Angel Investors?". Harvard Business Review. 2020-11-02. ISSN 0017-8012 . Retrieved 2021-02-15.