The False Claims Act (FCA), also called the "Lincoln Law", is an American federal law that imposes liability on persons and companies who defraud governmental programs. It is the federal Government's primary litigation tool in combating fraud against the Government. The law includes a qui tam provision that allows people who are not affiliated with the government, called "relators" under the law, to file actions on behalf of the government. Persons filing under the Act stand to receive a portion of any recovered damages.

Charles Ernest Grassley is an American politician serving as the president pro tempore emeritus of the United States Senate, and the senior United States senator from Iowa. He is in his seventh term in the Senate, having first been elected in 1980.

The United States federal budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. It has reported that large budget deficits over the next 30 years are projected to drive federal debt held by the public to unprecedented levels—from 98 percent of gross domestic product (GDP) in 2020 to 195 percent by 2050.

The Internal Revenue Service Restructuring and Reform Act of 1998, also known as Taxpayer Bill of Rights III,, resulted from hearings held by the United States Congress in 1996 and 1997. The Act included numerous amendments to the Internal Revenue Code of 1986.

A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of Title 26 of the United States Code. It is one of the 29 types of 501(c) nonprofit organizations in the US.

Kohn, Kohn & Colapinto is a Washington, D.C.-based international whistleblower rights law firm specializing in anti-corruption and whistleblower law, representing whistleblowers who seek rewards, or who are facing employer retaliation, for reporting violations of the False Claims Act, Foreign Corrupt Practices Act, Dodd-Frank Wall Street Reform, Sarbanes-Oxley Acts, Commodity and Security Exchange Acts and the IRS Whistleblower law.

Internal Revenue Service, Criminal Investigation (IRS-CI) is the United States federal law enforcement agency responsible for investigating potential criminal violations of the U.S. Internal Revenue Code and related financial crimes, such as money laundering, currency violations, tax-related identity theft fraud, and terrorist financing that adversely affect tax administration. While other federal agencies also have investigative jurisdiction for money laundering and some Bank Secrecy Act violations, IRS-CI is the only federal agency that can investigate potential criminal violations of the Internal Revenue Code, in a manner intended to foster confidence in the tax system and deter violations of tax law. Criminal Investigation is a division of the Internal Revenue Service, which in turn is a bureau within the United States Department of the Treasury.

The United States Department of Justice Tax Division is responsible for the prosecution of both civil and criminal cases arising under the Internal Revenue Code and other tax laws of the United States. The Division began operation in 1934, under United States Attorney General Homer Stille Cummings, who charged it with primary responsibility for supervising all federal litigation involving internal revenue.

The National Whistleblower Center (NWC) is a nonprofit, nonpartisan, tax exempt, educational and advocacy organization based in Washington, D.C. It was founded in 1988 by the lawyers Kohn, Kohn & Colapinto, LLP. As of March 2019, John Kostyack is the executive director. Since its founding, the Center has worked on whistleblower cases relating to environmental protection, nuclear safety, government and corporate accountability, and wildlife crime.

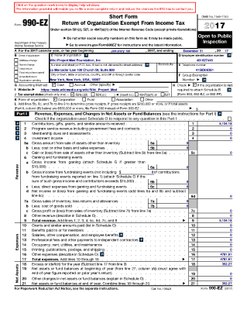

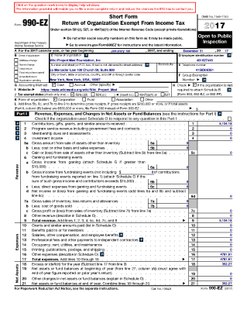

Form 990 is a United States Internal Revenue Service form that provides the public with financial information about a nonprofit organization. It is often the only source of such information. It is also used by government agencies to prevent organizations from abusing their tax-exempt status. Certain nonprofits have more comprehensive reporting requirements, such as hospitals and other health care organizations.

A tax protester is someone who refuses to pay a tax claiming that the tax laws are unconstitutional or otherwise invalid. Tax protesters are different from tax resisters, who refuse to pay taxes as a protest against a government or its policies, or a moral opposition to taxation in general, not out of a belief that the tax law itself is invalid. The United States has a large and organized culture of people who espouse such theories. Tax protesters also exist in other countries.

The Internal Revenue Service (IRS) is the revenue service of the United States federal government responsible for collecting taxes and administering the Internal Revenue Code, the main body of federal statutory tax law. It is part of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act.

Bradley Charles Birkenfeld is an American private banker, convicted felon, and whistleblower. During the mid- to late-2000s, he made a series of disclosures about UBS Group AG clients, in violation of Swiss banking secrecy laws, to the U.S. government alleging possible tax evasion. Known as the 2007 "Birkenfeld Disclosure", the U.S. Department of Justice (DOJ) announced it had reached a deferred prosecution agreement with UBS that resulted in a US$780 million fine and the release of previously privileged information on American tax evaders.

Robert S. Khuzami was the Deputy U.S. Attorney for the United States Attorney's Office for the Southern District of New York until March 22, 2019. He previously was a United States federal prosecutor and Assistant United States Attorney for the office, and a former director of the Division of Enforcement of the U.S. Securities and Exchange Commission. He was previously a partner at law firm Kirkland & Ellis. and general counsel of Deutsche Bank AG.

Health care fraud includes "snake oil" marketing, health insurance fraud, drug fraud, and medical fraud. Health insurance fraud occurs when a company or an individual defrauds an insurer or government health care program, such as Medicare or equivalent State programs. The manner in which this is done varies, and persons engaging in fraud are always seeking new ways to circumvent the law. Damages from fraud can be recovered by use of the False Claims Act, most commonly under the qui tam provisions which rewards an individual for being a "whistleblower", or relator (law).

The United States fiscal cliff refers to the combined effect of several previously-enacted laws that came into effect simultaneously in January 2013, increasing taxes and decreasing spending.

Under the federal law of the United States of America, tax evasion or tax fraud, is the purposeful illegal attempt of a taxpayer to evade assessment or payment of a tax imposed by Federal law. Conviction of tax evasion may result in fines and imprisonment. Compared to other countries, Americans are more likely to pay their taxes fairly, honestly, and on time.

The U.S. Securities and Exchange Commission (SEC) whistleblower program went into effect on July 21, 2010, when the President signed into law the Dodd-Frank Wall Street Reform and Consumer Protection Act. The same law also established a whistleblower incentive program at the Commodity Futures Trading Commission to incentivize reporting of violations of the Commodity Exchange Act, which is run by former senior SEC enforcement attorney Christopher C. Ehrman. The SEC Whistleblower Program rewards people who submit tips related to violations of the federal securities laws. The program offers robust employment protections, monetary awards and the ability to report anonymously. SEC whistleblowers are entitled to awards ranging from 10 to 30 percent of the monetary sanctions collected, which are paid from a replenishing Investor Protection Fund. Since 2011, whistleblower tips have enabled the SEC to recover over $2 billion in financial penalties from wrongdoers. The SEC has awarded more than $700 million to whistleblowers.

The Swiss investment bank and financial services company, UBS Group AG, has been at the center of numerous tax evasion and avoidance investigations undertaken by U.S., French, German, Israeli, and Belgian tax authorities as a consequence of their strict banking secrecy practices.

The Bipartisan Budget Act of 2018 is a federal statute concerning spending and the budget in the United States, that was signed into law by President Donald Trump on February 9, 2018. Delays in the passage of the bill caused a nine-hour funding gap. The bill is the third in a series that increased spending caps originally imposed by the Budget Control Act of 2011; the first two were the Bipartisan Budget Act of 2013 and the Bipartisan Budget Act of 2015.