A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equities and fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants.

Financial capital is any economic resource measured in terms of money used by entrepreneurs and businesses to buy what they need to make their products or to provide their services to the sector of the economy upon which their operation is based. In other words, financial capital is internal retained earnings generated by the entity or funds provided by lenders to businesses in order to purchase real capital equipment or services for producing new goods or services.

In finance, a bond is a type of security under which the issuer (debtor) owes the holder (creditor) a debt, and is obliged – depending on the terms – to provide cash flow to the creditor. The timing and the amount of cash flow provided varies, depending on the economic value that is emphasized upon, thus giving rise to different types of bonds. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure.

In corporate finance, a debenture is a medium- to long-term debt instrument used by large companies to borrow money, at a fixed rate of interest. The legal term "debenture" originally referred to a document that either creates a debt or acknowledges it, but in some countries the term is now used interchangeably with bond, loan stock or note. A debenture is thus like a certificate of loan or a loan bond evidencing the company's liability to pay a specified amount with interest. Although the money raised by the debentures becomes a part of the company's capital structure, it does not become share capital. Senior debentures get paid before subordinate debentures, and there are varying rates of risk and payoff for these categories.

In finance, a warrant is a security that entitles the holder to buy or sell stock, typically the stock of the issuing company, at a fixed price called the exercise price.

In finance, an equity derivative is a class of derivatives whose value is at least partly derived from one or more underlying equity securities. Options and futures are by far the most common equity derivatives, however there are many other types of equity derivatives that are actively traded.

In finance, a convertible bond, convertible note, or convertible debt is a type of bond that the holder can convert into a specified number of shares of common stock in the issuing company or cash of equal value. It is a hybrid security with debt- and equity-like features. It originated in the mid-19th century, and was used by early speculators such as Jacob Little and Daniel Drew to counter market cornering.

Preferred stock is a component of share capital that may have any combination of features not possessed by common stock, including properties of both an equity and a debt instrument, and is generally considered a hybrid instrument. Preferred stocks are senior to common stock but subordinate to bonds in terms of claim and may have priority over common stock in the payment of dividends and upon liquidation. Terms of the preferred stock are described in the issuing company's articles of association or articles of incorporation.

Fixed income refers to any type of investment under which the borrower or issuer is obliged to make payments of a fixed amount on a fixed schedule. For example, the borrower may have to pay interest at a fixed rate once a year and repay the principal amount on maturity. Fixed-income securities can be contrasted with equity securities that create no obligation to pay dividends or any other form of income. Bonds carry a level of legal protections for investors that equity securities do not: in the event of a bankruptcy, bond holders would be repaid after liquidation of assets, whereas shareholders with stock often receive nothing.

In economics and accounting, the cost of capital is the cost of a company's funds, or from an investor's point of view is "the required rate of return on a portfolio company's existing securities". It is used to evaluate new projects of a company. It is the minimum return that investors expect for providing capital to the company, thus setting a benchmark that a new project has to meet.

A convertible security is a financial instrument whose holder has the right to convert it into another security of the same issuer. Most convertible securities are convertible bonds or preferred stocks that pay regular interest and can be converted into shares of the issuer's common stock. Convertible securities typically include other embedded options, such as call or put options. Consequently, determining the value of convertible securities can be a complex exercise. The complex valuation issue may attract specialized professional investors, including arbitrageurs and hedge funds who try to exploit disparities in the relationship between the price of the convertible security and the underlying common stock.

Mezzanine capital is a type of financing that sits between senior debt and equity in a company's capital structure. It is typically used to fund growth, acquisitions, or buyouts. Technically, mezzanine capital can be either a debt or equity instrument with a repayment priority between senior debt and common stock equity. Mezzanine debt is subordinated debt that represents a claim on a company's assets which is senior only to that of the common shares and usually unsecured. Redeemable preferred stock equity, with warrants or conversion rights, is also a type of mezzanine financing.

Security market is a component of the wider financial market where securities can be bought and sold between subjects of the economy, on the basis of demand and supply. Security markets encompasses stock markets, bond markets and derivatives markets where prices can be determined and participants both professional and non professional can meet.

Earnings per share (EPS) is the monetary value of earnings per outstanding share of common stock for a company. It is a key measure of corporate profitability and is commonly used to price stocks.

Participating preferred stock is preferred stock that provides a specific dividend that is paid before any dividends are paid to common stock holders, and that takes precedence over common stock in the event of a liquidation. This form of financing is used by private equity investors and venture capital (VC) firms. Holders of participating preferred stock have the choice between two payoffs: a liquidation preference or an optional conversion. In a liquidation, they first get their money back at the original purchase price, the balance of any proceeds is then shared between common and participating preferred stock as though all convertible stock was converted. In an optional conversion, all shares are converted into common stock. Holders of participating preferred stock will always pick the option with the highest payoff.

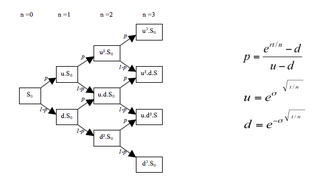

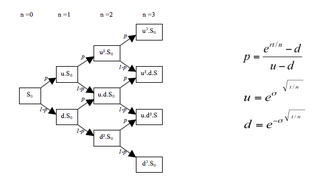

In finance, a lattice model is a technique applied to the valuation of derivatives, where a discrete time model is required. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at "all" times before and including maturity. A continuous model, on the other hand, such as Black–Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par. The method is also used for valuing certain exotic options, where because of path dependence in the payoff, Monte Carlo methods for option pricing fail to account for optimal decisions to terminate the derivative by early exercise, though methods now exist for solving this problem.

A reverse convertible security or convertible security is a short-term note linked to an underlying stock. The security offers a steady stream of income due to the payment of a high coupon rate. In addition, at maturity the owner will receive either 100% of the par value or, if the stock value falls, a predetermined number of shares of the underlying stock. In the context of structured product, a reverse convertible can be linked to an equity index or a basket of indices. In such case, the capital repayment at maturity is cash settled, either 100% of principal, or less if the underlying index falls conditional on barrier is hit in the case of barrier reverse convertibles.

A split share corporation is a corporation that exists for a defined period of time to transform the risk and investment return of a basket of shares of conventional dividend-paying corporations into the risk and return of the two or more classes of publicly traded shares in the split share corporation.

Stocks consist of all the shares by which ownership of a corporation or company is divided. A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets, or voting power, often dividing these up in proportion to the amount of money each stockholder has invested. Not all stock is necessarily equal, as certain classes of stock may be issued, for example, without voting rights, with enhanced voting rights, or with a certain priority to receive profits or liquidation proceeds before or after other classes of shareholders.

Hybrid investments, also known as derivatives or just hybrids, are a form of investment that combines equity and debt-like features, allowing companies to protect themselves against financial risks in securities transactions. This form of investment is essential for traders and investment professionals to diversify their asset portfolio. Hybrid Investments work to maintain a sense of security for both the business and the investor.