Related Research Articles

The economy of Denmark is a modern mixed economy with comfortable living standards, a high level of government services and transfers, and a high dependence on foreign trade. The economy is dominated by the service sector with 80% of all jobs, whereas about 11% of all employees work in manufacturing and 2% in agriculture. The nominal gross national income per capita was the seventh-highest in the world at $58,439 in 2020. Correcting for purchasing power, per capita income was Int$57,781 or 10th-highest globally. The Income distribution is relatively equal, but inequality has somewhat increased during the last decades. This increase was attributed to both a larger spread in gross incomes and various economic policy measures. In 2017, Denmark had the seventh-lowest Gini coefficient of the then 28 European Union countries. With 5,822,763 inhabitants, Denmark has the 36th largest national economy in the world measured by nominal gross domestic product (GDP), and the 51st largest in the world measured by purchasing power parity (PPP).

Guaranteed minimum income (GMI), also called minimum income, is a social-welfare system that guarantees all citizens or families an income sufficient to live on, provided that certain eligibility conditions are met, typically: citizenship; a means test; and either availability to participate in the labor market, or willingness to perform community services.

Official development assistance (ODA) is a category used by the Development Assistance Committee (DAC) of the Organisation for Economic Co-operation and Development (OECD) to measure foreign aid. The DAC first adopted the concept in 1969. It is widely used as an indicator of international aid flow. It refers to material resources given by the governments of richer countries to promote the economic development of poorer countries and the welfare of their people. The donor government agency may disburse such resources to the government of the recipient country or through other organisations. Most ODA is in the form of grants, but some is measured as the concessional value in soft (low-interest) loans.

The median income is the income amount that divides a population into two equal groups, half having an income above that amount, and half having an income below that amount. It may differ from the mean income. The income that occurs most frequently is the income mode. Each of these is a way of understanding income distribution.

Household income is a measure of the combined incomes of all people sharing a particular household or place of residence. It includes every form of income, e.g., salaries and wages, retirement income, near cash government transfers like food stamps, and investment gains.

The Italian welfare state is based partly upon the corporatist-conservative model and partly upon the universal welfare model.

The Chile pension system refers to old-age, disability and survivor pensions for workers in Chile. The pension system was changed by José Piñera, during Augusto Pinochet's dictatorship, on November 4, 1980 from a PAYGO-system to a fully funded capitalization system run by private sector pension funds. Many critics and supporters see the reform as an important experiment under real conditions, that may give conclusions about the impact of the full conversion of a PAYGO-system to a capital funded system. The development was therefore internationally observed with great interest. Under Michelle Bachelet's government the Chile Pension system was reformed again.

Poverty in Canada refers to people that do not have "enough income to purchase a specific basket of goods and services in their community."

Median household disposable income in the UK was £29,400 in the financial year ending (FYE) 2019, up 1.4% (£400) compared with growth over recent years; median income grew by an average of 0.7% per year between FYE 2017 and FYE 2019, compared with 2.8% between FYE 2013 and FYE 2017.

Pension Credit is the principal element of the UK welfare system for people of pension age. It is intended to supplement the UK State Pension, or to replace it. It was introduced in the UK in 2003 by Gordon Brown, then Chancellor of the Exchequer. It has been subject to a number of changes over its existence, but has the core aim of lifting retired people of limited means out of poverty.

Social protection, as defined by the United Nations Research Institute for Social Development, is concerned with preventing, managing, and overcoming situations that adversely affect people's well-being. Social protection consists of policies and programs designed to reduce poverty and vulnerability by promoting efficient labour markets, diminishing people's exposure to risks, and enhancing their capacity to manage economic and social risks, such as unemployment, exclusion, sickness, disability, and old age. It is one of the targets of the United Nations Sustainable Development Goal 10 aimed at promoting greater equality.

Pensions in Spain consist of a mandatory state pension scheme, and voluntary company and individual pension provision.

The Organisation for Economic Co-operation and Development is an intergovernmental economic organisation with 38 member countries, founded in 1961 to stimulate economic progress and world trade. It is a forum of countries describing themselves as committed to democracy and the market economy, providing a platform to compare policy experiences, seek answers to common problems, identify good practices and coordinate domestic and international policies of its members. The majority of OECD members are high-income economies with a very high Human Development Index (HDI) and are regarded as developed countries. As of 2017, the OECD member countries collectively comprised 62.2% of global nominal GDP and 42.8% of global GDP at purchasing power parity. The OECD is an official United Nations observer.

Luxembourg has an extensive welfare system. It comprises a social security, health, and pension funds. The labour market is highly regulated, and Luxembourg is a corporatist welfare state. Enrollment is mandatory in one of the welfare schemes for any employed person. Luxembourg's social security system is the Centre Commun de la Securite Sociale (CCSS). Both employees and employers make contributions to the fund at a rate of 25% of total salary, which cannot eclipse more than five times the minimum wage. Social spending accounts for 21.8% of GDP.

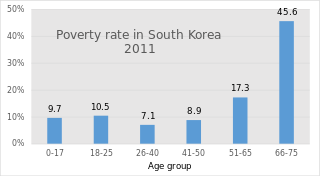

South Korea's pension scheme was introduced relatively recently, compared to other democratic nations. Half of the country's population aged 65 and over lives in relative poverty, or nearly four times the 13% average for member countries of the Organisation for Economic Co-operation and Development (OECD). This makes old age poverty an urgent social problem. Public social spending by general government is half the OECD average, and is the lowest as a percentage of GDP among OECD member countries.

Public pensions in Greece are designed to provide incomes to Greek pensioners upon reaching retirement. For decades pensions in Greece were known to be among the most generous in the European Union, allowing many pensioners to retire earlier than pensioners in other European countries. This placed a heavy burden on Greece's public finances which made the Greek state increasingly vulnerable to external economic shocks, culminating in a recession due to the 2008 financial crisis and subsequent European debt crisis. This series of crises has forced the Greek government to implement economic reforms aimed at restructuring the pension system and eliminating inefficiencies within it. Measures in the Greek austerity packages imposed upon Greek citizens by the European Central Bank have achieved some success at reforming the pension system despite having stark ramifications for standards of living in Greece, which have seen a sharp decline since the beginning of the crisis.

In 2014, the Cyprus Guaranteed Minimum Income and Social Benefits Law was passed to replace the previous Public Assistance and Service Law. It covers all EU citizens and also long-term residents with legal status, and its main intention is to shelter those with higher risk of poverty and to guarantee the recipients with basic standard of living.

References

- ↑ "Adequacy of Guaranteed Minimum Income benefits". stats.oecd.org. Retrieved 2020-06-06.

- ↑ "Adequacy of Guaranteed Minimum Income benefits". stats.oecd.org. Retrieved 2020-06-06.