Related Research Articles

An advance-fee scam is a form of fraud and is one of the most common types of confidence tricks. The scam typically involves promising the victim a significant share of a large sum of money, in return for a small up-front payment, which the fraudster claims will be used to obtain the large sum. If a victim makes the payment, the fraudster either invents a series of further fees for the victim to pay or simply disappears.

Internet fraud is a type of cybercrime fraud or deception which makes use of the Internet and could involve hiding of information or providing incorrect information for the purpose of tricking victims out of money, property, and inheritance. Internet fraud is not considered a single, distinctive crime but covers a range of illegal and illicit actions that are committed in cyberspace. It is, however, differentiated from theft since, in this case, the victim voluntarily and knowingly provides the information, money or property to the perpetrator. It is also distinguished by the way it involves temporally and spatially separated offenders.

Email fraud is intentional deception for either personal gain or to damage another individual using email as the vehicle. Almost as soon as email became widely used, it began to be used as a means to defraud people, just as telephony and paper mail were used by previous generations.

A lottery scam is a type of advance-fee fraud which begins with an unexpected email notification, phone call, or mailing explaining that "You have won!" a large sum of money in a lottery. The recipient of the message—the target of the scam—is usually told to keep the notice secret, "due to a mix-up in some of the names and numbers," and to contact a "claims agent." After contacting the agent, the target of the scam will be asked to pay "processing fees" or "transfer charges" so that the winnings can be distributed, but will never receive any lottery payment. Many email lottery scams use the names of legitimate lottery organizations or other legitimate corporations/companies, but this does not mean the legitimate organizations are in any way involved with the scams.

The white van speaker scam is a scam sales technique in which a con artist makes a buyer believe they are getting a good price on home entertainment products. Often a con artist will buy inexpensive, generic speakers and convince potential buyers that they are premium products worth hundreds or thousands of dollars, offering them for sale at a price that the buyer thinks is heavily discounted, but is actually a heavy markup from their real value. Con artists in this type of scam call themselves "speakerguys" or "speakermen", and usually claim to be working for a speaker delivery or installation company.

The bogus escrow scam is a straightforward confidence trick in which a scammer operates a bogus escrow service.

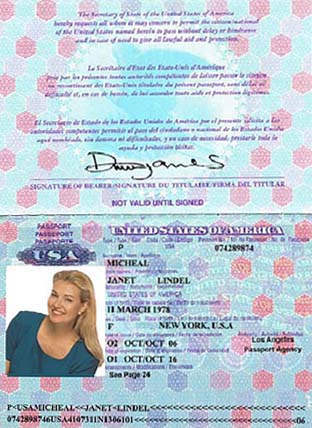

A romance scam is a confidence trick involving feigning romantic intentions towards a victim, gaining the victim's affection, and then using that goodwill to get the victim to send money to the scammer under false pretenses or to commit fraud against the victim. Fraudulent acts may involve access to the victim's money, bank accounts, credit cards, passports, e-mail accounts, or national identification numbers; or forcing the victims to commit financial fraud on their behalf.

Voice phishing, or vishing, is the use of telephony to conduct phishing attacks.

In a reloading scam, a victim is repeatedly approached by con artists, often until "sucked dry". This form of fraud is perpetrated on those more susceptible to pressure after the first losses, perhaps because of hopes to recover money previously invested, perhaps because of inability to say "no" to a con man.

A money mule, sometimes called a "smurfer", is a person who transfers money acquired illegally, such as by theft or fraud. Money mules transfer funds in person, through a courier service, or electronically, on behalf of others. Typically, the mule is paid for services with a small part of the money transferred. Money mules are often recruited on-line under the guise of legitimate employment, not aware that the money they are transferring is the product of crime. Similar techniques are used to transfer merchandise illegally.

Telemarketing fraud is fraudulent selling conducted over the telephone. The term is also used for telephone fraud not involving selling.

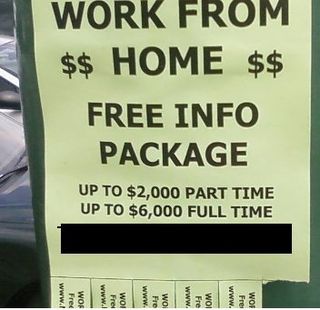

A work-at-home scheme is a get-rich-quick scam in which a victim is lured by an offer to be employed at home, very often doing some simple task in a minimal amount of time with a large amount of income that far exceeds the market rate for the type of work. The true purpose of such an offer is for the perpetrator to extort money from the victim, either by charging a fee to join the scheme, or requiring the victim to invest in products whose resale value is misrepresented.

Credit card fraud is an inclusive term for fraud committed using a payment card, such as a credit card or debit card. The purpose may be to obtain goods or services or to make payment to another account, which is controlled by a criminal. The Payment Card Industry Data Security Standard is the data security standard created to help financial institutions process card payments securely and reduce card fraud.

The green goods scam, also known as the "green goods game", was a fraud scheme popular in the 19th-century United States in which people were duped into paying for worthless counterfeit money. It is a variation on the pig-in-a-poke scam using money instead of other goods like a pig.

Utility scams are fraudulent acts where a perpetrator calls or arrives unannounced at a utility customer's house in an attempt to take money or sell unnecessary energy accessories through misrepresentation. Often, the fraud involves telling the victim that he or she owes the utility company money and that their power, gas, or water will be shut off immediately unless payment is made.

An SSA impersonation scam, or SSA scam, is a class of telecommunications fraud and scam which targets citizens of the United States by impersonating personnel of the Social Security Administration. SSA scams are typically initiated by pre-recorded messages, or robocalls, which are designed to panic the victim so that they follow the scammer's instructions. In 2018, over 35,000 incidences of SSA scam robocalls were reported to the Better Business Bureau, and the total losses of victims added up to over $10 million. It is believed that approximately 47% of Americans were subject to an SSA impersonation scam robocall during a three-month period in mid- to late 2020, and that 21% of seniors were targeted by at least three SSA scam robocalls in the same time period.

An overpayment scam, also known as a refund scam, is a type of confidence trick designed to prey upon victims' good faith. In the most basic form, an overpayment scam consists of a scammer claiming, falsely, to have sent a victim an excess amount of money. The scammer then attempts to convince the victim to return the difference between the sent amount and the intended amount. This scam can take a number of forms, including check overpayment scams and online refund scams.

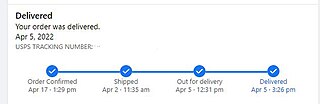

A package redirection scam is a form of e-commerce fraud, where a malicious actor manipulates a shipping label, to trick the mail carrier into delivering the package to the wrong address. This is usually done through product returns to make the merchant believe that they mishandled the return package, and thus provide a refund without the item being returned. It can also be done by the seller, generally by creating fraudulent online stores or creating fake listings on sites such as eBay or Mercari. This makes it very hard to perform a chargeback, as the tracking shows the item has been delivered. This is also known as an FTID scam, standing for Fake Tracking ID. When this scam is successful, the tracking number will show that the package has been delivered to the correct address, when the package was instead delivered to a different address. This package is generally empty or filled with garbage. However, this scam has mostly been “patched” via new technology provided by the various couriers globally. It is estimated the scam cost retailers £18,000,000,000 in lost revenue.

A pig butchering scam is a type of long-term confidence trick and investment fraud in which the victim is gradually lured into making increasing contributions, usually in the form of cryptocurrency, to a fraudulent cryptocurrency scheme. The scammer builds trust with the victim through online communication, subsequently persuading them to invest in a fraudulent cryptocurrency scheme. Frequently, the victim is induced to make further payments before realizing they have fallen prey to fraud. The "butchering" or "slaughtering" of the victim transpires when their assets or funds are stolen by the criminal(s), leading to significant financial and emotional distress for the victim.

References

- 1 2 3 4 5 Leyden, John (28 October 2008). "Parcel mules scam exposed: Cybercrook, keen phisherman seeks reliable partners on dating sites". The Register.

- 1 2 Greek, Dinah (27 October 2008). "Criminals dupe vulnerable into handling stolen goods: Fraudsters targeting women on dating websites in particular". Computeract!ve. Archived from the original on 31 October 2008. Retrieved 15 February 2015.

- ↑ "Do not be a Parcel Mule as Part of a Reshipping Scam | Crime Prevention News | 3rd September 2015 | The Crime Prevention Website". thecrimepreventionwebsite.com. 3 September 2015. Retrieved 4 October 2021.

- 1 2 3 4 5 "Notice 129: Don't Be the Victim of a Reshipping Scam: USPS" (PDF).

- ↑ "Reshipping Fraud – Parcel Mule Scams – HOAX DETECTION AND ANALYZER" . Retrieved 4 October 2021.

- 1 2 3 RSA FraudAction Research Lab (12 November 2009). "Deep Inside a Reshipping Scam: Mules Victimized by "Air Parcel Express"". Archived from the original on 13 August 2010. Retrieved 16 February 2015.