Reaganomics, or Reaganism, were the neoliberal economic policies promoted by U.S. President Ronald Reagan during the 1980s. These policies are characterized as supply-side economics, trickle-down economics, or "voodoo economics" by opponents, while Reagan and his advocates preferred to call it free-market economics.

The Economic Recovery Tax Act of 1981 (ERTA), or Kemp–Roth Tax Cut, was an Act that introduced a major tax cut, which was designed to encourage economic growth. The Act was enacted by the 97th US Congress and signed into law by US President Ronald Reagan. The Accelerated Cost Recovery System (ACRS) was a major component of the Act and was amended in 1986 to become the Modified Accelerated Cost Recovery System (MACRS).

David Alan Stockman is an American politician and former businessman who was a Republican U.S. Representative from the state of Michigan (1977–1981) and the Director of the Office of Management and Budget (1981–1985) under President Ronald Reagan.

Ronald Reagan's tenure as the 40th president of the United States began with his first inauguration on January 20, 1981, and ended on January 20, 1989. Reagan, a Republican from California, took office following his landslide victory over Democrat incumbent president Jimmy Carter and independent congressman John B. Anderson in the 1980 presidential election. Four years later, in the 1984 presidential election, he defeated former Democratic vice president Walter Mondale, to win re-election in a larger landslide. Due to U.S. Constitutional law, Reagan was limited to two terms and was succeeded by his vice president, George H. W. Bush, who won the 1988 presidential election. Reagan's 1980 landslide election resulted from a dramatic conservative shift to the right in American politics, including a loss of confidence in liberal, New Deal, and Great Society programs and priorities that had dominated the national agenda since the 1930s.

Budget reconciliation is a special parliamentary procedure of the United States Congress set up to expedite the passage of certain federal budget legislation in the Senate. The procedure overrides the Senate's filibuster rules, which may otherwise require a 60-vote supermajority for passage. Bills described as reconciliation bills can pass the Senate by a simple majority of 51 votes or 50 votes plus the vice president's as the tie-breaker. The reconciliation procedure also applies to the House of Representatives, but it has minor significance there, as the rules of the House of Representatives do not have a de facto supermajority requirement. Because of greater polarization, gridlock, and filibustering in the Senate in recent years, budget reconciliation has come to play an important role in how the United States Congress legislates.

The Omnibus Budget Reconciliation Act of 1993 was a federal law that was enacted by the 103rd United States Congress and signed into law by President Bill Clinton on August 10, 1993. It has also been unofficially referred to as the Deficit Reduction Act of 1993. Part XIII of the law is also called the Revenue Reconciliation Act of 1993.

The Tax Equity and Fiscal Responsibility Act of 1982, also known as TEFRA, is a United States federal law that rescinded some of the effects of the Kemp-Roth Act passed the year before. Between summer 1981 and summer 1982, tax revenue fell by about 6% in real terms, caused by the dual effects of the economy dipping back into recession and Kemp-Roth's reduction in tax rates, and the deficit was likewise rising rapidly because of the fall in revenue and the rise in government expenditures. The rapid rise in the budget deficit created concern among many in Congress. TEFRA was created to reduce the budget gap by generating revenue through closure of tax loopholes; introduction of tougher enforcement of tax rules; rescinding some of Kemp-Roth's reductions in marginal personal income tax rates that had not yet gone into effect; and raising some rates, especially corporate rates. TEFRA was introduced November 13, 1981 and was sponsored by US Representative Pete Stark of California. After much deliberation, the final version was signed by President Ronald Reagan on September 3, 1982.

The economic policies of the Bill Clinton administration, referred to by some as Clintonomics, encapsulates the economic policies of president of the United States Bill Clinton that were implemented during his presidency, which lasted from January 1993 to January 2001.

PAYGO is the practice in the United States of financing expenditures with funds that are currently available rather than borrowed.

The Budget Enforcement Act of 1990 (BEA) was enacted by the United States Congress as title XIII of the Omnibus Budget Reconciliation Act of 1990, to enforce the deficit reduction accomplished by that law by revising the federal budget control procedures originally enacted by the Gramm–Rudman–Hollings Balanced Budget Act. The BEA created two new budget control processes: a set of caps on annually-appropriated discretionary spending, and a "pay-as-you-go" or "PAYGO" process for entitlements and taxes.

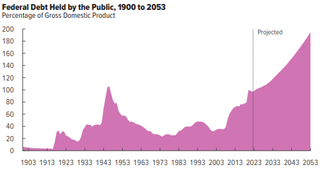

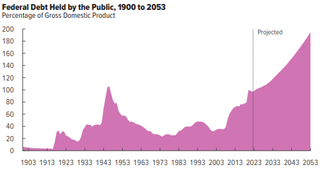

The United States budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. CBO estimated in February 2024 that Federal debt held by the public is projected to rise from 99 percent of GDP in 2024 to 116 percent in 2034 and would continue to grow if current laws generally remained unchanged. Over that period, the growth of interest costs and mandatory spending outpaces the growth of revenues and the economy, driving up debt. Those factors persist beyond 2034, pushing federal debt higher still, to 172 percent of GDP in 2054.

In American political theory, fiscal conservatism or economic conservatism is a political and economic philosophy regarding fiscal policy and fiscal responsibility with an ideological basis in capitalism, individualism, limited government, and laissez-faire economics. Fiscal conservatives advocate tax cuts, reduced government spending, free markets, deregulation, privatization, free trade, and minimal government debt. Fiscal conservatism follows the same philosophical outlook as classical liberalism. This concept is derived from economic liberalism.

The history of the United States public debt began with federal government debt incurred during the American Revolutionary War by the first U.S treasurer, Michael Hillegas, after the country's formation in 1776. The United States has continuously experienced fluctuating public debt, except for about a year during 1835–1836. To facilitate comparisons over time, public debt is often expressed as a ratio to gross domestic product (GDP). Historically, the United States public debt as a share of GDP has increased during wars and recessions, and subsequently declined.

The Highway Trust Fund is a transportation fund in the United States which receives money from a federal fuel tax of 18.4 cents per gallon on gasoline and 24.4 cents per gallon of diesel fuel and related excise taxes. It currently has two accounts, the Highway Account funding road construction and other surface transportation projects, and a smaller Mass Transit Account supporting mass transit. Separate from the Highway Trust Fund is the Leaking Underground Storage Tank Trust Fund, which receives an additional 0.1 cents per gallon on gasoline and diesel, making the total amount of tax collected 18.5 cents per gallon on gasoline and 24.5 cents per gallon on diesel fuel. The Highway Trust Fund was established in 1956 to finance the United States Interstate Highway System and certain other roads. The Mass Transit Account was created in 1982. The federal tax on motor fuels yielded $28.2 billion in 2006.

The Reagan era or the Age of Reagan is a periodization of recent American history used by historians and political observers to emphasize that the conservative "Reagan Revolution" led by President Ronald Reagan in domestic and foreign policy had a lasting impact. It overlaps with what political scientists call the Sixth Party System. Definitions of the Reagan era universally include the 1980s, while more extensive definitions may also include the late 1970s, the 1990s, and even the 2000s. In his 2008 book, The Age of Reagan: A History, 1974–2008, historian and journalist Sean Wilentz argues that Reagan dominated this stretch of American history in the same way that Franklin D. Roosevelt and his New Deal legacy dominated the four decades that preceded it.

Budget sequestration is a provision of United States law that causes an across-the-board reduction in certain kinds of spending included in the federal budget. Sequestration involves setting a hard cap on the amount of government spending within broadly defined categories; if Congress enacts annual appropriations legislation that exceeds these caps, an across-the-board spending cut is automatically imposed on these categories, affecting all departments and programs by an equal percentage. The amount exceeding the budget limit is held back by the Treasury and not transferred to the agencies specified in the appropriation bills. The word sequestration was derived from a legal term referring to the seizing of property by an agent of the court, to prevent destruction or harm, while any dispute over said property is resolved in court.

The American Taxpayer Relief Act of 2012 (ATRA) was enacted and passed by the United States Congress on January 1, 2013, and was signed into law by US President Barack Obama the next day. ATRA gave permanence to the lower rates of much of the "Bush tax cuts".

The 2014 United States federal budget is the budget to fund government operations for the fiscal year (FY) 2014, which began on October 1, 2013 and ended on September 30, 2014.

The phrase Reagan tax cuts refers to changes to the United States federal tax code passed during the presidency of Ronald Reagan. There were two major tax cuts: The Economic Recovery Tax Act of 1981 and the Tax Reform Act of 1986. The tax cuts popularized the now infamous phrase "trickle-down economics" as it was primarily used as a moniker by opponents of the bill in order to degrade supply-side economics, the driving principle used to promote the tax cuts.

The presidency of Ronald Reagan began on January 20, 1981, when Ronald Reagan was inaugurated as the 40th president of the United States, and ended on January 20, 1989.