In economics, a free market is an economic system in which the prices of goods and services are determined by supply and demand expressed by sellers and buyers. Such markets, as modeled, operate without the intervention of government or any other external authority. Proponents of the free market as a normative ideal contrast it with a regulated market, in which a government intervenes in supply and demand by means of various methods such as taxes or regulations. In an idealized free market economy, prices for goods and services are set solely by the bids and offers of the participants.

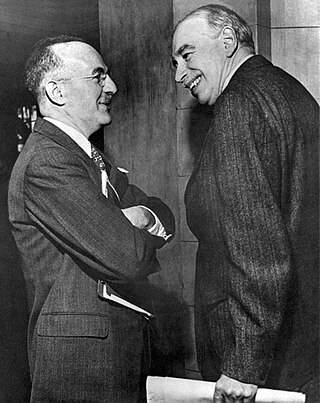

Joseph Alois Schumpeter was an Austrian political economist. He served briefly as Finance Minister of Austria in 1919. In 1932, he emigrated to the United States to become a professor at Harvard University, where he remained until the end of his career, and in 1939 obtained American citizenship.

Keynesian economics are the various macroeconomic theories and models of how aggregate demand strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. It is influenced by a host of factors that sometimes behave erratically and impact production, employment, and inflation.

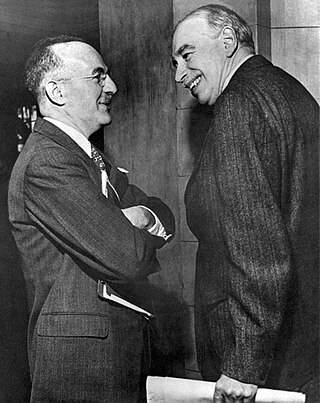

John Maynard Keynes, 1st Baron Keynes was a British economist and philosopher whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in mathematics, he built on and greatly refined earlier work on the causes of business cycles. One of the most influential economists of the 20th century, he produced writings that are the basis for the school of thought known as Keynesian economics, and its various offshoots. His ideas, reformulated as New Keynesianism, are fundamental to mainstream macroeconomics. He is known as the "father of macroeconomics".

A market economy is an economic system in which the decisions regarding investment, production and distribution to the consumers are guided by the price signals created by the forces of supply and demand. The major characteristic of a market economy is the existence of factor markets that play a dominant role in the allocation of capital and the factors of production.

Post-Keynesian economics is a school of economic thought with its origins in The General Theory of John Maynard Keynes, with subsequent development influenced to a large degree by Michał Kalecki, Joan Robinson, Nicholas Kaldor, Sidney Weintraub, Paul Davidson, Piero Sraffa and Jan Kregel. Historian Robert Skidelsky argues that the post-Keynesian school has remained closest to the spirit of Keynes' original work. It is a heterodox approach to economics.

A mixed economy is variously defined as an economic system blending elements of a market economy with elements of a planned economy, markets with state interventionism, or private enterprise with public enterprise. Common to all mixed economies is a combination of free-market principles and principles of socialism. While there is no single definition of a mixed economy, one definition is about a mixture of markets with state interventionism, referring specifically to a capitalist market economy with strong regulatory oversight and extensive interventions into markets. Another is that of active collaboration of capitalist and socialist visions. Yet another definition is apolitical in nature, strictly referring to an economy containing a mixture of private enterprise with public enterprise. Alternatively, a mixed economy can refer to a reformist transitionary phase to a socialist economy that allows a substantial role for private enterprise and contracting within a dominant economic framework of public ownership. This can extend to a Soviet-type planned economy that has been reformed to incorporate a greater role for markets in the allocation of factors of production.

In classical economics, Say's law, or the law of markets, is the claim that the production of a product creates demand for another product by providing something of value which can be exchanged for that other product. So, production is the source of demand. In his principal work, A Treatise on Political Economy, Jean-Baptiste Say wrote: "A product is no sooner created, than it, from that instant, affords a market for other products to the full extent of its own value." And also, "As each of us can only purchase the productions of others with his own productions – as the value we can buy is equal to the value we can produce, the more men can produce, the more they will purchase."

The Anglo-Saxon model is a regulated market-based economic model that emerged in the 1970s based on the Chicago school of economics, spearheaded in the 1980s in the United States by the economics of then President Ronald Reagan, and reinforced in the United Kingdom by then Prime Minister Margaret Thatcher. However, its origins are said to date to the 18th century in the United Kingdom and the ideas of the classical economist Adam Smith.

Alvin Harvey Hansen was an American economist who taught at the University of Minnesota and was later a chair professor of economics at Harvard University. Often referred to as "the American Keynes", he was a widely read popular author on economic issues, and an influential advisor to the government on economic policy. Hansen helped create the Council of Economic Advisors and the Social Security system. He is best remembered today for introducing Keynesian economics in the United States in the 1930s and 40s.

The history of economic thought is the study of the philosophies of the different thinkers and theories in the subjects that later became political economy and economics, from the ancient world to the present day in the 21st century. This field encompasses many disparate schools of economic thought. Ancient Greek writers such as the philosopher Aristotle examined ideas about the art of wealth acquisition, and questioned whether property is best left in private or public hands. In the Middle Ages, Thomas Aquinas argued that it was a moral obligation of businesses to sell goods at a just price.

In the history of economic thought, a school of economic thought is a group of economic thinkers who share or shared a common perspective on the way economies work. While economists do not always fit into particular schools, particularly in modern times, classifying economists into schools of thought is common. Economic thought may be roughly divided into three phases: premodern, early modern and modern. Systematic economic theory has been developed mainly since the beginning of what is termed the modern era.

The neoclassical synthesis (NCS), neoclassical–Keynesian synthesis, or just neo-Keynesianism was a neoclassical economics academic movement and paradigm in economics that worked towards reconciling the macroeconomic thought of John Maynard Keynes in his book The General Theory of Employment, Interest and Money (1936). It was formulated most notably by John Hicks (1937), Franco Modigliani (1944), and Paul Samuelson (1948), who dominated economics in the post-war period and formed the mainstream of macroeconomic thought in the 1950s, 60s, and 70s.

Following the global financial crisis of 2007–2008, there was a worldwide resurgence of interest in Keynesian economics among prominent economists and policy makers. This included discussions and implementation of economic policies in accordance with the recommendations made by John Maynard Keynes in response to the Great Depression of the 1930s, most especially fiscal stimulus and expansionary monetary policy.

The Keynesian Revolution was a fundamental reworking of economic theory concerning the factors determining employment levels in the overall economy. The revolution was set against the then orthodox economic framework, namely neoclassical economics.

The post-war displacement of Keynesianism was a series of events which from mostly unobserved beginnings in the late 1940s, had by the early 1980s led to the replacement of Keynesian economics as the leading theoretical influence on economic life in the developed world. Similarly, the allied discipline known as development economics was largely displaced as the guiding influence on economic policies adopted by developing nations.

Keynes: The Return of the Master is a 2009 book by economic historian Robert Skidelsky. The work discusses the economic theories and philosophy of John Maynard Keynes, and argues about their relevance to the world following the Financial crisis of 2007–2010. In contrast to the 30 years he needed to write his prize-winning biography on Keynes, the author was able to write this 240-page book in only three months.

Throughout modern history, a variety of perspectives on capitalism have evolved based on different schools of thought.

Mariana Francesca Mazzucato is an Italian–American-British economist and academic. She is a professor in the Economics of Innovation and Public Value at University College London (UCL) and founding director of the UCL Institute for Innovation and Public Purpose (IIPP). She is best known for her work on dynamics of technological change, the role of the public sector in innovation, and the concept of value in economics. The New Republic have called her one of the "most important thinkers about innovation".

Marxism and Keynesianism is a method of understanding and comparing the works of influential economists John Maynard Keynes and Karl Marx. Both men's works has fostered respective schools of economic thought that have had significant influence in various academic circles as well as in influencing government policy of various states. Keynes' work found popularity in developed liberal economies following the Great Depression and World War II, most notably Franklin D. Roosevelt's New Deal in the United States in which strong industrial production was backed by strong unions and government support. Marx's work, with varying degrees of faithfulness, led the way to a number of socialist states, notably the Soviet Union and the People's Republic of China. The immense influence of both Marxian and Keynesian schools has led to numerous comparisons of the work of both economists along with synthesis of both schools.